Each year, the Internal Revenue Service (IRS) makes adjustments to the U.S. tax code based on inflation. This is to help prevent taxpayers from being bumped into higher tax brackets or losing value from credits and/or deductions when they haven’t had any increase in actual income. The IRS currently uses the Chained Consumer Price Index (C-CPI) to determine income thresholds, deduction amounts, and credit values. Here is a brief overview of the 2021 tax brackets and other IRS tax changes that will impact tax returns filed in 2022.

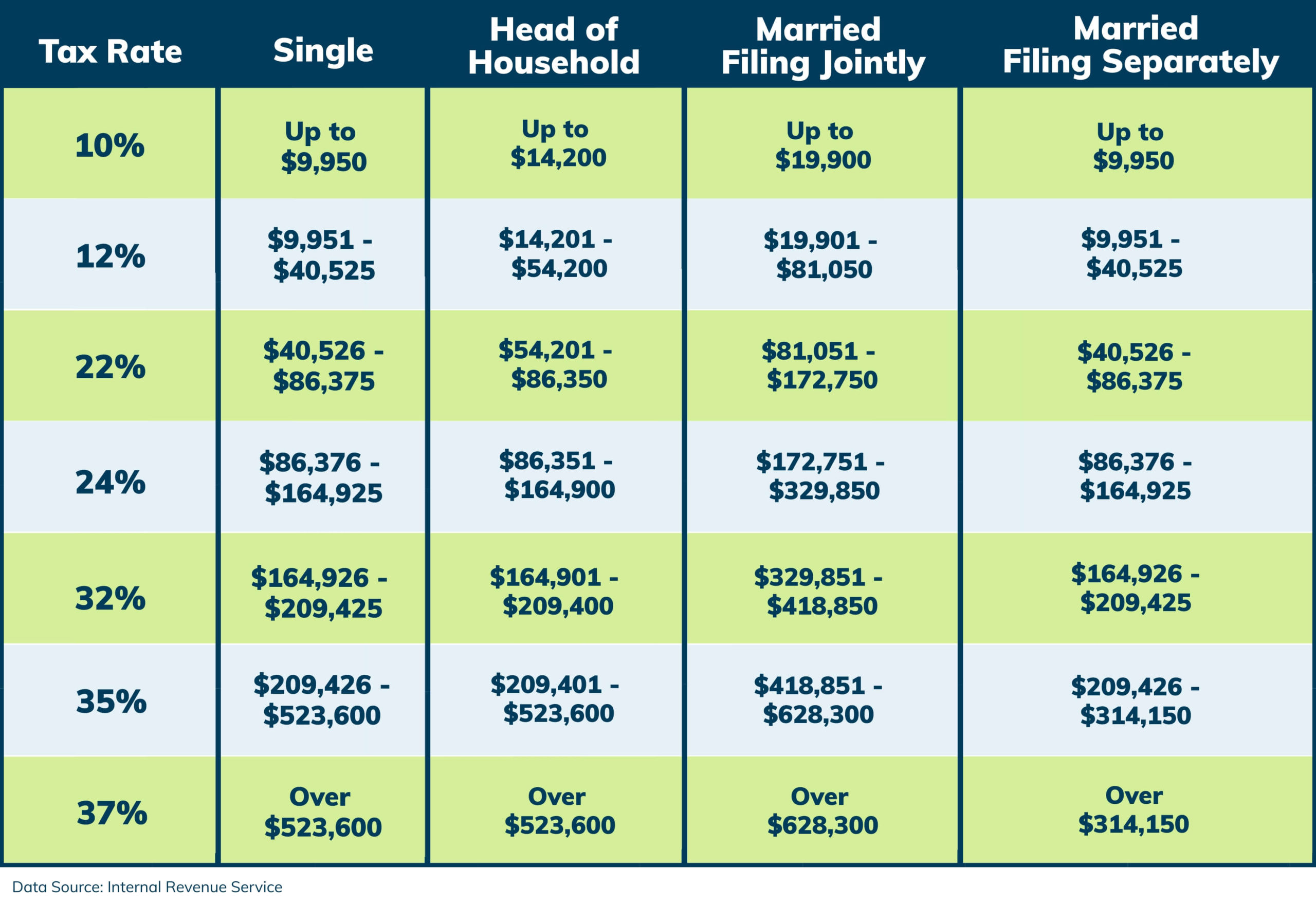

2021 Tax Brackets

The tax rates for 2021 will remain the same as they were for 2020. The top tax rate will again be 37 percent. The 2021 tax bracket ranges, however, have increased.

Standard Deduction

For 2021, the standard deduction for those with filing statuses of single, head of household, or married filing separately will increase by $150. Married couples filing jointly will get a $300 increase. Per the 2017 Tax Cuts and Jobs Act, there is no personal exemption.

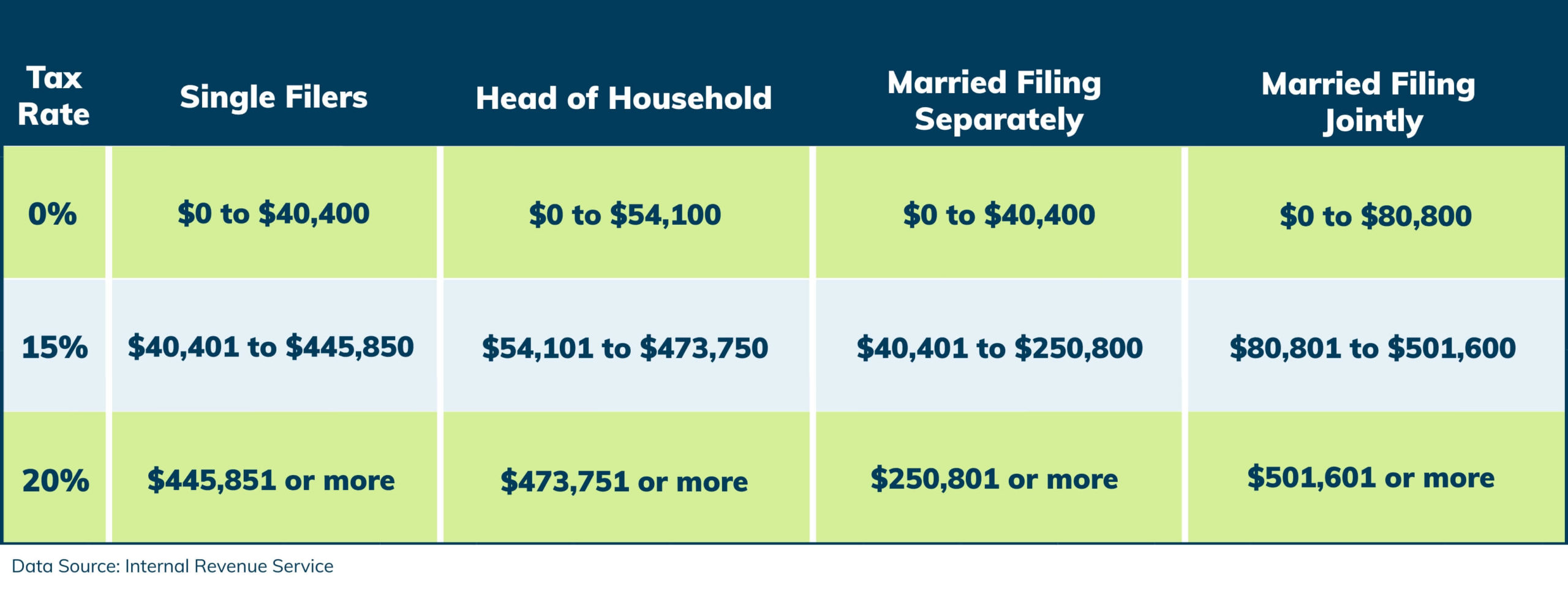

Capital Gains

If you sell an asset or an investment for more than it was purchased, the excess income (profit) is considered a capital gain. Short-term capital gains (assets or investments owned for less than a year) will be taxed at the 2021 tax rates (see above). For assets or investment owned longer than a year, please refer to the chart below for specific 2021 long-term capital gains tax rates and brackets.

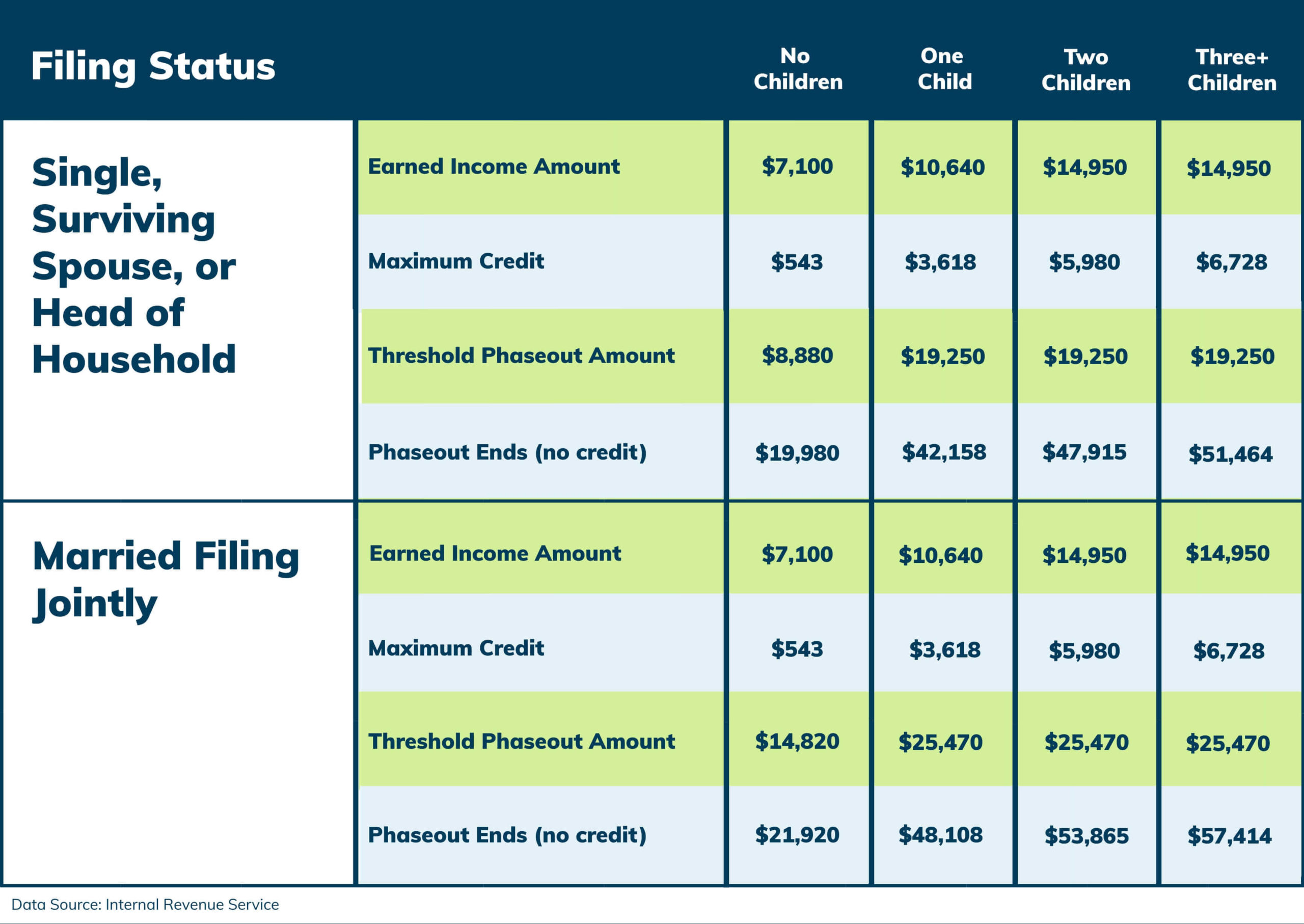

Earned Income Tax Credit

There are small increases to the Earned Income Tax credit for 2021. No credit will be allowed, however, if the aggregate amount of investment income exceeds $3,650.

Alternative Minimum Tax (AMT)

The 2021 Alternative Minimum Tax exemption for unmarried taxpayers is $73,600. For married filing jointly, the AMT exemption is $114,600. Phaseout thresholds begin at $523,600 for single filers and $1,047,300 for married filing jointly.

Retirement Plan Contributions

For 2021, Roth IRA contribution limits are unchanged at $6,000. Workers age 50 and older have an additional $1,000 catch-up contribution limit. Income phaseout is $125,000 to $140,000 (single filers), $198,000 to $208,000 (married filing jointly), and $0 to $10,000 (married filing separately). Contribution limits for 401(k), 403(b), and 457 plans remain at $19,500. An additional $6,500 catch-up contribution limit is in place for workers age 50 and older.

Taxpayers should be aware that the relaxed rules for certain distributions and loans from retirement plans under the Coronavirus Aid, Relief, and Economic Security (CARES) Act have not carried over to 2021 at this time.

2021 Tax Planning

To ensure you are prepared for next year’s tax changes, be sure to visit IRS.gov. You can also schedule a free consultation with Tax Defense Network. We offer affordable tax planning services for individual taxpayers and small business owners.