Form 1040-ES, Estimated Tax For Individuals

If you earn income that isn’t subject to withholding, you’ll need to make estimated tax payments during the year. Form 1040-ES can help you determine how much these quarterly payments should be and potentially avoid underpayment penalties and interest fees.

Who Should File Form 1040-ES?

Independent contractors, sole proprietors, partnerships, LLCs, and S corporations typically use Form 1040-ES. Individual taxpayers who do not elect voluntary withholding for certain taxable income, such as unemployment compensation or Social Security benefits, can also use this form and submit quarterly tax payments.

In most cases, you should pay estimated taxes if both of the following apply:

- You expect to owe $1,000 or more in tax for the year (after deducting your withholding and refundable credits), and

- You expect your withholding and refundable credits to be less than the smaller of:

- 90% of the tax shown on your current tax return, or

- 100% of the tax shown on the previous year’s return (if it covers all 12 months).

There is, however, an exception to this rule. If you had zero tax liability during the previous tax year (12-month period), and you were a U.S. citizen or resident the entire year, you aren’t required to file Form 1040-ES.

How to Make Estimated Payments

Estimated taxes are due quarterly. For most individuals, the payment due dates are April 15, June 15, September 15, and January 15 of the following year. If the due date falls on a weekend or holiday, the payment is due the next business day.

If you don’t follow the calendar year, however, your payment dates will differ. For those using a fiscal calendar, estimated tax payments are due the 15th of the fourth, sixth, and ninth month of the year. The final payment for the tax year is due the 15th day of the first month of the next fiscal year.

You can make payments using any of the following methods:

- Your IRS online account. Go to IRS.gov/Account to make payments or view your payment history.

- IRS Direct Pay. To transfer money directly from your checking or savings account with zero fees, go to IRS.gov/Payments.

- Pay by card. You can use a credit or debit card by going to IRS.gov/Payments or by calling one of the authorized service providers. Fees may apply.

- Pay through the app. To pay through your mobile device, download the IRS2Go app.

- Pay by phone through EFTPS. To use the Electronic Federal Tax Payment System (EFTPS), you’ll need to enroll online or request a form be mailed to you. For more information, visit IRS.gov/Payments or www.EFTPS.gov.

- Pay in cash. Cash payments are only accepted through retail partners and cannot exceed $1,000 per day per transaction. You must register at fed.acipayonline.com before making your payment.

- Pay by check or money order. See instructions below.

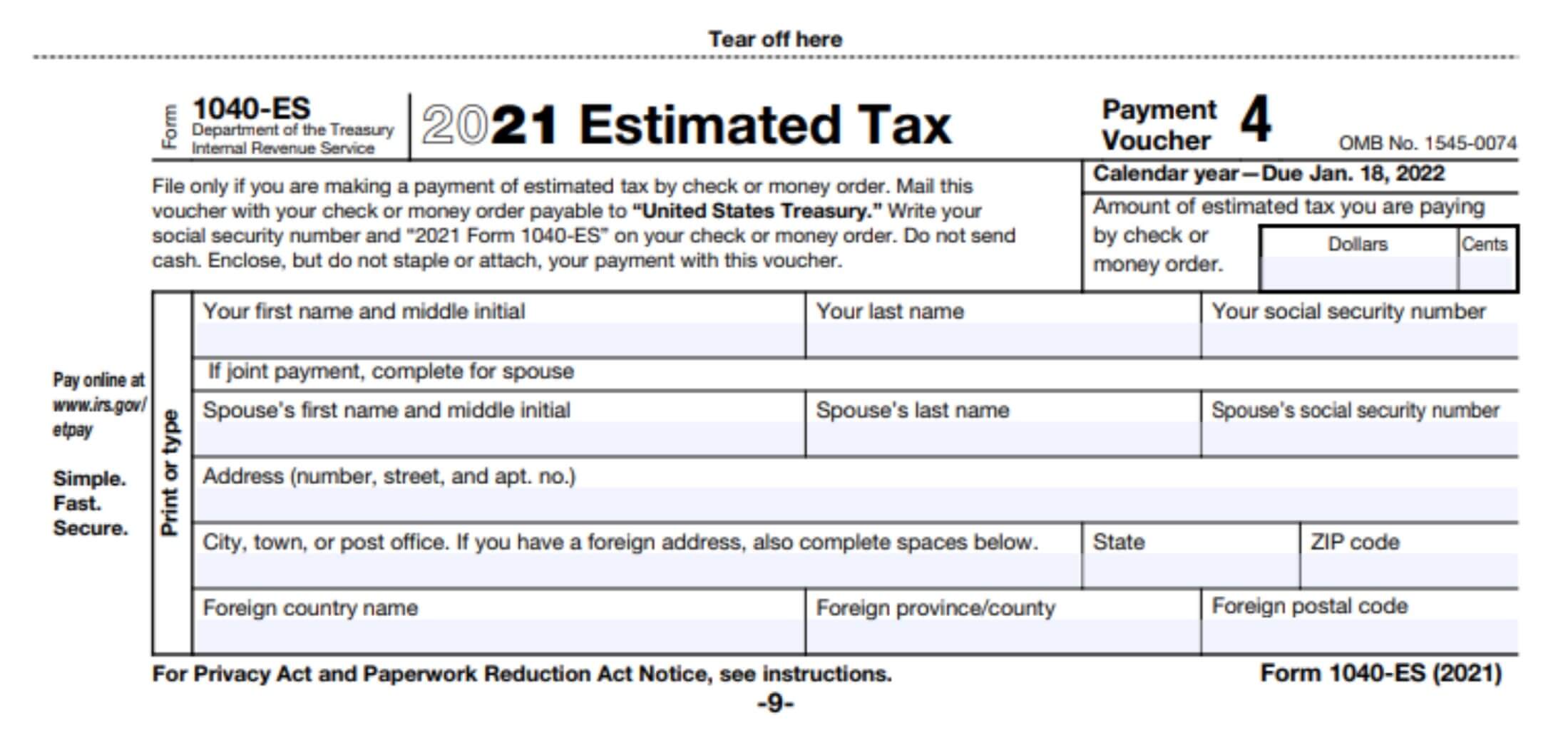

Form 1040-ES Instructions – Check or Money Order Payments

To make payments by check or money order, you’ll need to use the estimated tax payment voucher (Form 1040-ES). Be sure that use the form that corresponds to the payment due date. This is located in the upper right corner under the payment voucher number.

To complete the voucher and send in your payment, follow these steps:

- Print your name, address, and Social Security number (SSN) in the space provided. If you have an ITIN, enter it in the SSN box. For those filing a joint voucher, be sure to include your spouse’s name and SSN. The names and SSNs should be listed in the same order as they appear on your tax return.

- In the dollars box, enter only the amount you are sending in by check or money order.

- Make your check or money order payable to “United States Treasury.” Do not send cash. To avoid processing delays, enter the amount in the following format only – $XXX.XX. Don’t use dashes or lines.

- In the memo section of your check or money order, enter “[tax year] Form 1040-ES” and your SSN. For example, “2022 Form 1040-ES” would be used for payments sent in April or the fourth month of this fiscal year. For joint filers, only enter the SSN that is shown first on your tax return.

- Include your payment and voucher in the same envelope but do not staple or attach them to each other.

Depending on your location, your payment and voucher should be sent to one of the addresses below.

| IF you live in… | SEND your payment to… |

|---|---|

| Alabama, Arizona, Florida, Georgia, Louisiana, Mississippi, New Mexico, North Carolina, South Carolina, Tennessee, Texas | Internal Revenue Service P.O. Box 1300 Charlotte, NC 28201-1300 |

| Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service P.O. Box 931100 Louisville, KY 40293-1100 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, Ohio, Oregon, North Dakota, Pennsylvania, South Dakota, Utah, Washington, Wyoming | Internal Revenue Service P.O. Box 802502 Cincinnati, OH 45280-2502 |

Need Help?

If you need assistance completing your tax forms, please contact Tax Defense Network at 855-476-6920 for a free quote. You can also find instructions on how to complete Form 1040-ES and estimate your quarterly taxes by visiting IRS.gov.