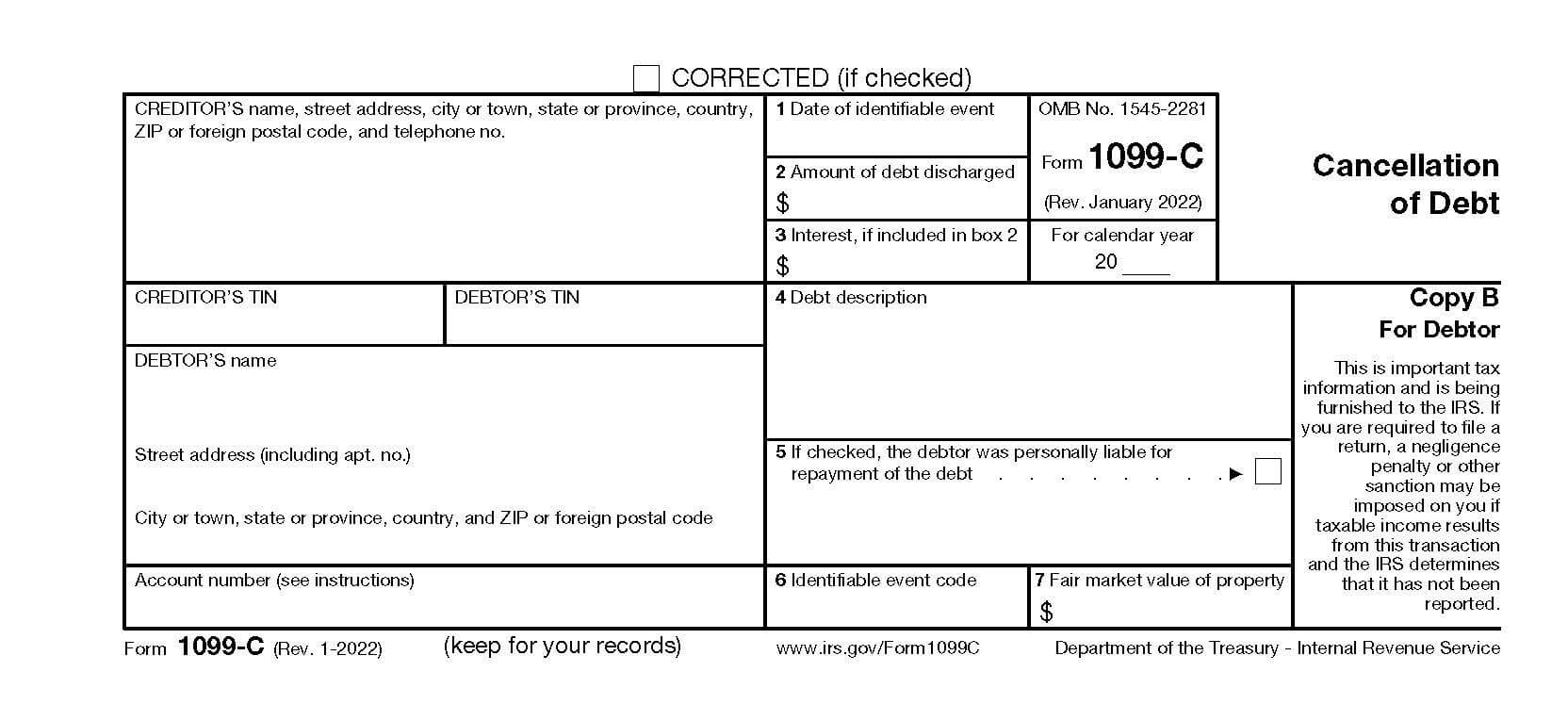

Form 1099-C, Cancellation of Debt

Form 1099-C is used to report canceled debt. Both you and the IRS receive the form from the business that discharged the debt you previously owed. The IRS views canceled debt as taxable income, which means you are responsible for claiming it on your tax return and paying any taxes associated with it.

Who Uses Form 1099-C?

Any business that cancels a debt of $600 or more is required to send Form 1099-C. There are numerous reasons why debt may be canceled. For example, the business may agree to settle the debt for less than you owe or they may have given up on trying to collect the debt. If you voluntarily surrender property (tangible and intangible) and its value is less than what you owe, it may also result in Form 1099-C being issued.

Even if you don’t receive Form 1099-C from a business or lender, the canceled debt may still be considered taxable income. States also have different rules regarding the treatment of canceled debt. For these reasons, it’s always best to consult a tax professional to ensure everything is correctly reported on your return.

Understanding Form 1099-C

Form 1099-C is a short, easy-to-understand form. On the left-hand side of the form, you’ll find the creditor’s name and contact information, as well as their Tax Identification Number (TIN). Your information is also provided, as well as an account number used by the business to identify you (if applicable).

Box 1. This is the date the business canceled or forgave the debt.

Box 2. The amount of debt canceled.

Box 3. Any interest that was included in the total reported in box 2.

Box 4. The description of the canceled debt or property.

Box 5. Shows whether you were personally responsible for the repayment of the debt when it was created or modified.

Box 6. Gives the reason (code) why the business canceled the debt.

Box 7. If, in the same calendar year, a foreclosure or abandonment of property occurred in connection with the canceled debt, the fair market value (FMV) of the property will be shown here.

If you disagree with the amount reported in box 2, contact the business/lender immediately and request an updated form.

Need Help?

You must report canceled debt correctly when filing. Failure to do so could result in a rejected return or an audit. We strongly recommend working with an experienced tax professional who is familiar with Form 1099-C and other unusual tax situations. If you need assistance, contact Tax Defense Network at 855-476-6920 and request a free consultation today.