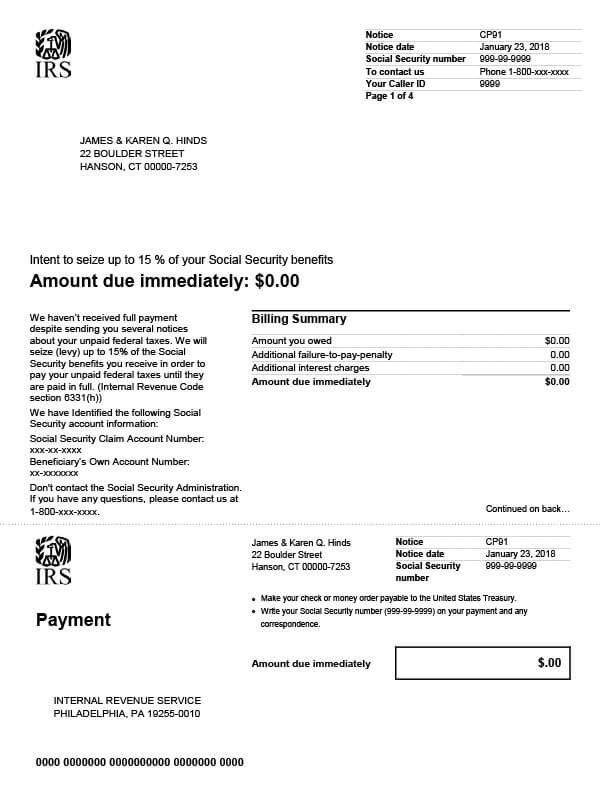

IRS Notice CP91 – Intent to Levy Social Security Benefits

IRS Notice CP91 notifies taxpayers that their Social Security benefits may be levied due to unpaid tax debt.

Why Did I Receive IRS Notice CP91?

You received IRS Notice CP91 because you have an outstanding tax balance that was not paid by the due date. The IRS sent several notices regarding your back taxes but never received payment. This is your final warning to pay by the deadline date or the IRS will seize up to 15% of your Social Security benefits.

Next Steps

Read your CP91 notice and keep a copy for your records. Be sure to carefully review the billing details to ensure they are accurate. If you’ve already paid the balance in full or there’s a missing payment, send proof of payment to the address listed on your notice.

If you can’t pay the balance due by the deadline date:

- Pay as much as possible now and make payment arrangements with the IRS.

- You can also call the number on your notice to discuss your options, such as an Offer in Compromise or a payment plan.

If you don’t pay the amount in full or make payment arrangements before the deadline date on your notice, the IRS can seize funds from your Social Security account, or, if applicable, from an account for which you are a beneficiary.

Who Should I Contact if I Have More Questions?

Do not ignore IRS Notice CP91. Call the IRS number listed on your notice or 800-829-1040 immediately if you can’t pay. It may also be helpful to speak with a tax professional to determine which tax relief options are best for you. For a free consultation, call Tax Defense Network at 855-476-6920 today!