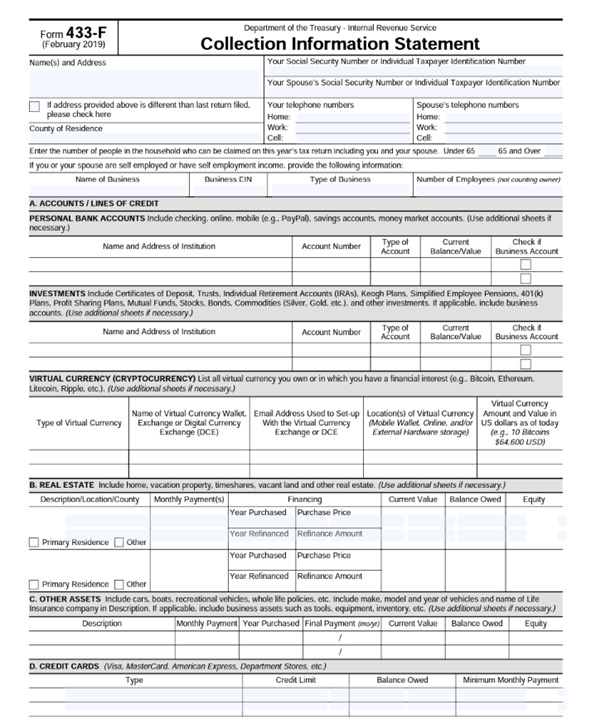

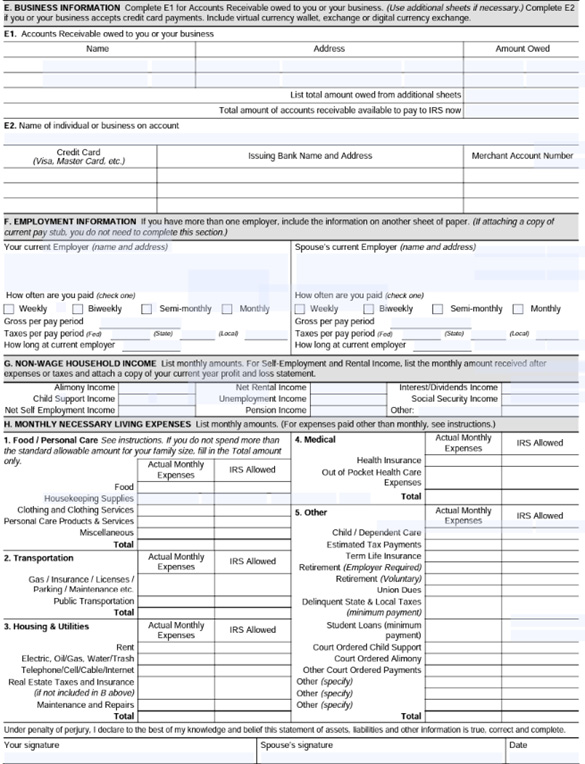

Form 433-F, Collection Information Statement

IRS Form 433-F is used to collect financial information from taxpayers who owe back taxes. The IRS uses this information to determine their ability to pay and eligibility for payment plans or Currently Not Collectible status.

Who Should File Form 433-F?

If you owe more than $100,000 and are seeking uncollectible status, you should use IRS Form 433-F. You can also use this form to apply for a payment plan. Certain businesses with more than $25,000 in tax debt may also use Form 433-F.

What’s The Difference Between Form 433-A, 433-B, and 433-F?

Form 433-A (individual) and 433-B (business) are much more extensive than Form 433-F. IRS revenue officers generally request the lengthier versions of the collection information statement, whereas 433-F is generally used by agents at the Automated Collection System (ACS) unit. Form 433-F is basically a condensed version of 433-A and 433-B.

How to Complete Form 433-F

IRS Form 433-F has a total of two pages, making it much easier to complete than the six pages on 433-A and 433-B.

On page 1, you’ll need to include your name, address, Social Security number, and other contact information. If your spouse is jointly responsible for the tax debt, you must include their information, too. You’ll also need to provide a list of your personal bank accounts, investments, virtual currency, real estate, credit cards, and other assets.

Page 2 is where you’ll provide information regarding your business, if applicable. You also need to include your current employer’s information, as well as other non-wage household income. Finally, list out all necessary monthly living expenses. Be sure to sign and date the form.

Need Help?

With Form 433-F, the IRS has made it much easier for you to provide your financial information and gain approval for an installment agreement (Form 9465) or non-collectible status. If you need help completing IRS Form 433-F, however, call Tax Defense Network at 855-476-6920.