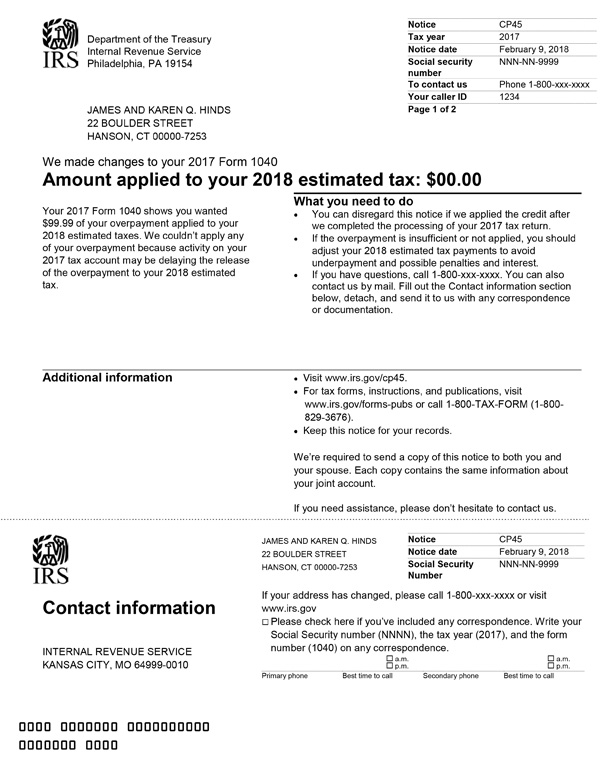

IRS Notice CP45 – Unable to Apply Your Overpayment

IRS Notice CP45 is sent to a taxpayer when the IRS is unable to apply an overpayment from one tax year to their estimated tax for the next tax year as requested.

Why Did I Receive IRS Notice CP45?

You received IRS Notice CP45 because you asked the IRS to apply your overpayment from one tax year to your estimated taxes for another tax year. This usually happens when there is a delay in processing the return with the overpayment or there is an error in your calculations.

Next Steps

Read your CP45 notice carefully. If the overpayment was applied after the IRS processed your tax return, nothing further is needed. You can check this by getting a copy of your tax account transcript, as the IRS will not send additional notices after this one.

Additionally, if the overpayment was insufficient or not applied, you should adjust your estimated tax payments accordingly to avoid possible underpayment penalties and interest for the current tax year.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP45 or possible changes made to your tax return, please call the toll-free number listed on your notice.