As tax season approaches, one crucial document that often causes confusion and raises questions is IRS Form 1098-T. This form is a critical piece of the puzzle when it comes to claiming education-related tax benefits. Whether you’re a student, a parent, or a guardian, understanding the intricacies of this form can help you maximize your tax savings and ensure compliance with IRS regulations.

Understanding The Purpose of Form 1098-T

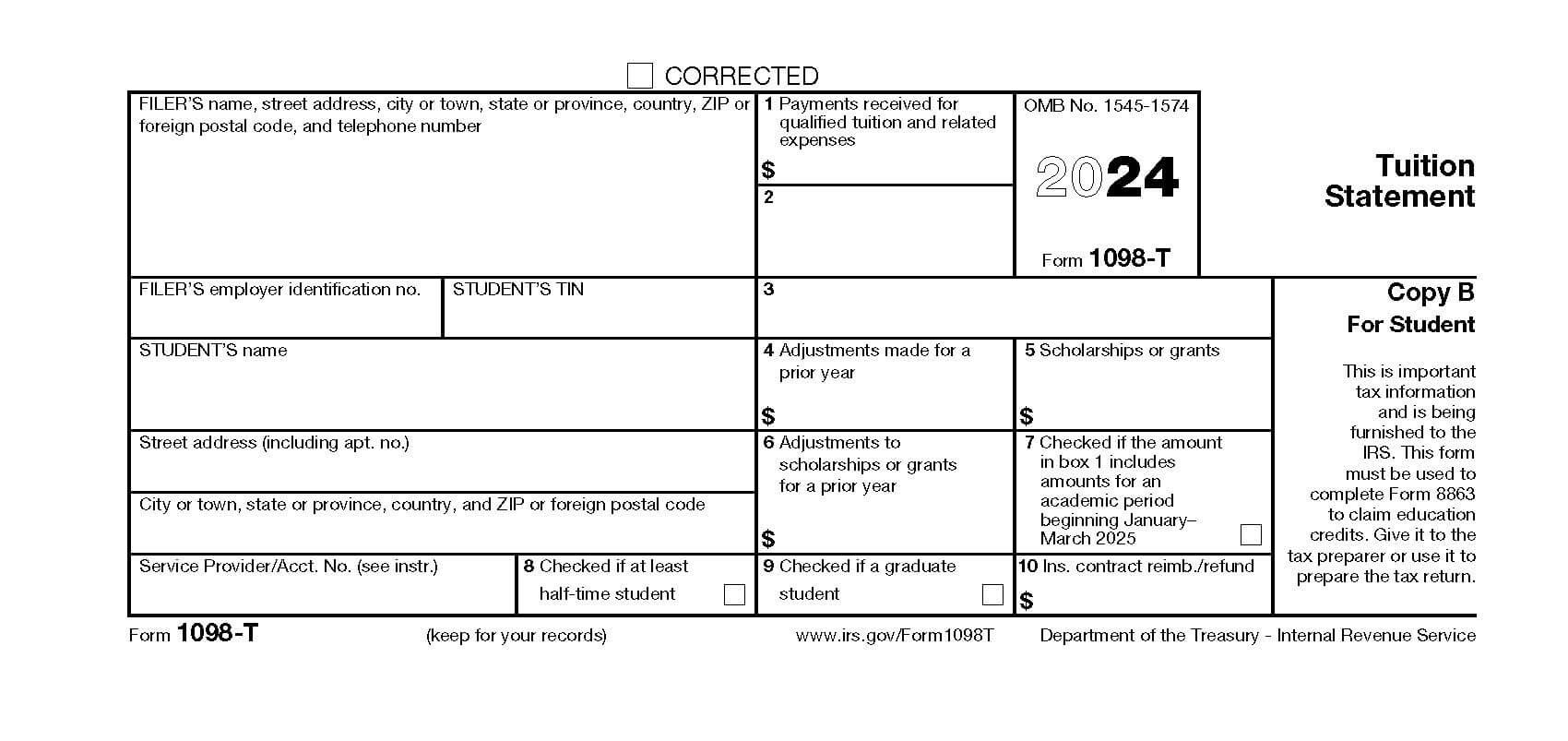

IRS Form 1098-T, also known as the Tuition Statement, is an informational form issued by eligible educational institutions to report qualified tuition and related expenses paid during the tax year. This form is crucial for taxpayers seeking to claim education-related tax credits or deductions, such as the American Opportunity Tax Credit (AOTC) or the Lifetime Learning Credit (LLC).

By providing detailed information about the amount of qualified expenses paid, IRS Form 1098-T serves as a vital document for substantiating your eligibility for these valuable tax benefits. It also helps ensure that you accurately report your education expenses and receive the appropriate tax savings.

Who Uses Form 1098-T?

IRS Form 1098-T is primarily used by individuals who have paid qualified tuition and related expenses for themselves, their spouse, or their dependents. This includes:

- Students enrolled in eligible educational institutions, such as colleges, universities, or vocational schools

- Parents or guardians who have paid qualified expenses for their dependent children

- Taxpayers who have paid qualified expenses for themselves or their spouse

It’s important to note that the form is issued by eligible educational institutions, not by the IRS itself. These institutions are responsible for providing accurate and timely information to their students or the individuals who have paid the qualified expenses.

Key Information Found on Your Tuition Statement

IRS Form 1098-T contains several key pieces of information that are crucial for claiming education-related tax benefits. Here are some of the most important items you’ll find on the form.

- Student’s Name and Taxpayer Identification Number (TIN). This section includes the name and TIN (typically the Social Security Number) of the student for whom the qualified expenses were paid.

- Institution’s Name and Address. The name and address of the eligible educational institution that issued the form.

- Payments Received (Box 1). The total amount received by the eligible institution from any source for qualified tuition and related expenses, minus any reimbursements or refunds.

- Adjustments Made For a Prior Year (Box 4). Any adjustments made to tuition or related expenses reported in a prior year, which may affect the current year’s tax calculations.

- Total Scholarships or Grants Administered (Box 5). The total amount of grants or scholarships administered and processed by the institution. This may reduce the amount of educational credit you can claim.

- Adjustment to Scholarships For a Prior Year (Box 6). Shows any adjustments to grants or scholarships for a prior year. This may affect the amount of allowable tuition and fees deduction or education credit you can claim. You may also need to file an amended tax return.

It’s essential to review the information on IRS Form 1098-T carefully to ensure its accuracy and to identify any potential discrepancies or adjustments that may impact your tax situation.

Common Mistakes to Avoid

Although IRS Form 1098-T is a straightforward document, there are some common mistakes that taxpayers should be aware of and avoid.

- Assuming All Expenses are Qualified. Not all expenses reported on the form are necessarily qualified for tax benefits. Expenses such as room and board, transportation, or non-required fees may not be eligible.

- Overlooking Adjustments. Failing to account for any adjustments made for a prior year can lead to incorrect tax calculations and potential penalties.

- Duplicate Claiming. If multiple individuals (e.g., parents and students) are claiming the same expenses, it can result in duplicate claims and potential issues with the IRS.

By being vigilant and carefully reviewing the information on IRS Form 1098-T, as well as understanding the eligibility requirements for education-related tax benefits, you can avoid these common pitfalls and ensure accurate tax reporting.

Got Questions About IRS Form 1098-T?

As you navigate the complexities of IRS Form 1098-T and education-related tax benefits, you may have questions. Here are some FAQs and their answers.

- What if I don’t receive the Form 1098-T? If you don’t receive Form 1098-T from the eligible educational institution by early February, you should contact the institution’s financial aid office to request a copy. You may still be able to claim education-related tax benefits if you have the necessary documentation to substantiate your qualified expenses.

- Can I claim education-related tax benefits even if I didn’t receive a Form 1098-T? Yes, it is possible to claim education-related tax benefits even if you didn’t receive a Form 1098-T. However, you’ll need to have adequate documentation, such as receipts, account statements, or other proof of qualified expenses paid during the tax year.

- What if the information on Form 1098-T is incorrect? If you notice any inaccuracies or discrepancies in the information reported on Form 1098-T, you should contact the educational institution immediately to request a corrected form. Providing accurate information is crucial for claiming the appropriate tax benefits.

- Can I claim education-related tax benefits for expenses paid with student loans? Yes, qualified expenses paid with student loans are eligible for education-related tax benefits. However, you should consult with a tax professional or review the specific eligibility requirements to ensure you meet all the necessary criteria.

- What if I paid qualified expenses for multiple students? If you paid qualified expenses for more than one student, you may be able to claim education-related tax benefits for each eligible student. However, it’s important to ensure that you don’t duplicate claims or exceed any applicable limits or thresholds.

By addressing these common questions, you’ll gain a better understanding of IRS Form 1098-T and its role in claiming education-related tax benefits, allowing you to navigate the process with greater confidence and accuracy.

Conclusion

IRS Form 1098-T is a crucial document for anyone seeking to claim education-related tax benefits. By understanding its purpose, the key information it contains, and the proper steps to follow, you can maximize your tax savings and ensure compliance with IRS regulations.

Remember to review the form carefully, compare the information with your records, and retain all necessary documentation. Additionally, explore strategies for maximizing education tax benefits, stay aware of important deadlines, and don’t hesitate to seek professional assistance if you have complex tax situations.