You may be able to take the credit for child and dependent care expenses if you pay someone to watch your dependent child (12 or younger), your disabled spouse, or other disabled dependent (any age) while you are working or looking for work. Here’s what you need to know for this tax year.

What’s New

Unfortunately, the changes to the credit for child and dependent care expenses made under the American Rescue Plan Act of 2021 have expired. This means that the credit will revert to its pre-pandemic rules. For the tax year 2022, the following will apply:

- The credit is no longer refundable.

- You may only claim the credit on qualifying employment-related expenses of up to $3,000 for one qualifying person, or $6,000 if you have two or more qualifying persons.

- The maximum credit is 35% of your employment-related expenses. This decreases to 20% once your adjusted gross income exceeds $43,000.

Since the enhancement to dependent care benefits has also expired, the maximum amount you can have excluded from your income through a dependent care assistance program is $5,000. If you are married and filing separately, however, that amount is reduced to $2,500

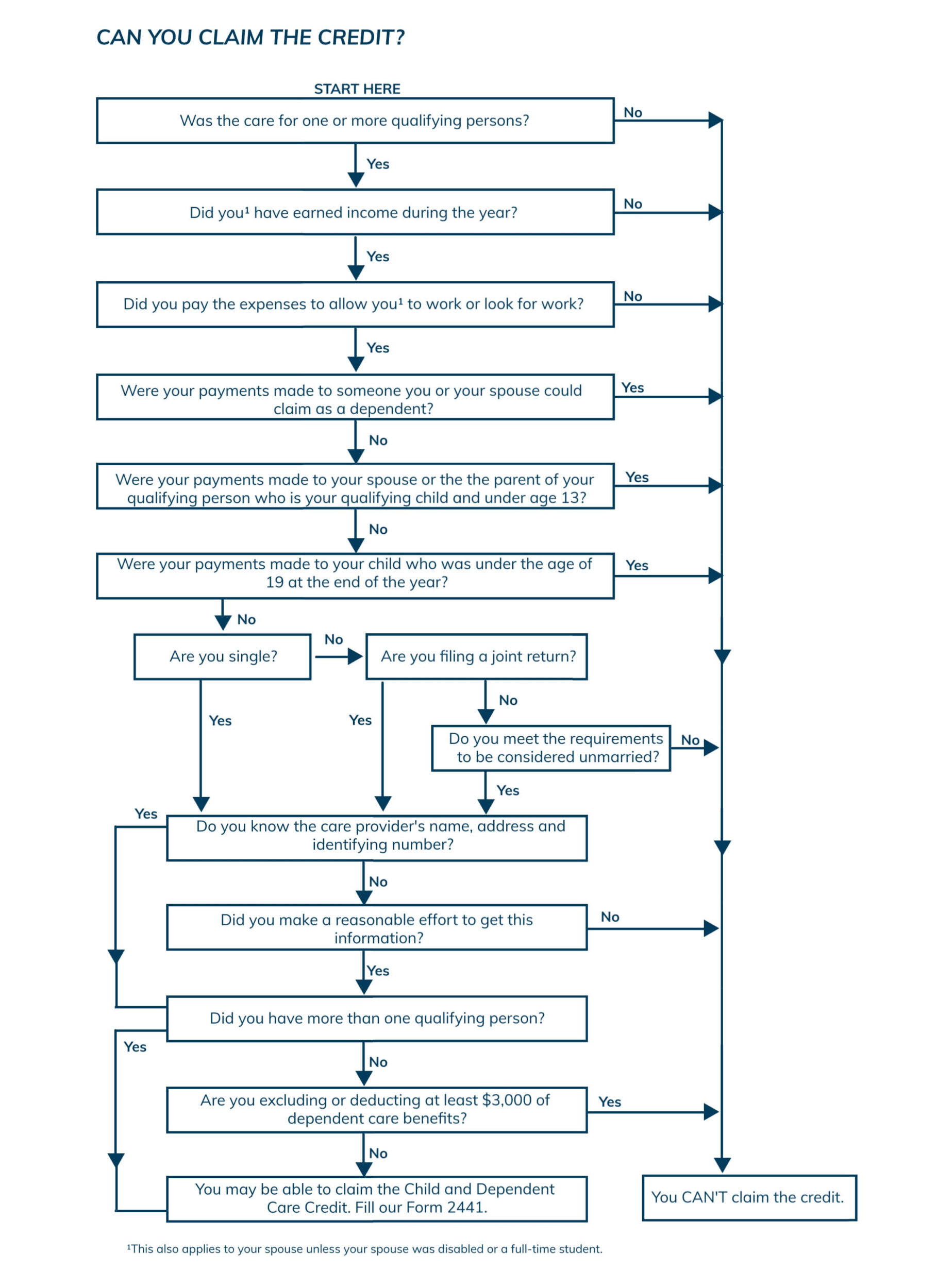

Can You Claim The Credit?

Before you can claim the credit for child and dependent care expenses, you must meet all of the following tests.

Qualifying Person Test

Your expenses must be for the care of a qualifying child who is your dependent and under age 13. A spouse who is physically or mentally disabled and unable to care for themselves may also qualify if they lived with you for at least half of the tax year.

Additionally, a disabled person who lived with you for more than half of the year will also qualify if they are your dependent (any age) or would have been a dependent except:

- They received gross income of $4,400 or more;

- They filed a joint return, or;

- You or your spouse, if filing jointly, could be claimed as a dependent on someone else’s tax return.

Your qualifying person must also have a Social Security number (SSN) or individual taxpayer identification number (ITIN).

Earned Income Test

You, and your spouse (if filing jointly), must have earned income for the year. Earned income includes wages, salaries, tips, other taxable employee compensation, as well as net earnings from self-employment. Your spouse is treated as having earned income for any month that they are a full-time student or unable to care for themselves (mentally or physically disabled).

Work-Related Expense Test

Your child and dependent care expenses must be work related to qualify for the tax credit. Expenses are considered work-related if both of the following are true:

- They allow you (and your spouse, if filing jointly) to work or look for work, and;

- The expenses are for a qualifying person’s care.

Non-Dependent Provider Test

You can’t make payments for child and dependent care to a spouse, or the parent of your qualifying child (age 12 or younger). Only payments made to someone you can’t claim as a dependent will qualify, including adult children who are 19 or older.

Joint Return Test

Your filing status must be single, head of household, or qualifying surviving spouse. If you are married, you generally must file a joint tax return to claim the credit. In some instances, you may be able to take the credit if you are legally separated or living apart from your spouse.

Provider Identification Test

You must identify any person or organization (business) that provides care for your child or dependent. This includes:

- The provider’s name

- Address

- Taxpayer identification number – SSN or employer identification number (EIN)

If the care is provided through a church or other tax-exempt organization, no taxpayer identification number is required.

You can also use the chart below to see if you meet the requirements.

How to Claim The Credit For Child and Dependent Care Expenses

To claim the tax credit, you must file Form 1040, 1040-SR, or 1040-NR. Additionally, you must complete and attach Form 2441, Child and Dependent Care Expenses, to your tax return. You will enter the amount of your credit on Schedule 3, line 2.

Figuring Your Work-Related Expenses

To determine the total for your 2022 work-related expenses, only include those you paid by December 31, 2022. Do not include prepaid expenses unless care was received in the same year. For example, if you paid $500 in 2022 for services provided in early 2023, you would not count this as an expense on your 2022 tax return. You may, however, be able to claim it as an expense on next year’s return.

There is an exception. If you paid 2021 expenses in 2022, these should not be included in your 2022 total. Instead, you may be able to claim these expenses as an additional credit, but they must be figured separately.

Dependent Care Benefit Reduction

If you received dependent care benefits, your dollar limit for purposes of the credit may be reduced. Dependent care benefits include:

- Amounts your employer paid directly to either you or your care provider for the care of your qualifying person while you worked;

- The fair market value of care in an employer-sponsored daycare facility, and;

- Pre-tax contributions you made to a dependent care flexible savings account (FSA).

Amount of Credit

To figure out your credit amount, multiply your qualified work-related expenses (after applying earned income and dollar limits) by a percentage. The percentage you use depends on your adjusted gross income (AGI) from line 11 on Form 1040, 1040-SR, or 1040-NR.

| If your adjusted gross income is: | ||

| Over: | But not over: | The percentage is: |

| $0 | $15,000 | 35% |

| $15,000 | $17,000 | 34% |

| $17,000 | $19,000 | 33% |

| $19,000 | $21,000 | 32% |

| $21,000 | $23,000 | 31% |

| $23,000 | $25,000 | 30% |

| $25,000 | $27,000 | 29% |

| $27,000 | $29,000 | 28% |

| $29,000 | $31,000 | 27% |

| $31,000 | $33,000 | 26% |

| $33,000 | $35,000 | 25% |

| $35,000 | $37,000 | 24% |

| $37,000 | $39,000 | 23% |

| $39,000 | $41,000 | 22% |

| $41,000 | $43,000 | 21% |

| $43,000 | No limit | 20% |

For example, if you have an AGI of $31,000, your percentage is 27%. If you had one qualifying child and spent $5,000 in work-related childcare expenses, the total credit would be $860 because you are limited to $3,000 for one qualifying person ($3,000 x 27% = $860).

Need Help?

There are a lot of variables involved when determining the amount of your credit for child and dependent care expenses. If you need help, be sure to check out Publication 503 or consult with a tax professional.