It’s the start of the New Year and you may be wondering, “Do I have to file taxes?” In general, you won’t need to file a tax return if your income does not exceed the standard deduction for your age and filing status. There are, however, other circumstances that may require you to file even if your income does not exceed the minimum amount. Unfortunately, nothing is ever easy when it comes to taxes. That’s why we’ve created some handy charts and other information to help you determine whether you need to file taxes this year.

Income Requirements for Filing Taxes

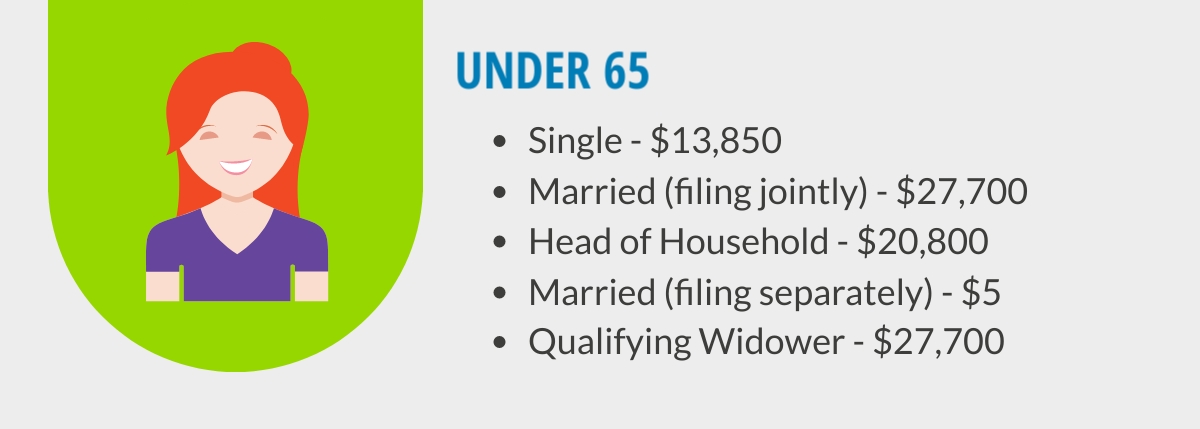

If you’re single and under the age of 65, you’ll probably need to file taxes if your gross income was $13,850 or more. For those who are 65 or older, use a different filing status, or are claimed as a dependent on another taxpayer’s return, the income thresholds will be different.

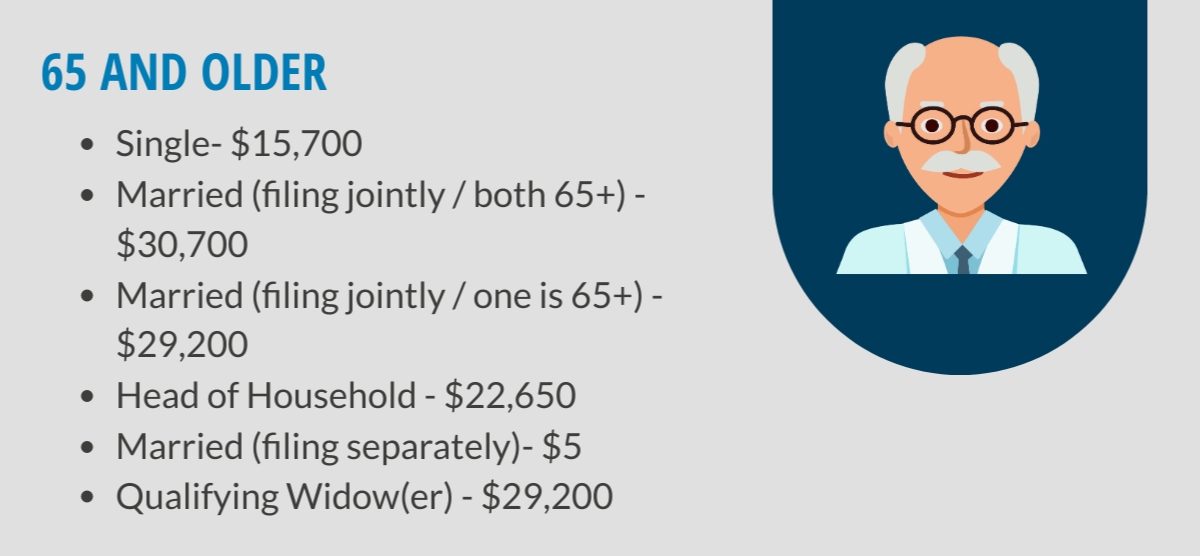

For taxpayers 65 and older, the income thresholds are slightly higher. Please note that these income requirements also apply to taxpayers who are legally blind.

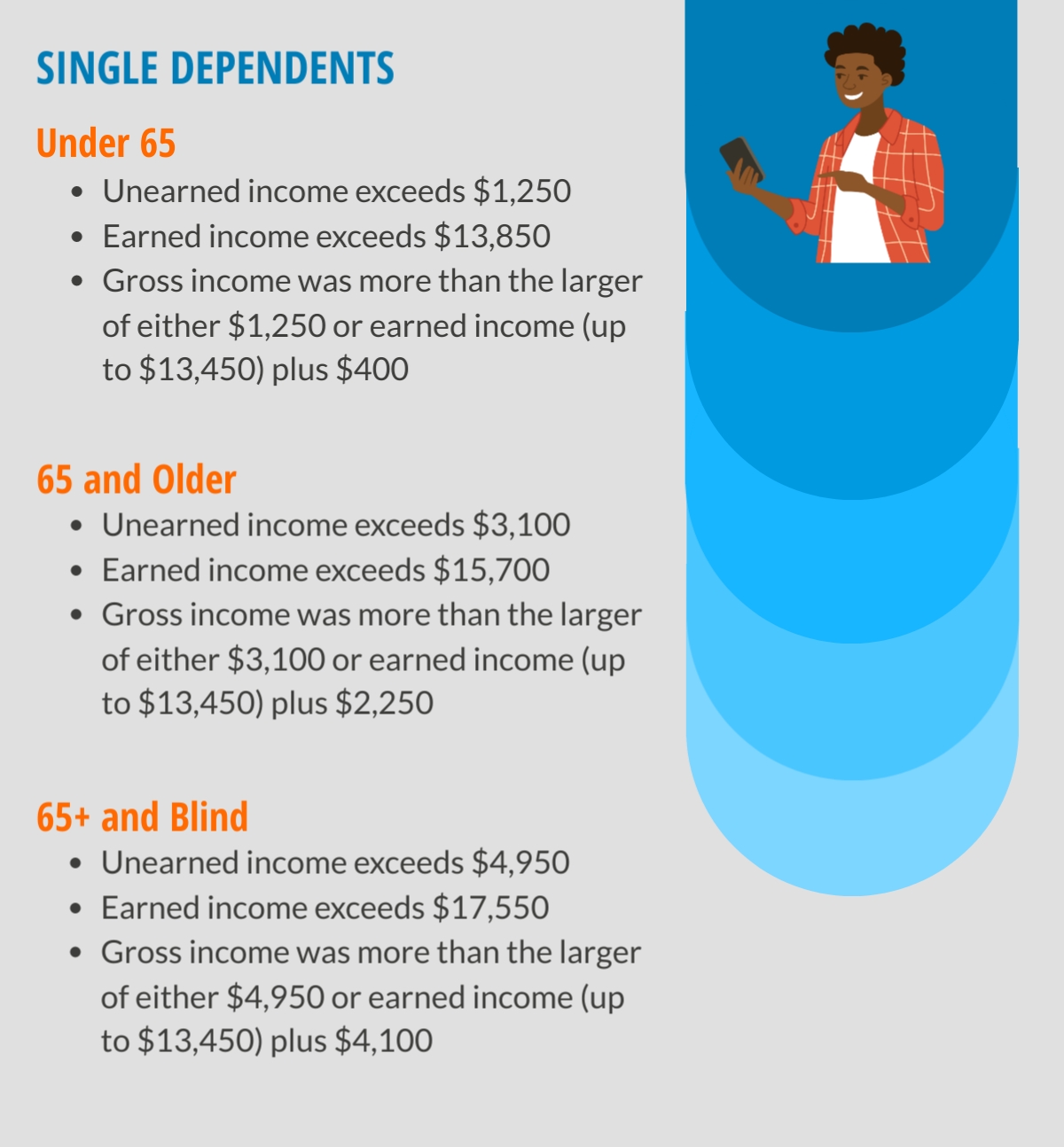

If you are single and another taxpayer can claim you as a dependent on their tax return, you may still be required to file a tax return if you meet the following income requirements.

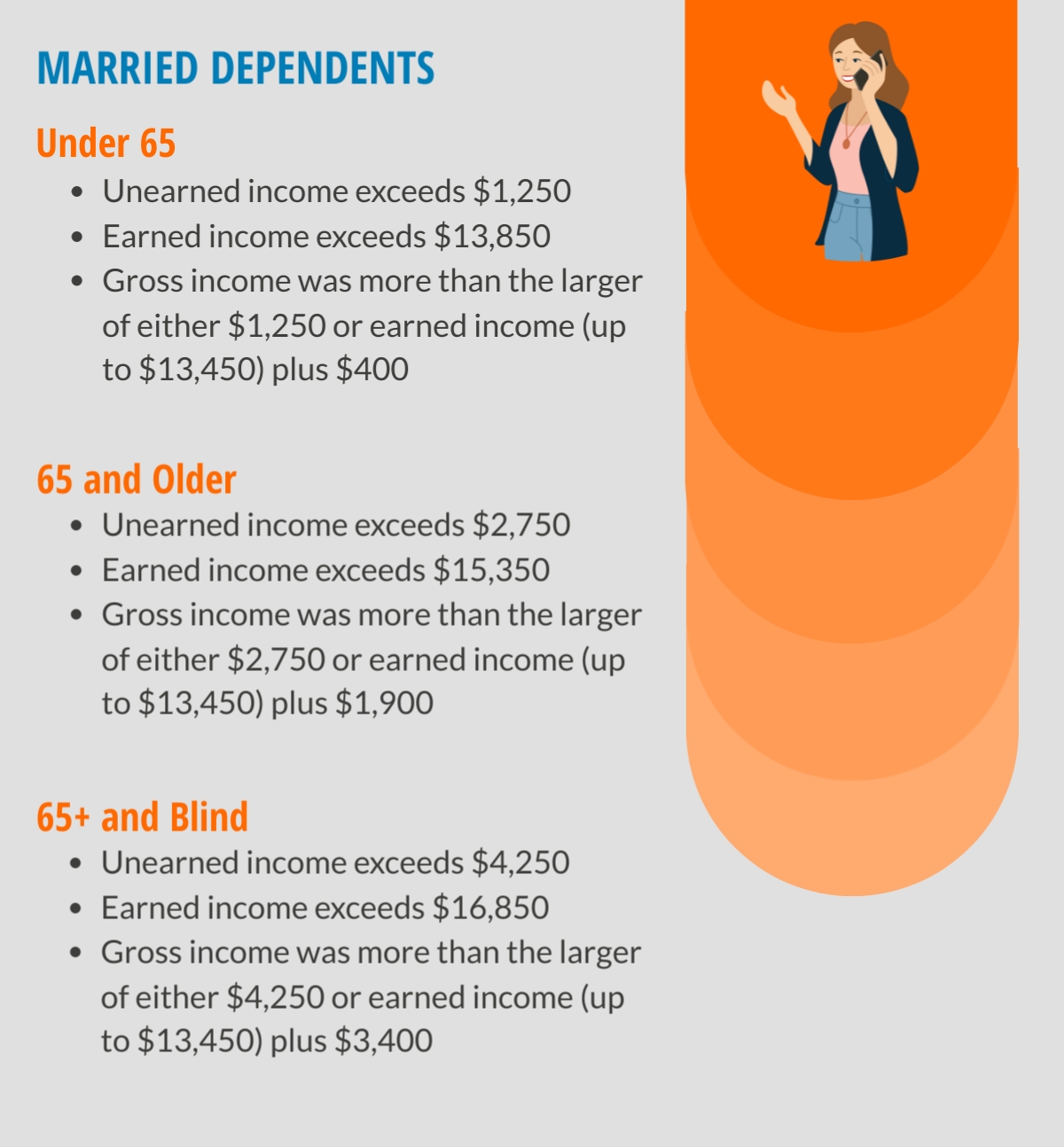

Under certain circumstances, it’s also possible that a married person may be claimed as a dependent on another person’s tax return. When this happens, the following income thresholds are used to determine if a separate tax return must also be filed by the dependent.

If the dependent’s spouse files separately and itemizes deductions, however, the dependent must also file a return if they have gross income of $5 or more.

Do I Have to File Taxes for Social Security?

In general, Social Security benefits are not considered taxable income. There are, however, a few instances where you may have to file a return. For example, if you are married filing jointly, you must file a return if your combined income is more than $30,700 (if your spouse is 65+). The income threshold drops to $29,200 if your spouse is not yet 65 or older.

Did you live with your spouse at any time during the year? For married filing separately, you’ll need to include 85% of your Social Security in your gross income calculation, which could push you past the income threshold.

You may also be required to file a tax return if you have other income in addition to your Social Security benefits. To determine if your Social Security benefits are taxable, follow these simple steps:

- Add 50% of your Social Security income to all other income (this includes tax-exempt interest);

- Compare the total to the standard deduction amount for your filing status;

- If the total exceeds the deduction amount, a portion of your Social Security income may be taxable.

If you are still unsure about your filing requirements, we highly recommend speaking with a tax professional who can help you determine what Social Security benefits, if any, must be included.

Other Reasons You May Need to File a Tax Return

Although the “do I have to file taxes” question is often answered based on your income, there are other instances where you may be required to file. If any of the following are true, you will likely need to submit a tax return.

- Self-employed and have $400 or more in net earnings

- Received unemployment income

- Sold your home

- Owe Alternative Minimum Tax (AMT)

- Earned $108.28 working for a church or church organization

- Owe taxes (Social Security or Medicare) on unreported tips

- Received distributions from a health savings account (HSA)

- Owe taxes on a tax-favored account (HSA, IRA, etc.)

- You owe nanny taxes

- Claimed the first-time homebuyer credit on a previous return

- Received payment on a 1099-MISC or 1099-NEC form

- Purchased health insurance from a state or federal marketplace

- Owe recapture taxes

You will also be required to submit a tax return if you are currently making payments through an IRS payment plan. If you don’t file, it could jeopardize your installment agreement.

Why You May Want to File a Return if It’s Not Required

Even if you aren’t required to file a tax return this year, you may want to do so anyway. It lowers the risk of someone fraudulently filing on your behalf, which creates all types of problems. It could also result in a tax refund. Not only can you get back the income tax withheld from your paychecks, but you may even qualify for certain tax credits. Many low-income taxpayers are eligible for the Earned Income Tax Credit. If you have children or qualifying dependents, you could also receive a refund by using the Additional Child Tax Credit. Students and parents may also increase their refund by up to $1,000 if they’re eligible for the American Opportunity Tax Credit.

If you need assistance with your tax return, call 855-476-6920 to schedule a free consultation with Tax Defense Network today. We offer affordable tax preparation services for individuals and small business owners.