The landscape of work has undergone a significant transformation in recent years, with more individuals than ever before conducting business from the comfort of their homes. This shift has brought renewed attention to the home office deduction, a valuable tax benefit for those who qualify. Whether you’re a seasoned entrepreneur or newly self-employed, understanding the intricacies of this deduction can lead to substantial tax savings. This comprehensive guide will walk you through everything you need to know about claiming a home office deduction, from eligibility criteria to calculation methods and beyond.

What is The Home Office Deduction?

The home office deduction allows eligible taxpayers to deduct certain expenses related to using their home for business purposes. This tax benefit recognizes that maintaining a workspace at home incurs costs that would otherwise be covered by an employer in a traditional office setting. By claiming this deduction, self-employed individuals can reduce their taxable income and potentially increase their overall tax savings.

However, it’s crucial to note that not everyone who works from home qualifies for this deduction. The Internal Revenue Service (IRS) has established specific criteria that must be met to claim this benefit. Understanding these requirements is the first step in determining your eligibility and maximizing your potential deduction.

Eligibility Criteria for Home Office Deduction

The IRS has set forth clear guidelines regarding who can claim the home office deduction. These criteria ensure that the deduction is reserved for those who genuinely use their home as a primary place of business.

Self-Employment Status

One of the fundamental requirements for claiming the home office deduction is self-employment status. This includes independent contractors, freelancers, sole proprietors, and other individuals who work for themselves. It’s important to note that following the Tax Cuts and Jobs Act of 2017, employees who work from home are no longer eligible for this deduction, even if they maintain a dedicated home office space.

Exclusive and Regular Use

To qualify for the deduction, you must use a portion of your home exclusively and regularly for your business. This means that the space should be used solely for business purposes and not for any personal activities. For example, a spare bedroom that serves as both a home office and a guest room would not meet this criteria. Additionally, the space must be used consistently for business, not just occasionally.

Principal Place of Business

Your home office must be your principal place of business. This doesn’t necessarily mean it’s the only place you conduct business, but it should be where you perform the majority of your work or where you handle the administrative and management aspects of your business. If you conduct business at multiple locations, your home office can still qualify if it’s used exclusively for administrative or management activities and there’s no other fixed location where you conduct these tasks.

Qualifying Spaces For Home Office Deduction

When considering the home office deduction, it’s essential to understand which types of spaces can qualify. The IRS provides flexibility in this regard, recognizing that home offices can take various forms. Here are some examples of qualifying spaces:

- A dedicated room in your house

- A portion of a room, such as a corner desk area

- A detached structure on your property, like a garage or studio

- A portion of your basement or attic

Remember, regardless of the type of space, it must meet the exclusive and regular use criteria to qualify for the deduction.

Calculating Your Home Office Deduction

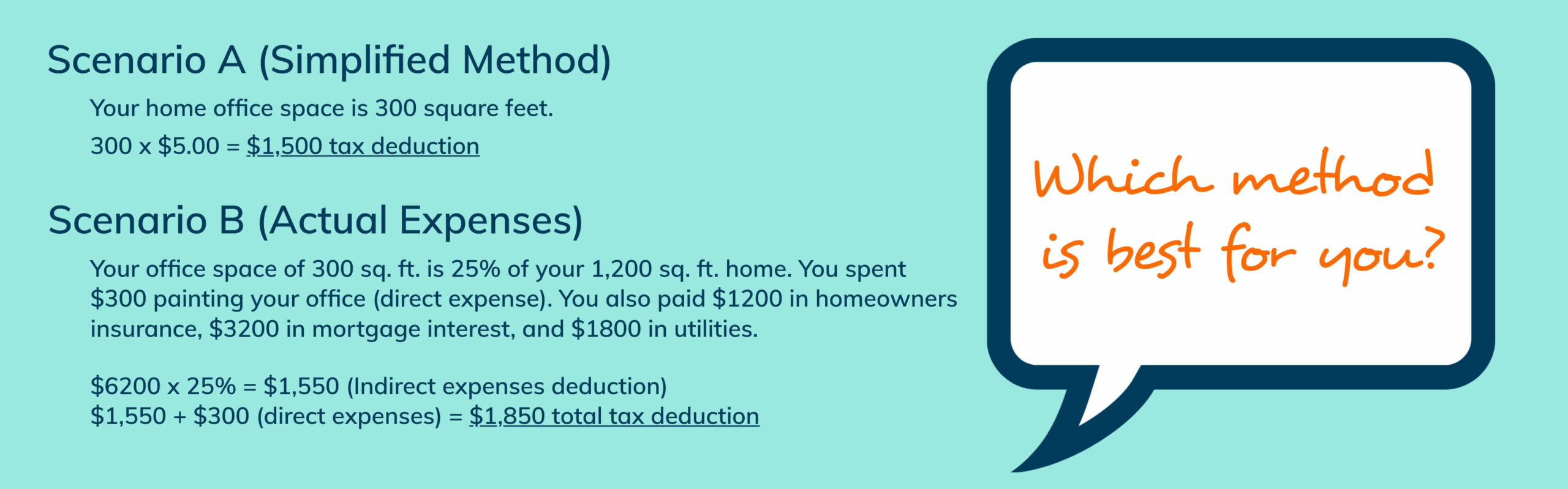

Once you’ve determined that you’re eligible for the home office deduction, the next step is calculating the amount you can claim. The IRS offers two methods for this calculation: the regular method and the simplified option. Each has its advantages and considerations, so it’s important to understand both to choose the one that best suits your situation.

The Regular Method

The regular method involves a more detailed calculation of your home office expenses. Here’s a step-by-step guide to using this method:

- Determine the percentage of your home used for business

- Calculate your total home expenses

- Apply the business-use percentage to your total home expenses

- Add any direct expenses related to your home office

This method allows for a potentially larger deduction but requires more record-keeping and calculations.

The Simplified Option

The simplified option offers a more straightforward approach to calculating your deduction. Under this method:

- You can deduct $5 per square foot of your home office space

- The maximum deduction is capped at $1,500 (300 square feet)

Although this method is easier to use, it may result in a smaller deduction for some taxpayers. Here’s an example of how your tax deduction may look using the two different options.

Deductible Expenses for Home Office

Understanding which expenses qualify for the home office deduction is crucial for maximizing your tax benefit. The IRS allows for both direct and indirect expenses to be deducted.

Direct Expenses

Direct expenses are those that relate specifically to your home office space. These may include, but are not limited to:

- Painting or repairs made specifically to your home office

- Furniture and equipment purchased for use in your home office

- Separate phone line or internet service dedicated to your business

Indirect Expenses

Indirect expenses are those that benefit your entire home, including your office space. These expenses are deductible based on the percentage of your home used for business. Common indirect expenses include:

- Mortgage interest or rent payments

- Property taxes

- Homeowners insurance

- Utilities (electricity, gas, water)

- General home repairs and maintenance

It’s important to keep detailed records of all expenses related to your home and business to ensure accurate calculations and support your deduction claim if audited.

Record-Keeping For Home Office Deduction

Proper record-keeping is essential when claiming the home office deduction. Not only does it ensure accurate calculations, but it also provides necessary documentation in case of an IRS audit. Here are some tips for maintaining thorough records.

- Keep all receipts related to home expenses and business purchases

- Maintain a record of the time spent working in your home office

- Take photographs of your home office setup

- Create a floor plan showing the layout of your home and the location of your office

- Keep records of any changes to your home office space or usage over time

By maintaining detailed records, you’ll be well-prepared to support your deduction claim and maximize your tax benefits.

Common Mistakes to Avoid

When claiming the home office deduction, there are several common pitfalls that taxpayers should be aware of and avoid.

- Overestimating Office Space. Be accurate in measuring your home office space. Inflating the size of your office can raise red flags with the IRS and potentially lead to an audit.

- Claiming Personal Expenses. Ensure that you’re only deducting expenses directly related to your business use of the home. Personal expenses should not be included in your calculations.

- Neglecting to Adjust for Part-Year Use. If you don’t use your home office for the entire tax year, make sure to adjust your deduction accordingly. Claiming a full year’s deduction for partial-year use can lead to issues with the IRS.

- Failing to Meet Exclusive Use Requirements. Remember that your home office must be used exclusively for business purposes. Using the space for personal activities, even occasionally, can disqualify you from claiming the deduction.

Special Considerations

Although the basic principles of the home office deduction are straightforward, there are several special considerations and exceptions.

Daycare Facilities

If you use space in your home for a licensed daycare facility, you may still be able to claim the home office deduction even if the space is not used exclusively for business. The IRS provides specific guidelines for calculating the deduction in these cases.

Inventory Storage

If you use part of your home to store inventory for your business, you may be able to include this space in your home office deduction calculation, even if it’s not used exclusively for business purposes.

Multiple Businesses

If you run multiple businesses from your home, each business must separately meet the eligibility criteria for the home office deduction. You cannot claim the deduction for one business if another business conducted in the same space doesn’t qualify.

Seeking Professional Advice

Although this guide provides a comprehensive overview of the home office deduction, tax situations can be complex and unique to each individual. If you’re unsure about your eligibility or how to calculate your deduction, it’s advisable to consult with a qualified tax professional. They can provide personalized advice based on your specific circumstances and help ensure that you’re maximizing your tax benefits while remaining compliant with IRS regulations.