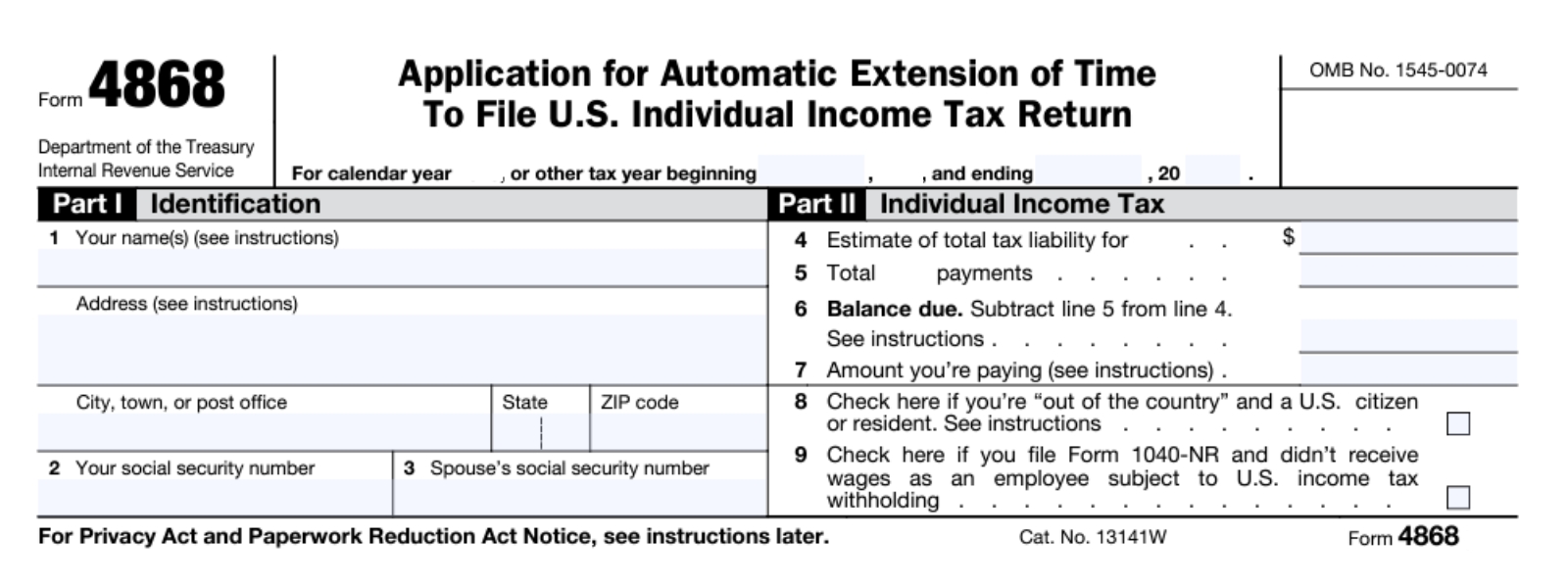

Do you need more time to file your federal income tax return? Great news! You can typically get a 6-month extension by submitting Form 4868, Application for Automatic Extension of Time to File U.S. Induvial Income Tax Return. The process is fairly easy, but there are a few steps you must follow to ensure your application is approved. Keep reading to learn how to get a tax-filing extension for the current tax year.

How to Request a Filing Extension

One of the most important steps for requesting a tax-filing extension is to submit it on or before the original tax filing deadline. In most cases, this will be April 15 or the next business day (if the 15th falls on a weekend). There are several ways you can request an extension, including online, by mail, or by making a payment. Best of all, there is no fee to request a tax-filing extension.

To get extra time to file, you must:

- Properly estimate your tax liability for the current tax using the information available to you,

- Enter your total tax liability for the year on line 4 of Form 4868, and

- Submit Form 4868 (see example below) before the regular tax filing deadline.

Submit Form 4868 Online

If you use online tax software to prepare your return, you can complete and file Form 4868 using the same program. You can also use IRS Free File to electronically request an automatic extension, regardless of your income level. If you’re working with a tax professional, they can also file an extension request on your behalf.

Submit Form 4868 By Mail

Another option is to submit your tax filing extension request by postal mail. Download Form 4868 from IRS.gov or call 800-829-3676 to have one mailed to you. Once you’ve completed the form, mail it to the appropriate address under “Where to File a Paper Form 4868” which is included in the packet. Those who use the fiscal year (not calendar year) to file taxes must submit a paper form and request an extension by mail. Do not submit a paper form if you’ve already requested an extension online. If you are making a payment by check or money order, however, you can use a copy of Form 4868 as a voucher.

Make an Electronic Payment

You can also request a tax-filing extension without using Form 4868 by paying all or part of your estimated tax due. Simply use IRS Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or pay by credit or debit card. When processing the payment, be sure to indicate that it’s for a filing extension. Once the payment is complete, you’ll receive a confirmation number for your records.

Automatic Extensions For Special Circumstances

There are certain circumstances when the IRS will automatically give a filing extension without submitting Form 4868 (other than making a payment).

Living Outside The U.S.

You are allowed an automatic 2-month extension to file your return and pay your taxes if you are a U.S. citizen or resident alien, and on the regular due date of your return:

- You’re living outside of the United States or Puerto Rico, or

- You are in the military and your duty station is outside of the U.S. or Puerto Rico.

To get the extension, attach a statement to your return explaining which of the above qualified you for the extension. Although you will receive an additional two months to pay, interest will begin to accrue on any unpaid taxes once the original filing deadline passes.

Combat Zone Extension

U.S. Armed Forces serving in a combat zone can get an automatic tax-filing extension that includes the combat service period plus 180 days after the last day in the combat zone. This extension option also extends to individuals serving in the combat zone in support of the U.S. Armed Forces, such as:

- Merchant marines serving aboard vessels under the operational control of the Department of Defense,

- Red Cross personnel, and

- Civilian personnel acting under the direction of the U.S. Armed Forces in support of those forces.

During the extension period, assessment and collection deadlines will also be extended. Interest and penalty fees will not accrue.

Was My Tax-Filing Extension Request Approved?

Most tax-filing extension requests are approved. If you applied online, you should receive a confirmation email within 24 hours. Mail applications, unfortunately, do not receive a confirmation email. To check on the status of your request, call 800-829-3676.

The IRS generally won’t contact you unless there is an issue with your application. This typically happens if you made an error on Form 4868 (misspelling or information differs from IRS records) and need to correct it. Once adjusted, you can resubmit your request. If the issue includes a gross underestimate of taxes due, however, your application could be denied.

Extra Time to File, Not Pay

Unless you qualify for a combat zone extension, it’s important to note that an approved tax-filing extension does not give you extra time to pay your taxes. If you owe, you should pay as much as you can when filing your extension. This will help reduce the penalties and interest fees charged for any unpaid balance remaining after the original filing deadline passes.

If you need help filing a tax extension or dealing with unexpected tax debt, contact Tax Defense Network at 855-476-6920 for a free consultation. Our tax experts can help you find an affordable solution for your tax problem.