It’s happened. You open your mailbox and there it is – the dreaded letter from the IRS stating that they’ve selected your tax return for “examination.” The IRS letter contains detailed instructions, but it doesn’t come with a translator. Before you get too worried about your tax audit fate, take a few deep breaths. We’ve got you covered. Here’s everything you need to know about audits and how tax audit help could help you through this distressing experience.

What does an audit include?

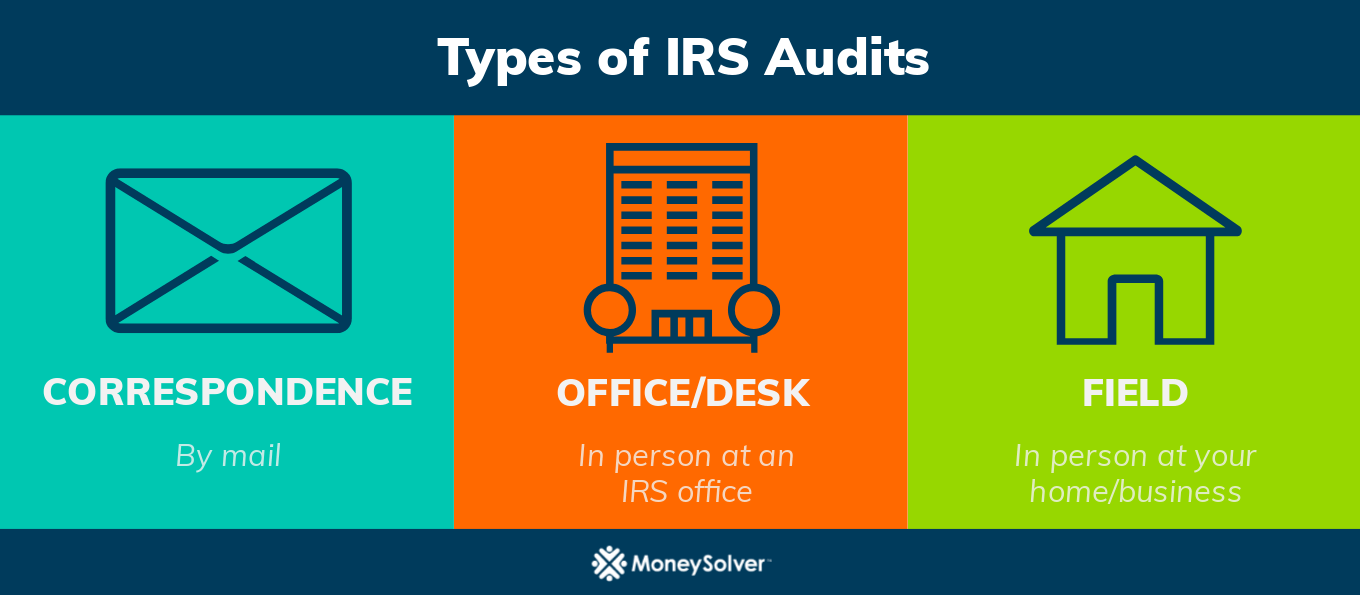

When the IRS audits you, they’re saying that they want to examine your return more closely. They’re looking to ensure all the information you provided is correct. There are three different audit types to look out for:

- Correspondence audits: Audits conducted mainly by mail.

- Office/desk audits: In-person audits at an IRS office.

- Field audits: In-person audits that are either at your home or business.

The majority of IRS audits for fiscal year 2017 were correspondence audits at 70.8 percent of all audits.

What triggers an audit?

Audits are typically triggered when something on your return is abnormal or “off” to the IRS. This can be as simple as making a typo or error, earning more money than you have in previous years, or forgetting to report cryptocurrency. But the cause can also be more complicated, like a self-employment tax issue.

Other audit causes include:

- Failing to report taxable income

- Having three consecutive years of business losses if you’re self-employed

- This isn’t likely for corporations, but it’s still possible.

- Using round numbers on your return

- Deducting 100 percent of a business car

The most interesting audit cause? The IRS selects a very small amount of returns for audit at random as part of the National Research Program they conduct. That’s why most tax preparers cannot offer you an entirely “audit-free” return. Even with a completely clean return, there’s always a possibility that you could face an audit.

What can come from an audit?

There are three ways to conclude an audit:

- Accepted – the IRS proposes changes that you understand and accept.

- Disagreed – the IRS proposes changes that you understand but don’t agree with completely.

- No change – no changes come from your audit.

Sometimes the changes that the IRS proposes will include an increase in your tax bill. However, it’s not always the case that you’ll owe money after an audit brings about changes. In almost 34,000 instances out of the total 1.1 million tax returns audited in 2016, taxpayers received additional refunds totaling more than $60 billion.

No matter what conclusion comes from your audit, the biggest key is to watch out for deadlines. The IRS gives you a specific amount of time to respond and if you don’t respond, they will still post the changes.

Why turn to professional tax audit help?

There’s nothing that says you can’t take on an audit on your own, especially if it’s a correspondence audit. With these types of audits, you can usually complete them by sending the IRS whatever they’ve asked for. But if they aren’t satisfied with what you’ve sent or if you don’t have what they want, it could benefit you to seek out professional tax audit help.

You have certain taxpayer rights, which extend to the right to retain representation. This means that you have the right to have an authorized representative of your choosing to represent you with the IRS. Dealing with the IRS is far from your favorite activity. Luckily, tax audit reps like ours have experience in dealing with the IRS. Experienced pros know the right questions to ask. They can even translate confusing IRS terminology into phrases normal people can understand. With tax audit help and representation, you will rarely have to talk to the IRS. We’ll handle all the legwork for you and spare you the droning IRS on-hold music.

Is tax audit help expensive?

You may think you’re saving money by skimping on tax audit representation. But it can be even more financially damaging to receive a hefty IRS bill for tax deficiencies and penalties you may not fully understand. A representative who is well versed in tax code should be able to keep you from paying more than is necessary.

So give us a call today. You’ll have a free consultation with one of our experienced tax audit pros to get to the root of your audit issue. We’re always transparent about what to expect when it comes to our process and pricing.