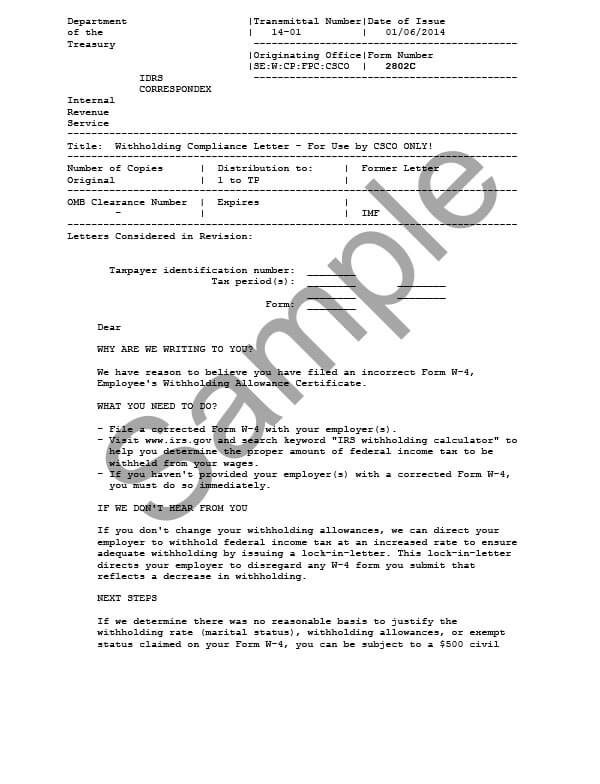

IRS Letter 2802C – Withholding Compliance Letter

IRS Letter 2802C is sent when a taxpayer’s withholding doesn’t meet the IRS guidelines, causing an insufficient amount of tax to be withheld.

Why Did I Receive IRS Letter 2802C?

You received IRS Letter 2802C because the amount of withholding on your W-4 is incorrect. The IRS has determined that you do not have enough federal income taxes withheld from your paycheck to cover the taxes you owe annually.

Next Steps

Review your 2802C letter carefully and save a copy for your records. You will have 30 days from the date of the letter to file a new W-4 with your employer and increase your withholding. You can use the Tax Withholding Estimator to determine your correct withholding amount.

If you fail to correct your W-4 as requested, the IRS will issue a “lock-in-letter” and have your employer withhold federal income taxes at an increased rate. You’ll receive a copy of this letter and have additional time to submit a new W-4 or provide a statement explaining why you believe you’re entitled to a lower withholding amount. If you don’t respond within the 60-day timeframe, your employer must withhold income tax from your wages at the single rate with no allowances. You won’t be able to decrease this amount without approval from the IRS.

Who should I contact if I have more questions?

Do not ignore IRS Letter 2802C. If you have questions, call the IRS at the number listed on the letter or call 800-829-1040.