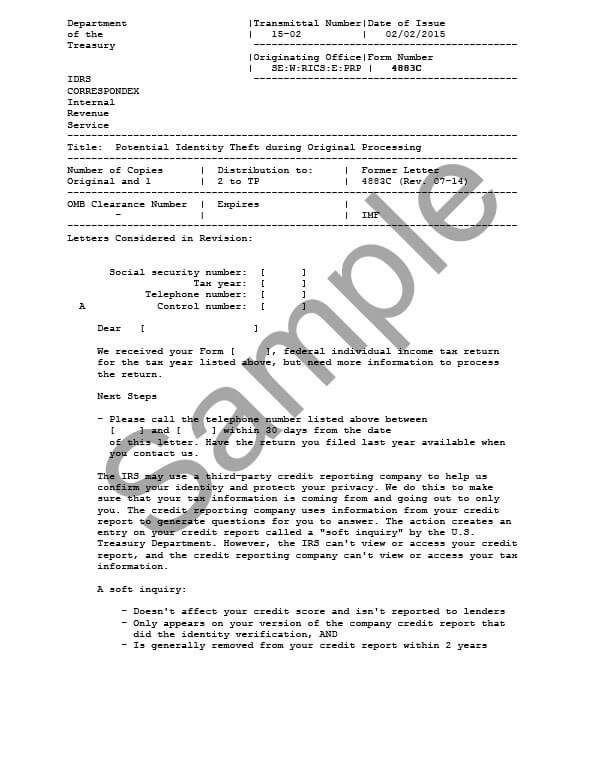

IRS Letter 4883C – Potential Identity Theft

IRS Letter 4883C is sent to a taxpayer when the IRS suspects there is a case of identity theft.

Why Did I Receive IRS Letter 4883C?

You received 4883C because the IRS fraud detection system flagged your account as a potential identity theft case. The IRS is requesting verbal identification by phone before it will process your tax return.

Next Steps

Call the IRS immediately at the phone number listed on your 4883C letter. Your tax return will not be processed until the IRS can confirm your identity. Be sure to have all of the following available when making the call:

- Your 4883C letter,

- The income tax return referenced in the letter,

- A prior-year tax return, other than the one referenced in the letter, and

- All supporting documents you filed with each of those returns (W-2s, 1099s, schedules, etc.).

Although the letter states that you only have 30 days to respond, the IRS will work with you regardless of how much time has elapsed. If the IRS cannot verify your identity by phone, you will need to schedule an appointment and bring in the above documents to a local IRS office to verify in person.

Who should I contact if I have more questions?

If you have questions regarding your IRS Letter 4883C, call the number listed on the letter for assistance.