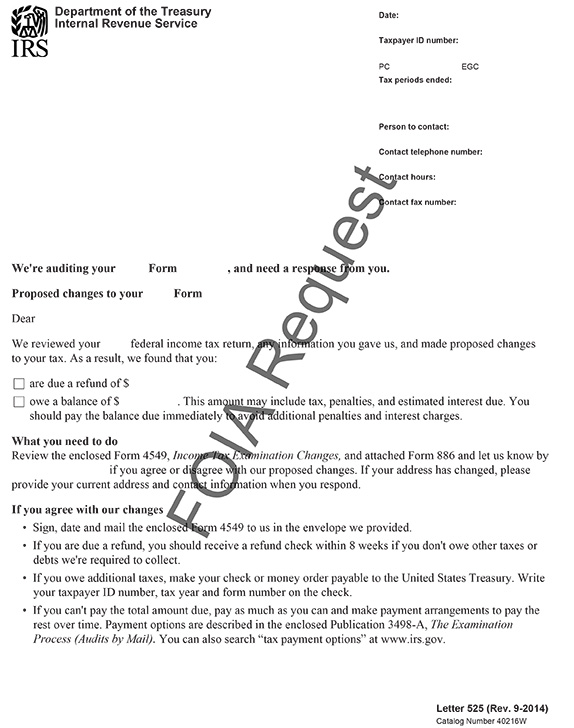

IRS Letter 525 – General 30-Day Letter

IRS Letter 525 is sent to taxpayers when the IRS makes adjustments to their tax returns after an audit.

Why Did I Receive IRS Letter 525?

You received IRS Letter 525 because the IRS completed an examination of your tax return. Upon completing their audit, the IRS determined that changes to your tax return were necessary. These changes may affect the amount you owe or the credits you claimed. The changes may also result in a refund. This 30-day letter allows you to review the proposed changes and challenge them, if needed.

Next Steps

Read your 525 letter carefully. It will detail the changes the IRS will be making to your return.

If you agree with the changes:

- Sign, date, and mail the enclosed Form 4549, Income Tax Examination Changes, within 30 days of the letter’s date (top of notice).

- If you owe additional taxes, include a check or money order made payable to the United States Treasury. Write your SSN, tax year, and form number on your payment. If you are unable to pay in full, you can make a partial payment or request a payment plan.

Refunds are typically received within 8 weeks unless you have other outstanding tax debts.

If you disagree with the changes:

- Respond to the IRS immediately. You can do this by calling the number on your letter or by mail. If you don’t do this within 30 days of the letter’s date, you will lose your appeal rights.

Who Should I Contact if I Have More Questions?

If you have questions regarding your IRS Letter 525, please call the toll-free number listed on your letter. You can also request a free consultation by contacting Tax Defense Network at 855-476-6920.