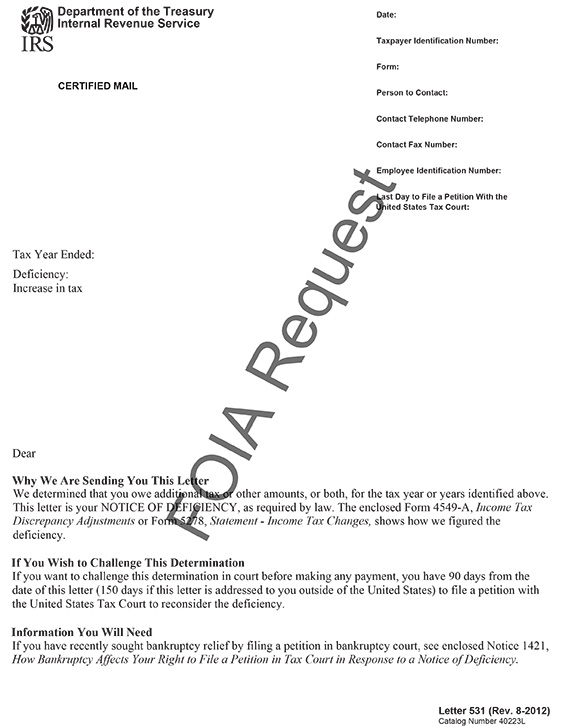

IRS Letter 531 – Notice of Deficiency (90-Day Letter)

IRS Letter 531 is sent by the IRS after proposed changes to a taxpayer’s tax return result in a balance due.

Why Did I Receive IRS Letter 531?

You received IRS Letter 531 because you failed to respond to IRS Letter 525. IRS Letter 531 is a legal notice that gives you 90 days to petition the U.S. Tax Court and challenge the proposed adjustments to your tax return.

Next Steps

Review the audit report included with your 531 letter.

If you agree with the changes:

- Sign, date, and mail the enclosed Form 4089-B, Notice of Deficiency Waiver.

If you disagree with the changes:

- You must petition the U.S. Tax Court within the 90 days indicated on your notice. You can file online through the Tax Court’s website. There is a $60 filing fee. You can also download a copy of the petition kit.

Who Should I Contact if I Have More Questions?

If you have questions regarding your IRS Letter 531, reach out to the number listed on your letter. You can also request a free consultation by contacting Tax Defense Network at 855-476-6920.