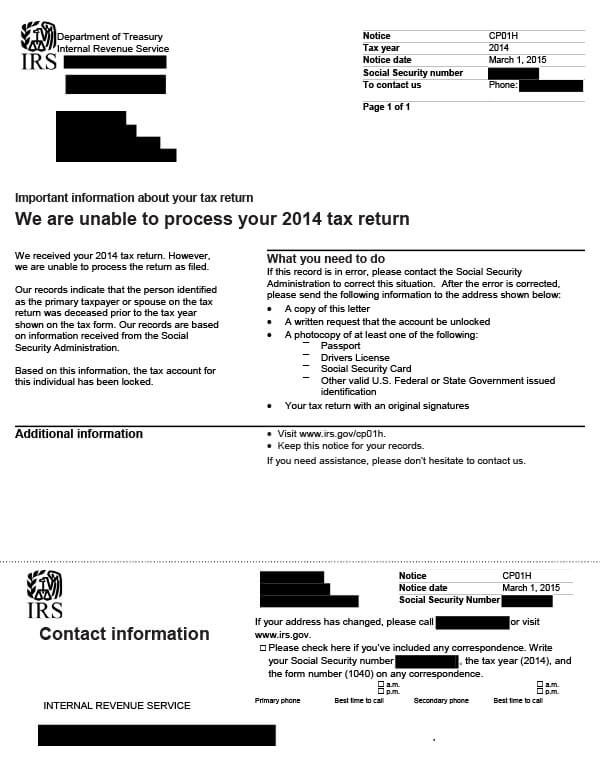

IRS Notice CP01H – Locked Tax Account

IRS Notice CP01H is sent to taxpayers who have used a Social Security number (SSN) that belongs to a locked account.

Why Did I Receive IRS Notice CP01H?

You received IRS Notice CP01H because the SSN included on your tax return belongs to a deceased taxpayer. Due to the potential for tax fraud and identity theft, the IRS locked the account associated with that SSN and will not process your return.

Next Steps

If you receive notice CP01H, double-check the SSNs on your tax return. If your SSN is correct, contact the Social Security Administration and ask them to fix the issue. Once the error is corrected, you’ll need to send a written request to the IRS asking them to unlock the account. You’ll also need to include the following items:

- A copy of your IRS Notice CP01H

- Photocopies of at least one of the following items:

- Passport

- Driver’s license

- Social Security card

- Other government-issued ID

- Your tax return with original signatures

The letter and supporting documents must be sent to the address listed on your CP01H notice. Be sure to keep a copy of your notice and correspondence for your records.

Who Should I Contact if I Have More Questions?

For additional questions regarding your CP01H notice, please refer to the contact information listed on the letter. You can also call the IRS at 800-908-4490.