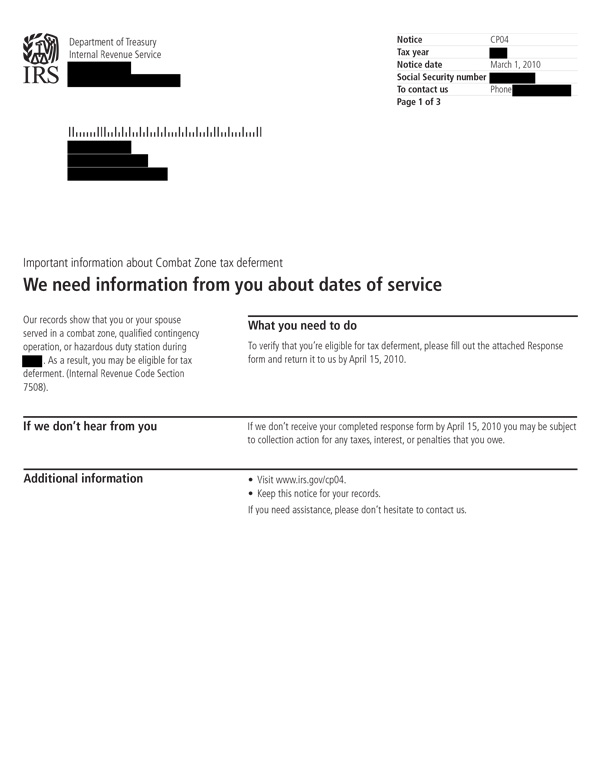

IRS Notice CP04 – Request for Combat Zone Status

IRS Notice CP04 is sent to taxpayers who may qualify for tax deferment due to service in a combat zone, qualified contingency operation, or hazardous duty station during the tax year.

Why Did I Receive IRS Notice CP04?

The IRS received information that you or your spouse served in a combat zone or other eligible military area during the tax year. Based on that information, you may qualify for a tax deferment, but the IRS needs to verify your eligibility.

Next Steps

Review IRS Notice CP04 and follow the instructions provided. You will need to download and complete Form 15109, Request for Tax Deferment, and include any supporting documentation. You will need to provide a copy of your notice, too.

You have several options for sending Form 15109 and your supporting documents to the IRS:

- Submit items online through the IRS Digital Mailroom.

- Upload your form and documents using the Document Upload Tool (use the access code found on your Notice CP04).

- Fax your completed form and supporting documentation to the number provided on IRS Form 15109.

- Mail your Form 15109, supporting documents, and CP04 stub to the address provided on your notice.

If you don’t complete Form 15109 by the requested due date on Notice CP04, you may be subject to collection actions for any taxes, penalties, or interest you may owe.

Who Should I Contact if I Have More Questions?

For additional questions regarding Notice CP04, please refer to the number on your letter or contact the Taxpayer Advocate Service (TAS) at 877-777-4778. You should also refer to Publication 3, Armed Forces’ Tax Guide for additional guidance.