IRS Notice CP05A – Request For More Information

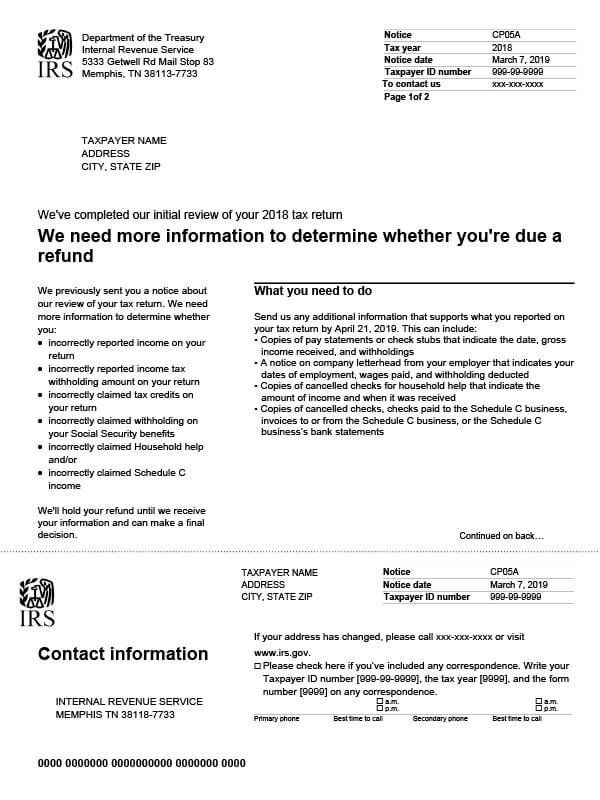

The IRS sends notice CP05A when it needs additional information from a taxpayer before releasing a tax refund.

Why Did I Receive IRS Notice CP05A?

The IRS has selected your tax return for further review. They generally look at income, tax credits, and deductions to verify accuracy. You received IRS Notice CP05A because they are holding your tax refund until they get additional documentation to support one or more items on your tax return.

Next Steps

Be sure to carefully read your CP05A notice. It will list the items being reviewed and the deadline date for sending your supporting documentation. You typically have 30 days from receipt of the notice to comply. If you don’t send the requested items before the deadline, the IRS may disallow all or part of your refund. Or worse, you could receive a tax bill.

Upon receipt of IRS Notice CP05A, we recommend:

- Reviewing the notice with your tax preparer; or

- Seeking assistance from a tax professional if you need help resolving the issues detailed in the notice.

If you did not file a tax return and believe you are a victim of tax fraud, submit Form 14039, Identity Theft Affidavit, immediately.

Who Should I Contact if I Have More Questions?

If you have questions about your CP05A notice, please refer to the contact information listed on the letter. You can also contact Tax Defense Network at 855-476-6920 for a free, no-obligation consultation.