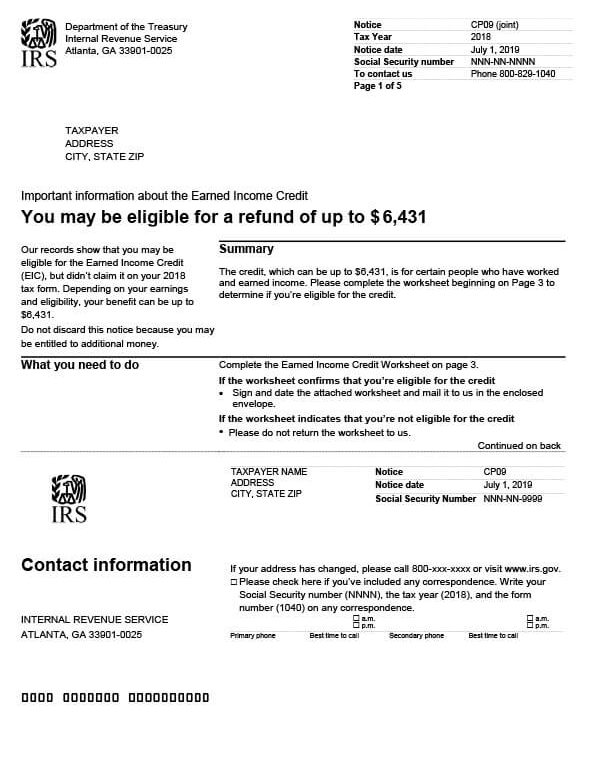

IRS Notice CP09 – Earned Income Credit Eligibility

Not all IRS notices are bad. If you receive IRS Notice CP09, you could be due a refund because you failed to claim a tax credit you may be eligible to receive.

Why Did I Receive IRS Notice CP09?

You received notice CP09 because the IRS determined that you could be eligible for the Earned Income Tax Credit (EITC) but did not claim it on your tax return. If you are eligible, it could result in a tax refund. The amount of the anticipated refund is also included in the notice.

Next Steps

To see if you can claim the Earned Income Tax Credit (EITC), you’ll need to complete the worksheet (Form 15111) on pages 3 through 5 of your IRS CP09 notice. Depending on whether you are eligible or not, you’ll need to take the following steps:

- No, I’m not eligible. Do not mail the worksheet to the IRS. No additional action is required.

- Yes, I am Eligible. Sign (you and your spouse, if married filing jointly) and date the worksheet. Place the completed worksheet in the envelope provided and mail it to the IRS.

The IRS will send you a refund check in approximately six to eight weeks. If you have an outstanding tax balance or other government debt, however, the funds will be used to pay down the balance. If the IRS denies the credit for any reason, they’ll send a letter of explanation.

Who Should I Contact if I Have More Questions?

If you need assistance with your IRS CP09 notice, please refer to the contact information listed on the letter. You can also call the IRS at 800-829-0922 if you haven’t received your refund and it’s been more than eight weeks.