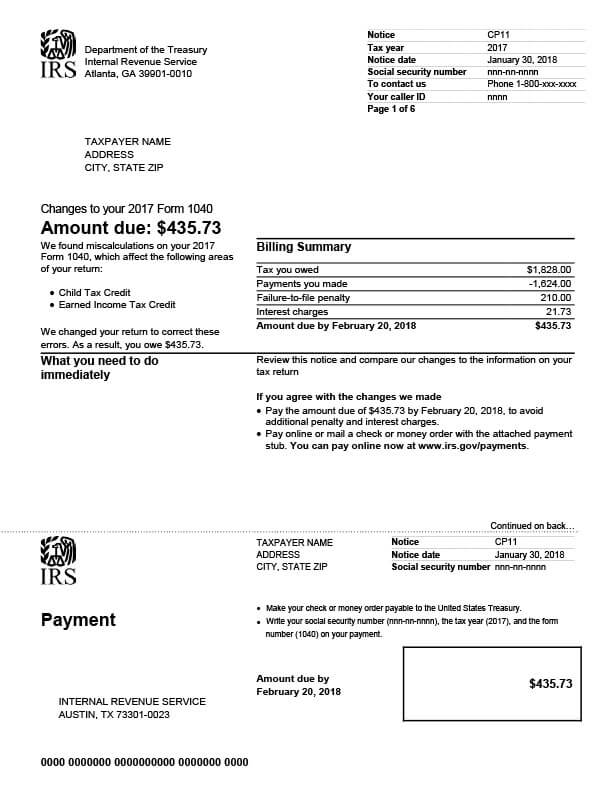

IRS Notice CP11 – Changes Made, Balance Due

The IRS sends notice CP11 to inform taxpayers about adjustments to their tax returns which resulted in a balance due.

Why Did I Receive IRS Notice CP11?

If you receive a CP11 notice, it means that the IRS has found a miscalculation on your tax return and made changes to it. As a result of those changes, you now owe taxes. A CP11 notice does not mean that you are being audited, though the IRS could take this step later.

Next Steps

Read your CP11 notice carefully. It will explain what changes were made, why you now owe taxes, and how much you owe.

If you agree with the changes:

- Update the copy of your tax return that you kept for your records. Do not send this to the IRS.

- Pay the amount due by the deadline date. You can send in your payment by mail (check or money order) or pay online. If paying by mail, make the check payable to the United States Treasury and include the payment stub. You should also write your Social Security number, the tax year, and the form number (1040) on your payment.

If you’re unable to pay the amount in full, you’ll need to set up a payment plan with the IRS or see if you qualify for other available tax relief.

If you disagree with the changes:

- Call the IRS at the number listed on your CP11 tax notice and review your account with a representative; or

- Contact the IRS in writing and they’ll reverse the change(s). Be sure to explain why you disagree and documentation to back up your claim. If you fail to do so, the IRS may forward your case for audit; or

- Speak with an experienced tax specialist. A tax specialist can review your return and determine the best course of action for you, ensuring your rights are preserved.

Regardless of which step you choose to take, be sure to pay close attention to the dispute deadline. You only have 60 days to respond. If you miss the deadline, you forfeit your appeal rights and the IRS will assume you agree with their findings. Don’t forget to make a copy of all correspondence to keep for your records, as well.

Who Should I Contact if I Have More Questions?

If you need help with an IRS CP11 notice, contact Tax Defense Network at 855-476-6920 and schedule a free consultation today. Our experienced tax professionals can help you take the necessary steps to address your situation and, if needed, help you find an affordable solution for paying your taxes.