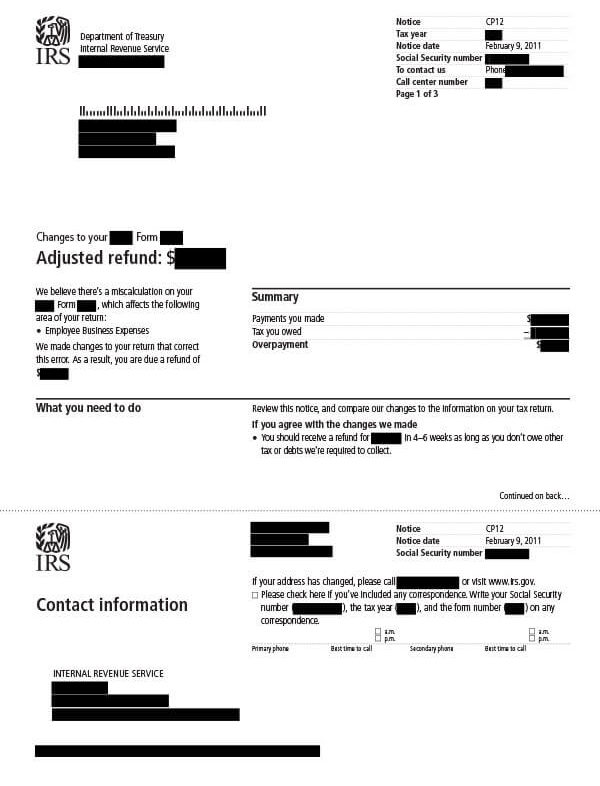

IRS Notice CP12 – Changes Made on Your Tax Return

When the IRS corrects one or more mistakes on a tax return, resulting in a refund, It will send notice CP12 to the taxpayer alerting them to these changes.

Why Did I Receive IRS Notice CP12?

Receiving a CP12 notice is not a bad thing. It means that you had one or more miscalculations on your tax return, but the IRS has corrected these for you. Thankfully, the adjustment(s) resulted in them owing you additional money (refund).

Next Steps

If you receive IRS Notice CP12, be sure to review it thoroughly. It will explain why the IRS believed there was an error on your tax return, what corrections were made, and the additional refund amount you are now due.

If you agree with the changes:

- Make the corrections to your tax return and keep the updated copy for your records. Do not send this to the IRS.

- Expect to receive your refund within 4-6 weeks. If you have an outstanding tax balance or government debt, however, your refund may be offset to pay down that debt.

If you disagree with the changes:

- Contact the IRS at the toll-free number shown on the top right corner of your notice or respond by mail to the address on your notice. If you submit your response in writing, include a copy of your notice and any supporting documentation.

You must contact the IRS within 60 days of receiving the tax notice. They will reverse the changes made but may also forward your case for audit. If you do not submit your reversal request in time, the changes will remain and you’ll lose your appeal rights in U.S. tax Court.

Who Should I Contact if I Have More Questions?

If you have additional questions about your CP12 notice, reach out to the IRS through the number listed on your tax notice.