IRS Notice CP2000 – Proposed Changes to Your Tax Return

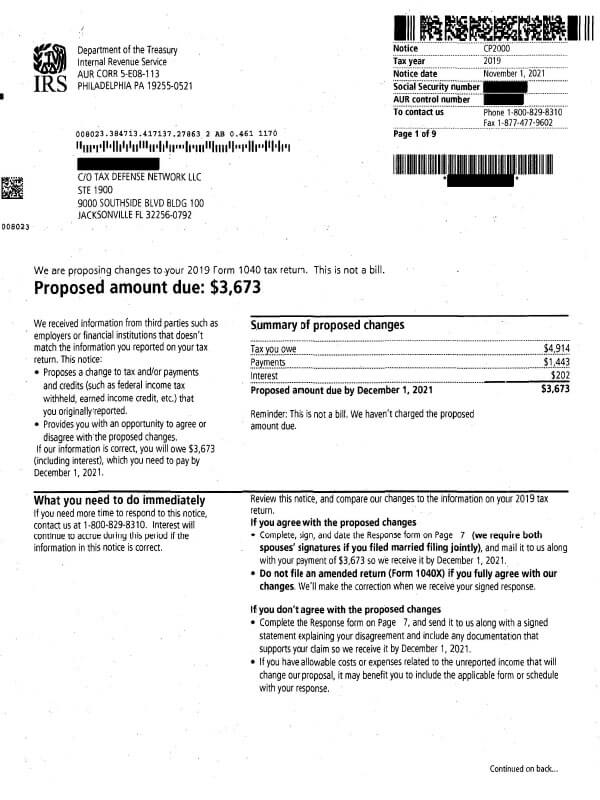

IRS Notice CP2000 is sent when the income or payment information the IRS has on file doesn’t match the information reported by the taxpayer.

Why Did I Receive IRS Notice CP2000?

You received notice CP2000 because the information you provided on your tax return doesn’t align with the information the IRS has on file. In many cases, it’s due to underreporting of income or issues with tax credits you claimed. For example, you may have neglected to include a 1099 or claimed a credit you are not eligible to receive. The discrepancy may cause an increase or decrease in the amount you owe or expect to receive (refund) or no change at all. Keep in mind that CP2000 is not a bill. It is a summary of proposed changes to your tax return.

Next Steps

Carefully review your CP2000 notice and keep a copy for your records. The notice will explain what information the IRS used to determine the changes, if any, to your tax return. Be sure to complete the notice response form and state whether you agree or disagree with the notice.

If you agree with the proposed changes:

- Complete, sign, and date the response form. If you filed a joint return, both parties must sign the form.

- Mail the form and payment (if one is due) by the deadline date to the address provided on the notice.

- Do not file an amended tax return. The IRS will make the necessary corrections to your return.

If you disagree with the proposed changes:

- Complete, sign, and date the response form.

- Include a signed statement that explains why you disagree with the changes.

- Provide documentation/evidence to support your statement. If the information provided to the IRS by a business is incorrect (W-2, 1099, etc.), you should contact the business directly. Request a corrected document or a statement to support why the initial information provided was in error.

- Mail the form, statement, and any documentation/evidence to the address provided.

It’s not necessary to file an amended return if you disagree with the proposed changes. If you choose to do so, however, be sure to write “CP2000” on the top of the return and attach it behind your completed response form.

Failure to send in the response form by the deadline date will result in the IRS assuming you agree with all changes. If you owe a balance, the IRS will send you a Notice of Deficiency followed by a final bill.

Who should I contact if I have more questions?

For questions regarding your IRS Notice CP2000, call the number listed on your notice. If you owe taxes and can’t pay in full, call Tax Defense Network at 855-476-6920 for a free consultation. Our tax specialists will review your case and explain your tax relief options.