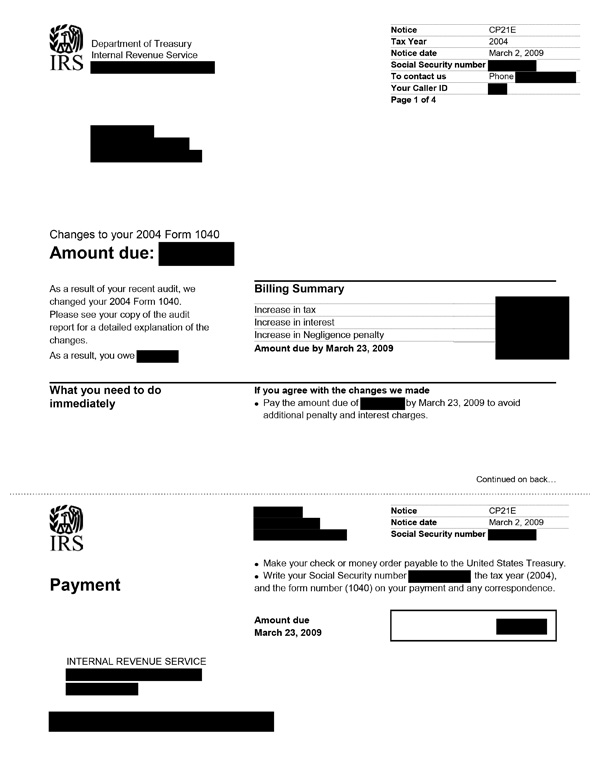

IRS Notice CP21E

IRS Notice CP21E is sent to a taxpayer when the IRS makes changes to a return after completing an audit. The taxpayer may be due a refund, owe money, or have no balance due as a result of the changes.

Why Did I Receive IRS Notice CP21E?

If you received IRS Notice CP21E, it means the IRS recently audited your income tax return and made some changes. These changes may have impacted the amount you owe or even increased your refund. In some cases, the changes may have no impact on your previous balance owed or refund due.

Next Steps

Read your CP21E carefully. It will detail the amount you owe (if applicable) and the due date. For a full explanation of what changes were made, you should refer to the audit report provided by the IRS.

If you agree with the changes:

- Pay the amount due by the deadline date.

- If you are unable to pay the amount in full, pay what you can and make payment arrangements for the remaining balance (installment agreement) or contact a tax professional to explore other repayment or tax settlement options.

- Correct your copy of your tax return and keep it for your records.

If you disagree with the changes:

- Call the number listed on your notice to review your account with an IRS representative.

- Request audit reconsideration if you have new information for the IRS to consider.

- If you disagree but don’t have any new information, you can appeal the decision.

- You may also file an amended tax return if you’ve already paid the amount due in full but disagree with the changes.

If the changes proposed by the IRS are the result of actions by your spouse and you were unaware of these actions, you may also qualify for Innocent Spouse Relief.

What If I’m Due a Refund?

If you are due a refund, you should receive it within two to three weeks from the date on your notice.

Who Should I Contact if I Have More Questions?

If you have additional questions regarding your CP21E notice, contact the number on your letter or reach out to the Taxpayer Advocate Service at 877-777-4778. You can also call Tax Defense Network at 855-476-6920 to explore your repayment options.