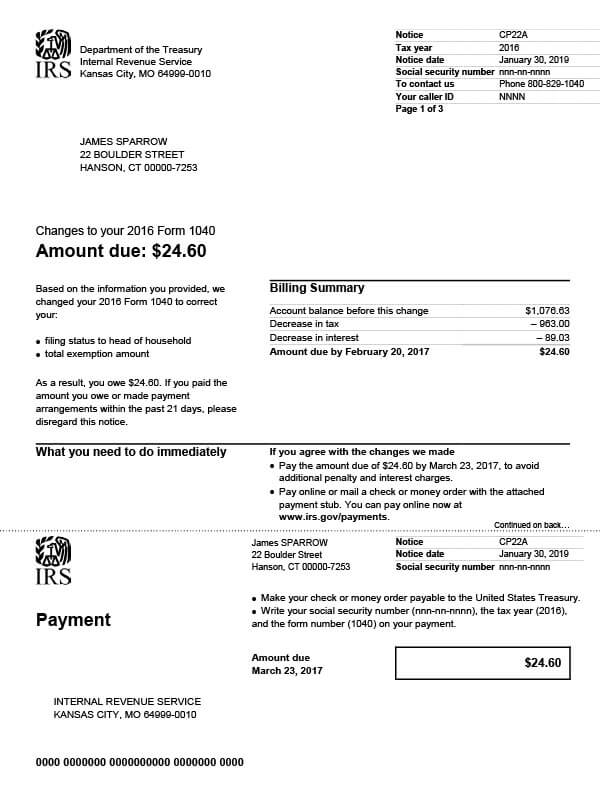

IRS Notice CP22A – Changes Made Form 1040

IRS Notice CP21C is sent to taxpayers when requested changes are made to their Form 1040 and those changes result in a balance due.

Why Did I Receive IRS Notice CP22A?

You may receive IRS Notice CP22A if you submitted an amended return or contacted the IRS directly to make changes to your income tax return. As a result of the requested adjustments to your 1040, you now owe the IRS. CP22A is alerting you to this new balance due.

Next Steps

Carefully review your CP22A notice and examine the changes made.

If you agree with the changes:

- Correct your tax return and keep a copy for your records. Do not send the updated version to the IRS!

- Pay the amount due by the requested deadline date to avoid penalty and interest charges. You can pay online or remit your payment (check or money order) by mail. If sending by mail, be sure to include the payment stub from your notice.

If you disagree with the changes:

- Contact the IRS by phone at the number listed on your tax notice. Have your account information ready before speaking with a representative. You should also have a copy of your tax return and notice on hand.

- If you haven’t been able to get answers by contacting the IRS, you can also call the Taxpayer Advocate Service at 877-777-4778, or

- Call a tax professional and ask for assistance. An experienced tax professional can review your return for potential mistakes and help you find the best solution for dealing with any outstanding tax balance.

You have 21 days from the notice date to respond. If the IRS doesn’t hear from you within this timeframe, it will assume you agree with the changes.

Who Should I Contact if I Have More Questions?

If you need assistance with your notice CP22A, contact the IRS at the number listed on your letter or call 800-829-1040. You can also request a free, no-obligation consultation by contacting Tax Defense Network at 855-476-6920.