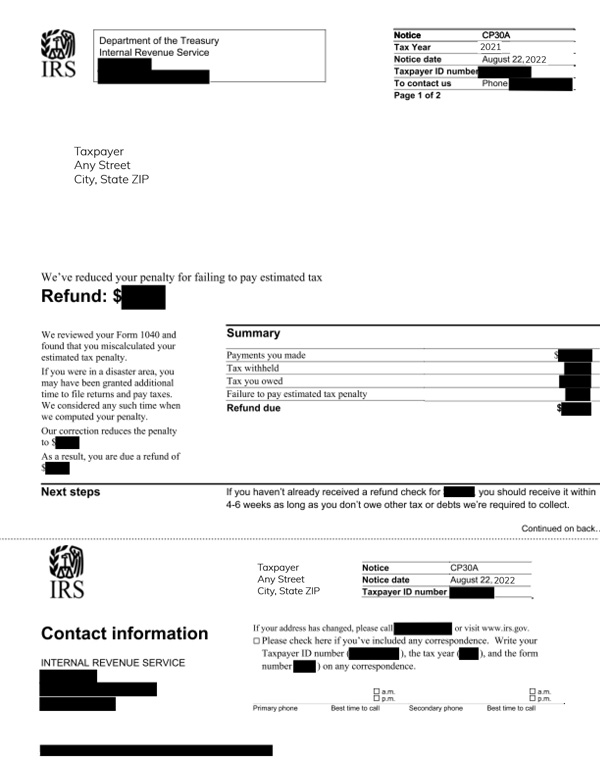

IRS Notice CP30A – Estimated Tax Penalty Reduced or Removed

IRS Notice CP30A is sent to a taxpayer when the IRS reduces or removes the underpayment penalty for estimated taxes reported on a return.

Why Did I Receive IRS Notice CP30A?

You received IRS Notice CP30A because the underpayment penalty assessed on your federal income tax return was greater than the actual penalty due. The IRS either reduced or removed the penalty after reviewing their records and determined the information they had when processing your tax return was inaccurate. If you live in a federally declared disaster area, an automatic waiver may have been applied which could also result in a penalty reduction or removal.

Next Steps

If you receive a CP30A notice, review the information provided. Generally, you will receive your refund within 4-6 weeks. Your refund may be offset, however, if you have an outstanding tax balance or other government debt.

If you disagree with the notice, call the toll-free number listed on it. Be sure to have a copy of your notice and any supporting documentation on hand before calling the IRS.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP30A, please call the number listed on your letter. You can also contact the IRS at 800-829-1040.