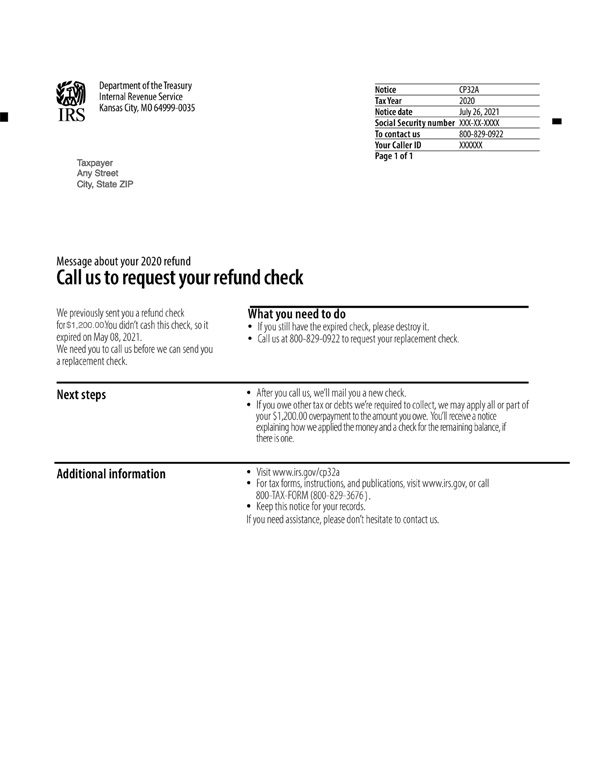

IRS Notice CP32A – Call to Request Refund Check

IRS Notice CP32A is sent to a taxpayer when their original refund check expires, and the IRS needs to verify some information before sending a replacement check.

Why Did I Receive IRS Notice CP32A?

You received IRS Notice CP32A because your original refund check has expired. Since the amount was over $1,000, the IRS needs to verify some information before it will mail out a replacement check to the address on file.

Next Steps

Call 800-829-0922 to request a new check and provide the information requested by the IRS. Destroy the original refund check if you still have it. Your replacement check will arrive within 30 days. To avoid a similar issue in the future, be sure to request your refund through direct deposit moving forward.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP32A, please call 800-829-0922.