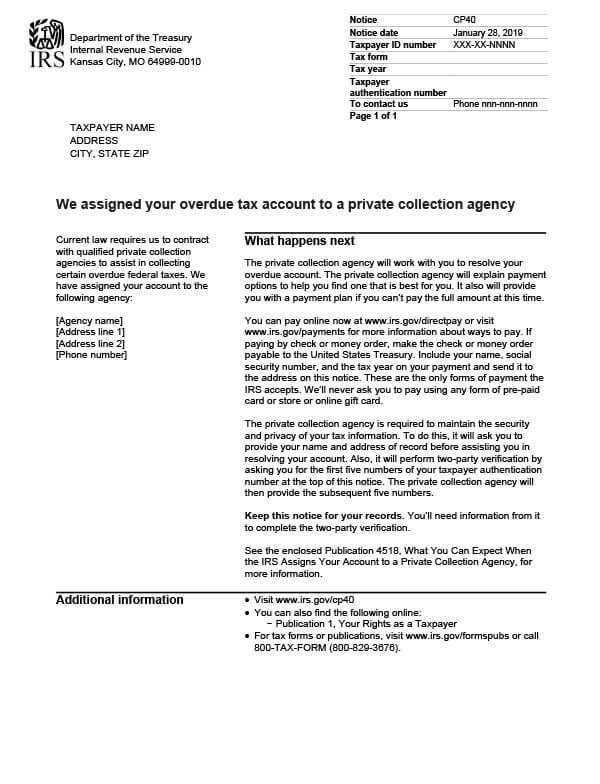

IRS Notice CP40 – Account Assigned to Private Collection Agency

The IRS sends notice CP40 to inform taxpayers that their unpaid account has been assigned to a private collection agency.

Why Did I Receive IRS Notice CP40?

You received IRS Notice CP40 because you have an overdue tax balance that the IRS has been unsuccessful in getting you to pay. They assigned your case to a private collection agency as required by law. Your CP40 notice includes the name and contact information of the agency assigned to your account. The collection agency will also send you a letter confirming the assignment of your tax account.

Next Steps

Read your CP40 notice carefully. It will explain what happens next and the steps you should take.

You may want to:

- Contact the collection agency directly or wait for them to contact you.

- Review Publication 4518, What You Can Expect When the IRS Assigns Your Account to a Private Collection Agency.

- Speak with a trusted tax professional and explore your tax relief options.

Be sure to keep a copy of the notice for your records. You will need it to complete the two-party verification required when communicating with the collection agency.

Who Should I Contact if I Have More Questions?

If you have questions about your IRS Notice CP40, contact the number listed on your notice. You can also call Tax Defense Network at 855-476-6920 to request a free consultation and case review. Our experienced tax specialists can help determine your eligibility for certain tax relief programs or assist with setting up an affordable payment plan.