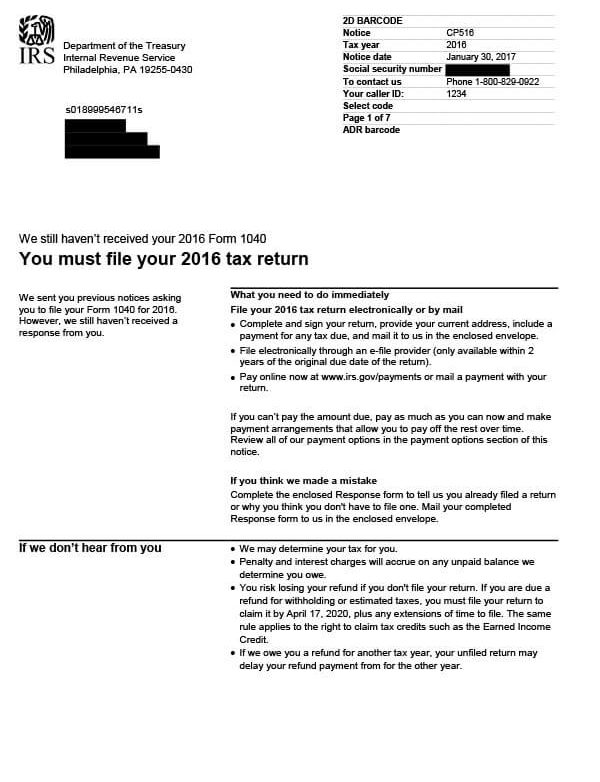

IRS Notice CP516 – Unfiled Tax Return

IRS Notice CP516 is sent to taxpayers as a reminder that they have not yet filed their required tax return for a specific year or years.

Why Did I Receive IRS Notice CP516?

You received notice CP516 because you have neglected to file your tax return for the tax year(s) indicated on the notice. The IRS has sent previous notices but still has no record of your tax return being filed.

Next Steps

Carefully review your CP516 notice and save a copy for your records.

What you need to do immediately:

- Complete and sign your tax return, including any payment due, and mail it using the envelope provided. You can also make your payment online at www.irs.gov/payments. If it’s within two (2) years of the original filing deadline, you may also e-file your return.

- If you can’t pay the amount due, pay as much as you can now and make payment arrangements with the IRS.

If you don’t think you need to file:

- Complete Form 15103, Form 1040 Return Delinquency. Explain the reasons why you don’t think you need to file your tax return. Sign and mail the form to the IRS.

If you’ve already filed:

- You do not have to do anything if you filed within the last eight (8) weeks.

- If it’s been longer than eight weeks, complete Form 15103 and enclose a signed and dated copy of your tax return as verification.

If you do not file or reply to the notice, the IRS may file a Substitute for Return. Penalty and interest charges will accrue on any unpaid tax balance they may determine you owe. If you are due a refund, you risk losing it.

Who Should I Contact if I Have More Questions?

To inquire about your IRS Notice CP516, contact the IRS at the number listed on your notice or 800-829-1040. If you need assistance with filing your late return(s), call Tax Defense Network at 855-476-6920 for a free consultation and quote.