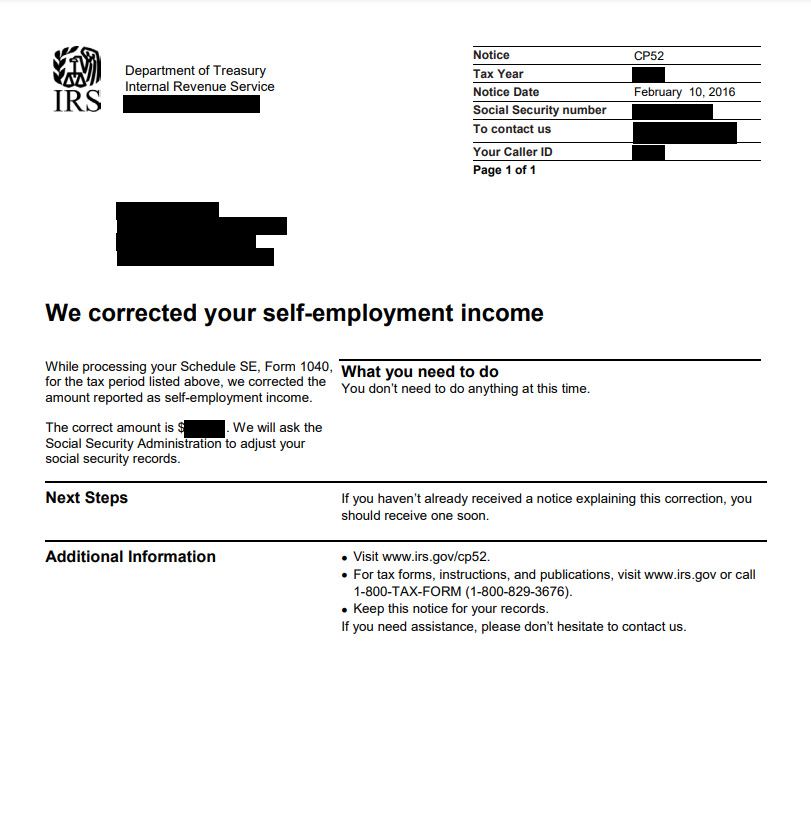

IRS Notice CP52 – Corrected Self-Employment Income

IRS Notice CP52 is sent to a taxpayer when the IRS adjusts the amount of self-employment income reported on Schedule SE (Form 1040).

Why Did I Receive IRS Notice CP52?

You received IRS Notice CP52 because the amount of self-employment income you reported on Schedule SE (Form 1040) was inaccurate. The IRS corrected the amount and has asked the Social Security Administration to adjust your records accordingly.

Next Steps

There are no additional steps needed at this time. You should receive another notice which explains the correction in detail. Be sure to keep a copy of this notice, as well as your CP52.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP52, contact the toll-free number listed on your notice.