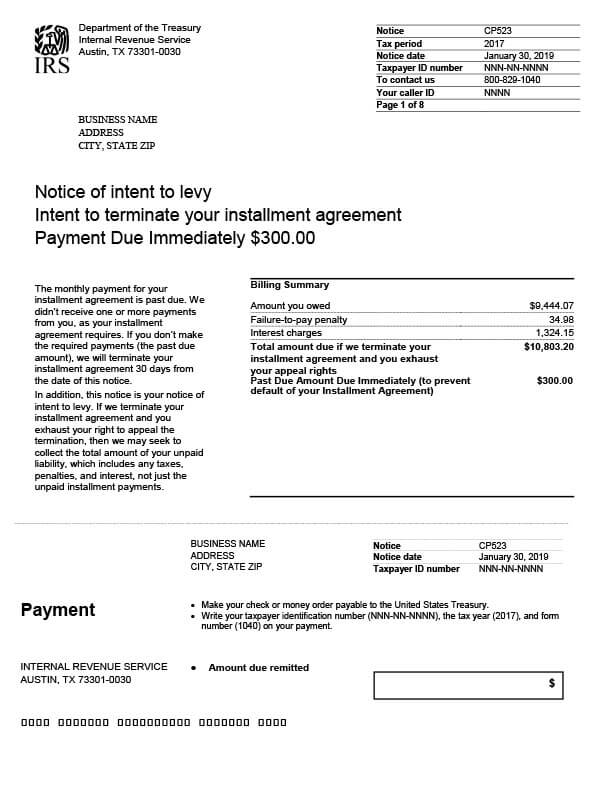

IRS Notice CP523 – Intent to Terminate Agreement & Levy Assets

IRS Notice CP523 notifies taxpayers that their installment agreement is scheduled to be terminated. Additionally, the IRS may levy (seize) their assets if they default on their agreement.

Why Did I Receive IRS Notice CP523?

You received notice CP523 because you defaulted on your IRS installment agreement due to either missing payments, unfiled tax returns, or new unpaid tax debt. The IRS plans to terminate your agreement and pursue collections actions if you fail to make arrangements within 30 days from the date of the notice.

Next Steps

Read your CP523 notice carefully and keep a copy for your records. It explains what steps you need to take now that your agreement is in default.

To avoid collection actions:

- Make the required payments before the deadline date.

- If you can’t pay the past due amount, call the IRS immediately at the number listed on the notice. You may be able to restructure your installment agreement.

If you disagree with the amount or want to appeal the termination:

- Call the IRS if you disagree with the amount due. A representative will review your account with you.

- You can also appeal the proposed termination by calling the number provided on the notice, or by sending a Collection Appeals Request (Form 9423) to the address at the top of your notice.

If you fail to make a payment or respond to the notice, the IRS will assume you agree with the information and move forward with terminating your agreement. Once this happens, the IRS can levy your assets, including income (wage garnishment), Social Security benefits, bank accounts, and other property. Depending on the amount owed, they may also deny or revoke your U.S. passport.

Who Should I Contact if I Have More Questions?

For questions concerning your IRS Notice CP523, please contact the IRS at the number listed on the notice or 800-829-1040. You may also contact Tax Defense Network at 855-476-6920 to explore your tax relief options.