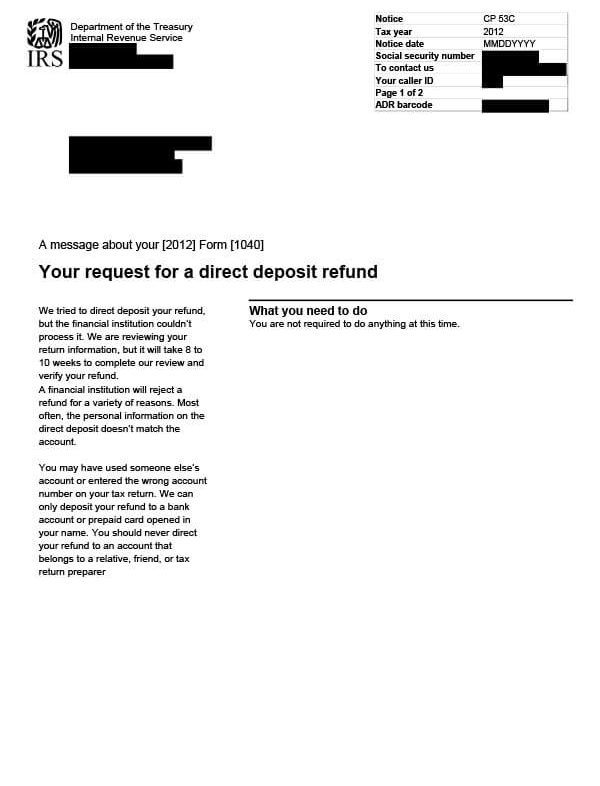

IRS Notice CP53C – Problem With Direct Deposit Refund

IRS Notice CP53C is sent to a taxpayer if the IRS attempts to direct deposit a tax refund but the financial institution rejects it due to incorrect account information.

Why Did I Receive IRS Notice CP53C?

You will generally receive IRS Notice CP53C because your financial institution rejected your tax refund due to an incorrect account number or routing number. They may also reject it if the name and Social Security do not match those on the IRS account. To ensure the refund is valid, the IRS is reviewing your account before resending it by mail. This process typically takes 8-10 weeks.

Next Steps

Be sure to keep a copy of IRS Notice CP53C for your records. There are no additional steps needed at this time.

Once the investigation is complete, the IRS will send a refund check by mail or they will request additional information. If you don’t receive your check or a letter from the IRS after 10 weeks, contact them at the number listed at the top of your CP53C notice.

Who Should I Contact if I Have More Questions?

If you need additional assistance regarding your IRS Notice CP53C, call the number listed on the notice or 800-829-1040.