IRS Notice CP566 – ITIN Application, Need More Information

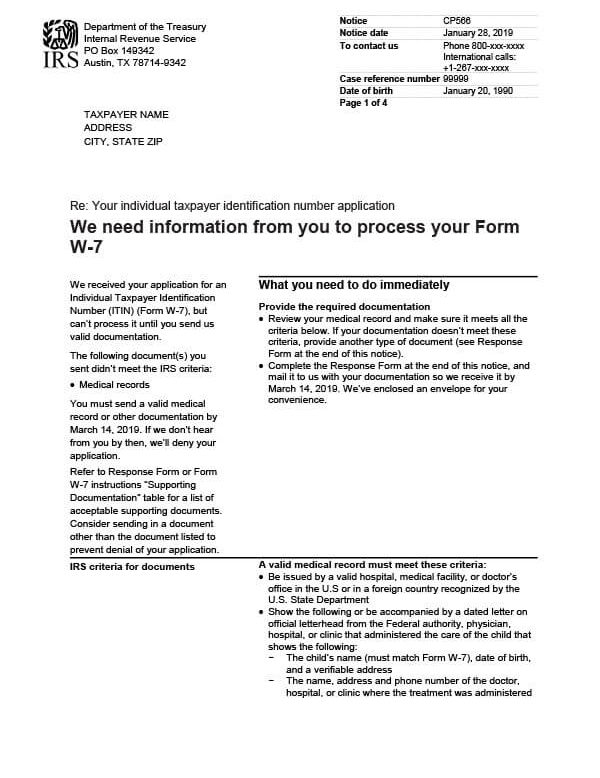

IRS Notice CP566 informs a taxpayer that their Individual Taxpayer Identification Number (ITIN) application can’t be processed until the IRS receives additional information.

Why Did I Receive IRS Notice CP566?

You received notice CP566 because your ITIN application was either incomplete or you may have sent the wrong documents. The IRS is requesting additional information before it can process your application.

Next Steps

Carefully review your CP566 notice. It will explain in detail what information is needed to move forward with your ITIN application. You will have 45 days from the date of the notice to send in the requested documentation and Response Form included with the notice.

If you do not respond before the deadline date, the IRS will deny your application. Your application will also be denied if any of the requested documents are missing. If this happens, you will need to submit a new application to have an ITIN assigned.

Who Should I Contact if I Have More Questions?

For questions regarding your IRS Notice CP566, please call the IRS at the number listed on the notice or 800-829-1040.