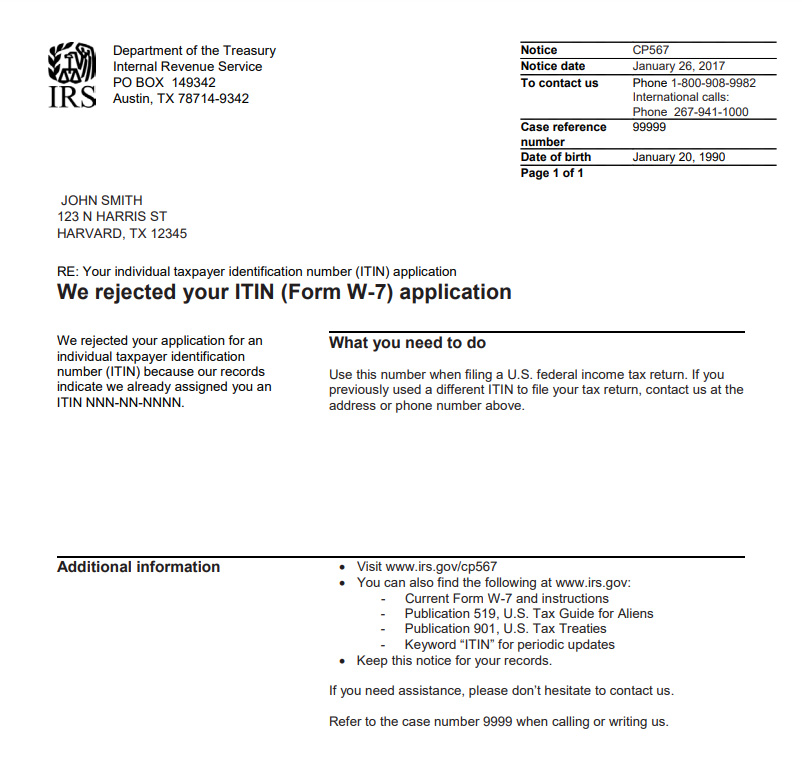

IRS Notice CP567 – Rejected ITIN Application

IRS Notice CP567 is sent to taxpayers when the IRS rejects their individual taxpayer identification number (ITIN) application.

Why Did I Receive IRS Notice CP567?

You received IRS Notice CP567 because the IRS rejected your ITIN application. You may already be assigned a number, have invalid documents, or may not be eligible to receive an ITIN. Your application could also be rejected if you failed to respond to a request for additional information.

Next Steps

Read your CP567 notice carefully. It will explain why the IRS rejected or revoked your ITIN.

What to do next:

- Make sure you don’t qualify for a Social Security number (SSN) and are eligible to receive an ITIN.

- Verify your documents are correct.

- Provide any additional information requested.

- Send in a new application and attach the correct documents. Be sure to include copies of your tax return and any supporting paperwork to it, as well.

Once you receive notice of a rejected ITIN application, the IRS will typically return your documentation within 60 days of the notice date. Call the number on your notice if you don’t receive them within 2 months.

Who Should I Contact if I Have More Questions?

If you have questions regarding your IRS Notice CP567, please call the toll-free number listed on your letter.