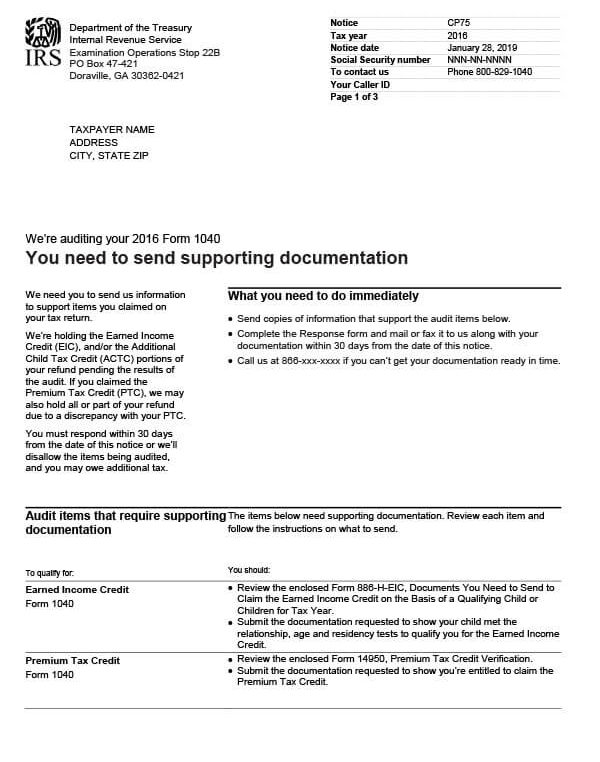

IRS Notice CP75 – Audit Notification, EIC Eligibility

IRS Notice CP75 is sent to a taxpayer when the IRS initiates an audit to determine if they are eligible for the Earned Income Credit (EIC). During the audit, any refund due for the EIC, Additional Child Tax Credit (ACTC), and/or Recovery Rebate Credit (RRC) claimed are placed on hold. If the taxpayer claimed the Premium Tax Credit (PTC), the IRS may also hold that portion of their refund.

Why Did I Receive IRS Notice CP75?

You received a CP75 notice because you claimed the EIC on your tax return. The IRS needs additional information to verify your eligibility for this tax credit and is actively auditing your tax return. Until you provide the information requested and the IRS determines you are eligible to receive the credit(s), the EIC, ACTC, RRB, and PTC portions of your refund are frozen.

Next Steps

Read your CP75 notice and all enclosed forms carefully. They explain what information you’ll need to send to the IRS. You should also review the rules for claiming the EIC to ensure your child meets all tests to qualify for the credit. We also recommend speaking with an experienced tax professional.

What you need to do immediately:

- Send copies of the information that supports the audit items listed on your notice.

- Complete the response form included with the notice and mail/fax it to the IRS along with your documentation within 30 days from the date of the notice.

- Call the IRS at the number listed on your notice if you are unable to get the information ready in time.

- Keep a copy of your CP75 notice for your records.

Once the IRS receives the requested information, they’ll review it and make a determination. If your information supports your tax return, the IRS will send your refund and a letter letting you know your audit is closed. Should the IRS determine you are not eligible based on the information provided, you’ll receive an audit report that explains the proposed changes to your tax return. This will include any tax you now owe, as well as any penalties and interest that may apply. If you do not respond within the 30-day window, the IRS will disallow the items being audited and send you a report showing the proposed changes to your tax return, which could result in you owing tax.

Who Should I Contact if I Have More Questions?

For questions regarding your IRS Notice CP75, contact the number listed on the notice or call 800-829-1040. To request audit help or to explore your tax relief options, call Tax Defense Network at 855-476-6920 for a free consultation.