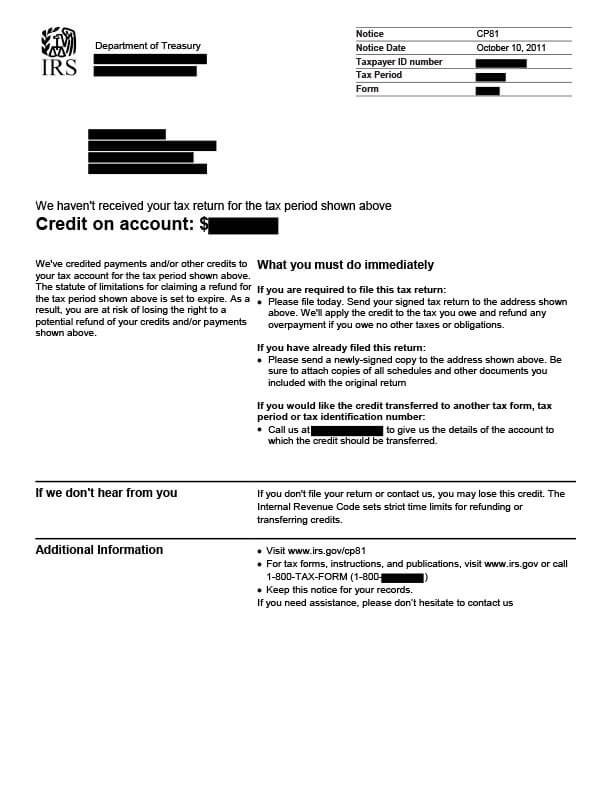

IRS Notice CP81 – No Return Filed, Refund Statute of Limitations Set to Expire

IRS Notice CP81 notifies taxpayers that the IRS hasn’t received their tax returns for a specific tax year. There is also a potential refund due to the taxpayer but the statute of limitations to claim it is set to expire soon.

Why Did I Receive IRS Notice CP81?

You received a CP81 notice because the IRS never received a tax return for the year in question. The IRS also determined that you are due a refund for that tax year. If they do not receive a tax return before the statute of limitations expires, you’ll forfeit your refund.

Next Steps

Review your notice CP81 and keep a copy for your records.

If you’re required to file a tax return:

- File your tax return immediately. Any delay could result in you losing your rights to a potential refund of your tax credits and/or payments. Be sure to sign your return and mail it to the address shown on your notice.

If you’ve already filed your return:

- Please send a newly-signed copy of your return to the address provided if it’s been longer than 8 weeks since you filed. Attach copies of all schedules and other documents included with the original return.

If you’d like the credit transferred to another tax form, period, or tax ID:

- Call the IRS at the number listed on your tax notice.

Failing to file or contact the IRS could result in the loss of your refund. The IRS has strict limits for refunding or transferring credits.

Who Should I Contact if I Have More Questions?

For questions about your IRS Notice CP81, call the number listed on your notice or 800-829-1040. If you need help filing your tax return, call Tax Defense Network at 855-476-6920 for a free consultation and quote.