IRS Notice CP94 – Amount Due (Criminal Restitution)

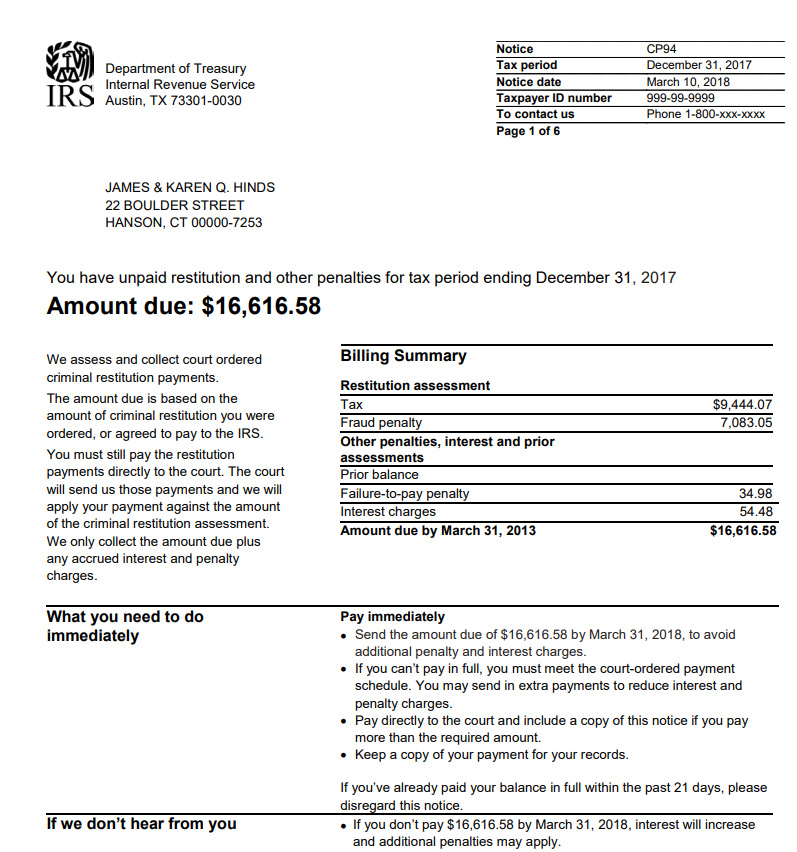

IRS Notice CP94 is sent to taxpayers who are court-ordered to pay restitution due to criminal proceedings regarding a tax debt.

Why Did I Receive IRS Notice CP94?

You received IRS Notice CP94 because the government filed criminal charges against you due to an unpaid tax balance. The court found you guilty and ordered criminal restitution payments.

Next Steps

Read your CP94 notice carefully. It will detail how much you owe in back taxes, as well as the fraud penalty amount. Other penalties and interest will also be listed on the notice.

What to do immediately:

- Send the total amount due by the deadline date listed on the notice to avoid additional penalty fees and interest.

- If you can’t pay in full, you must meet the court-ordered payment schedule.

- Make your payment directly to the court and include a copy of your CP94 notice if you pay more than the required amount.

- Keep a copy of this notice for your records.

If you have paid the balance in full within the past 21 days, you can disregard the notice. Failure to make your required court payment will result in additional penalties and interest.

Who Should I Contact if I Have More Questions?

If you have any questions regarding your IRS Notice CP94, please contact the number listed on your letter.