IRS Notice LT33 – Unpaid Tax Balance Due

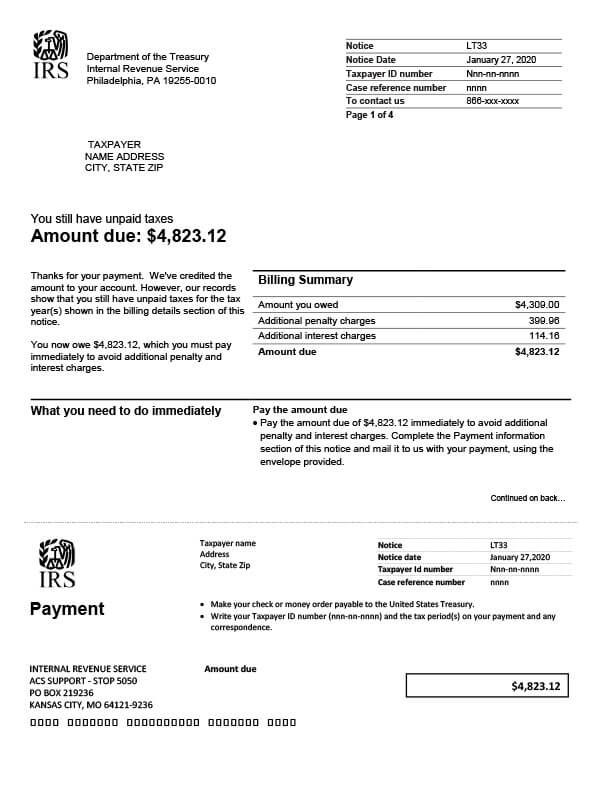

IRS LT33 is sent to taxpayers who have made a payment on their account but still have an outstanding balance due.

Why Did I Receive IRS LT33?

You received IRS LT33 because you recently made a payment on your account but still have unpaid tax debt.

Next Steps

Thoroughly review your LT33 and keep a copy for your records. It will include your billing details, as well as the total outstanding balance now due. To avoid additional penalties and interest charges, pay the full amount immediately. If you’re unable to pay in full, pay what you can and explore your other repayment options, such as:

- Payment plans

- Offer in Compromise

- Currently Not Collectible status

- Penalty abatement

Failure to pay or make payment arrangements could result in the IRS garnishing your wages, placing a lien on your property, or seizing your assets.

Who should I contact if I have more questions?

For questions concerning your IRS LT33, please call the number listed on your letter. If you need help applying for a payment plan or other tax relief, contact Tax Defense Network at 855-476-6920. We offer free, no-obligation consultations.