IRS Notice LT39 – Unpaid Taxes Reminder

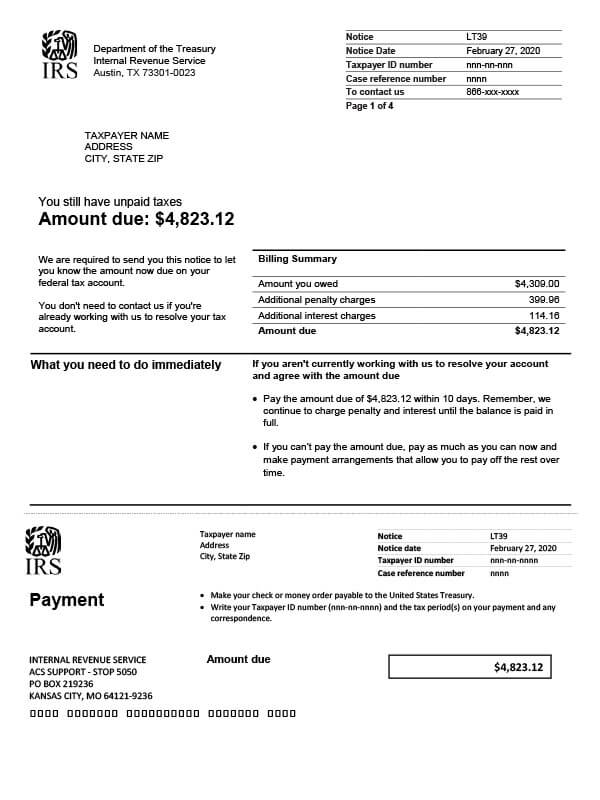

IRS LT39 is sent to taxpayers to remind them that they still have an outstanding tax balance due.

Why Did I Receive IRS LT39?

You received IRS LT39 because you still have unpaid tax debt. The IRS is required by law to send this reminder. If you do not pay the remaining balance within 10 days, the IRS may proceed with enforcement action.

Next Steps

Read your LT39 and save a copy for your records. It includes your billing details and the total amount due, including penalties and interest fees. To avoid additional penalties and interest fees, pay the remaining balance in full. If you can’t pay at this time, you should:

- Pay as much as you can now and make payment arrangements with the IRS, or

- Explore your other tax relief options.

The letter also explains what will happen if you don’t respond to the letter. For example, the IRS may file a Notice of Federal Tax Lien, levy your bank accounts, or garnish your wages. To avoid collection actions, you must respond within 10 days from the date of the notice.

Who should I contact if I have more questions?

For questions regarding your IRS LT39, please call the number on your notice. If you would like to explore your tax relief options, call Tax Defense Network at 855-476-6920 for a free consultation and case review.