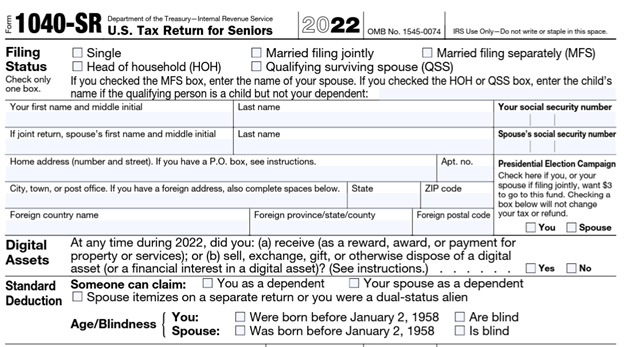

Form 1040-SR, U.S. Tax Return for Seniors

IRS Form 1040-SR may be used in place of Form 1040 by certain taxpayers. This form was developed to make filing income taxes easier for seniors. The form has a larger font and includes a senior-specific standard deduction table so those using it can quickly find their deduction amount. Form 1040-SR has the same schedules and instructions as Form 1040.

Who Should File Form 1040-SR?

Taxpayers age 65 or older may use Form 1040-SR instead of Form 1040. Other than that, there are no additional requirements to use the form.

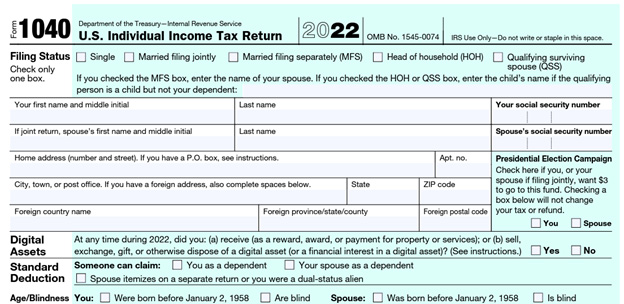

Form 1040-SR vs. Form 1040

As you can see from the screenshots below, the forms are virtually identical except for the larger text.

To complete IRS Form 1040-SR, please refer to the Form 1040 instructions.

Need Help?

If you need additional assistance completing your Form 1040-SR, please contact Tax Defense Network at 855-476-6920 for a free tax preparation quote.