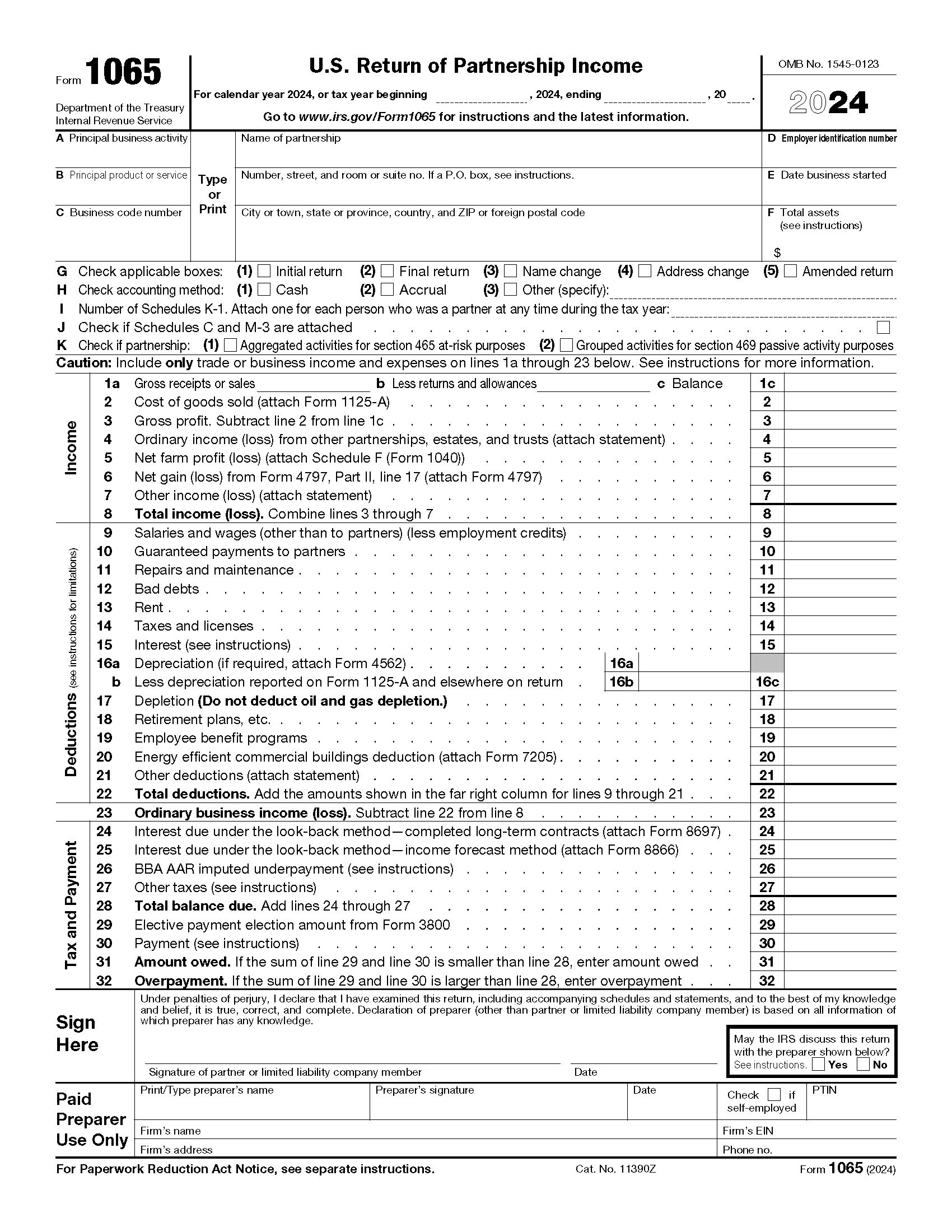

Form 1065, U.S. Return of Partnership Income

IRS Form 1065 is used to report income, losses, gains, credits, deductions, and other information from the operation of a partnership. A partnership generally doesn’t pay tax on its income. Instead, it passes through any profits or losses to its partners, who must include these items on their tax returns.

Who Should Use IRS Form 1065?

Domestic business partnerships headquartered in the U.S. must file IRS Form 1065 annually. This includes:

- General partnerships

- Limited partnerships

- Limited liability corporations (LLCs) with at least 2 members

Other entities, such as religious organizations that are exempt from income tax under Section 501(d), must also use Form 1065 to report their taxable income. Additionally, foreign partnerships with gross income derived from sources within the U.S. are required to file Form 1065.

When is Form 1065 Due?

Partnerships that file IRS Form 1065 must submit it by the 15th day of the 3rd month following the end of its tax year. For example, for a partnership that has a tax year that runs from April to March, June 15 is the filing deadline. If the partnership follows a calendar year, however, the deadline to file is March 15.

If the due date falls on a weekend or a legal holiday, it may be filed the next business day.

How to Complete Form 1065

IRS Form 1065 is quite lengthy (5 pages). It includes Schedule B, Schedule K, Schedule L, Schedule M-1, and Schedule M-2. Due to the complexity of the information required to complete Form 1065 and its schedules, we strongly recommend using a CPA or tax professional.

Below is a brief overview of each page.

Page 1

This page will include the partnership name, address, and employer identification number (EIN), as well as the date the business started. You’ll also need to identify the partnership’s principal business activity and product/service.

Additionally, you’ll need to check the appropriate boxes for the type of return, accounting method used, and the number of Schedules K-1 attached. Check the box on line J if any Schedules C or M-3 are included with the form.

The partnership’s income, deductions, and tax (including payments) are also listed on the first page of the form. Be sure to sign and date the form, too.

Page 2 & 3 – Schedule B

For Schedule B, you’ll need to answer a myriad of yes/no questions about the partnership. This includes the entity type, financial endeavors, foreign involvement, and distributions. You will also need to identify the partnership representative for the tax year covered on the form.

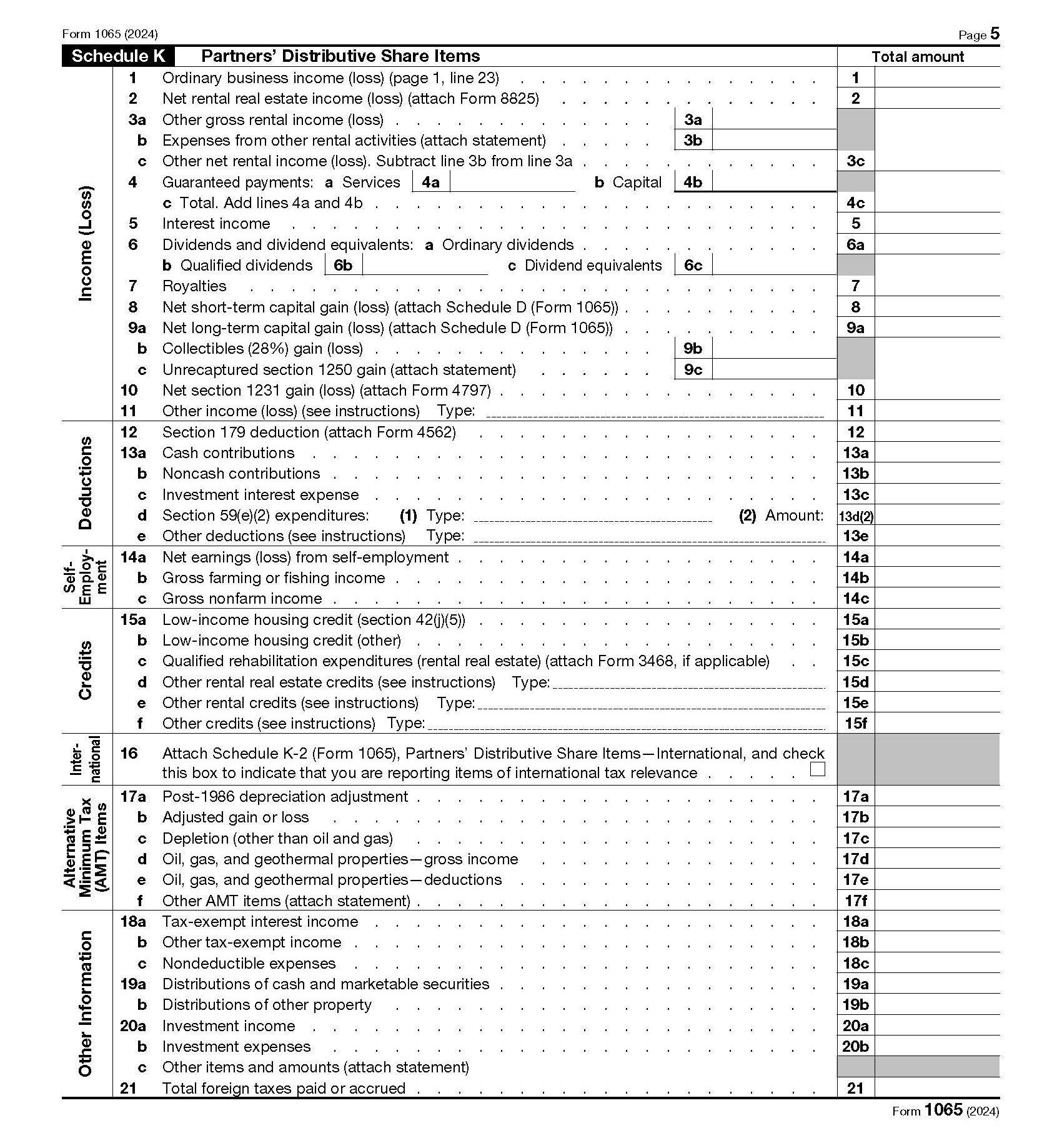

Page 4 – Schedule K

On page 4, you’ll need to provide the partners’ distributive share of items (Schedule K). This includes:

- Income

- Deductions

- Self-employment

- Credits

- International transactions

- Alternative Minimum Tax (AMT)

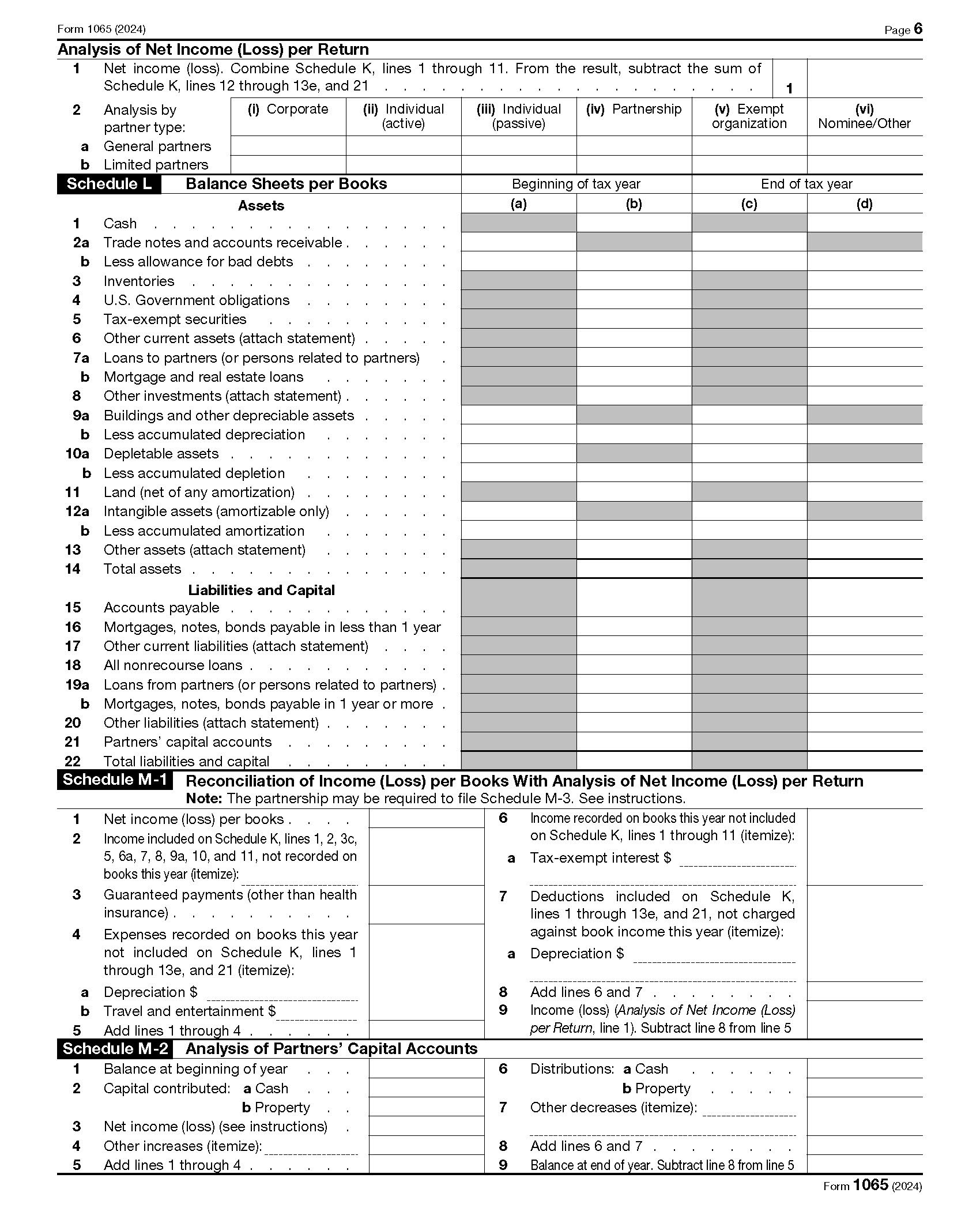

Page 5 – Schedules L, M-1, and M-2

The final page of IRS Form 1065 includes three schedules (L, M-1, and M-2). It also includes an analysis of net income (Schedule K).

- Schedule L is a balance sheet for the partnership’s assets, liabilities, and capital.

- Schedule M-1 is a reconciliation of income or loss using information reported on your partnership’s books.

- Schedule M-2 is an analysis of the partners’ capital accounts.

In certain cases, Schedule M-3 may be required in place of Schedule M-1. See the instructions for M-3 to learn more.

Need Help?

If you need help completing IRS Form 1065, please contact Tax Defense Network at 855-476-6920 or download the instructions from IRS.gov.