Form 2848, Power of Attorney and Declaration of Representative

Form 2848, Power of Attorney and Declaration of Representative, is used to authorize an individual to represent you before the IRS.

Who Should Use Form 2848?

There are certain instances where you may need a power of attorney (POA) in place when dealing with the IRS. Generally, it’s necessary to use IRS Form 2848 when you want to appoint someone to handle an audit, negotiate a tax debt, or appeal an IRS dispute.

Although you can authorize an immediate family member to act on your behalf, Form 2848 is typically used when authorizing a tax professional to deal with the IRS for you. This may include, but is not limited to, enrolled agents, certified public accountants (CPAs), and tax attorneys.

How to Complete IRS Form 2848

Do not use Form 2848 if you only want to authorize someone to inspect or receive your tax return information, but don’t want them to represent you before the IRS. Instead, use Form 8821, Tax Information Authorization.

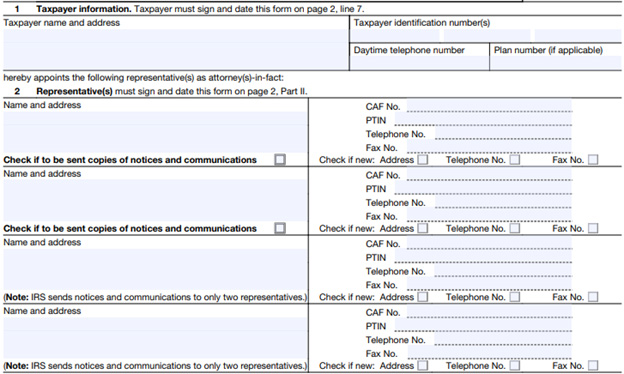

IRS Form 2848 has two pages with two parts. If you are married and file jointly, both spouses must complete and submit a separate POA.

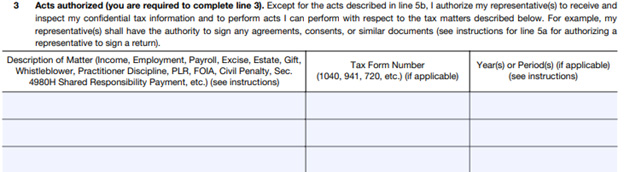

Part I – Power of Attorney

On line 1, put your name, address, and phone number, as well as your taxpayer identification number (SSN or TIN). Next, fill in the information (line 2) for anyone you are designating as your representative. You can include up to four on the form.

For line 3, specify which actions your representative can take, and which forms and years they can access. For example, you would list “income 1040 2022” if you wanted your representative to have access to your 2022 Form 1040. For multiple years you would list them as either 2018-2022, 2018 thru 2022, or 2018 through 2022. Do not use “all years” or “all taxes” as the IRS will return any POA with a general reference.

Check the box on line 4 if the POA is for a specific use or issue that the IRS will not record on the CAF system. If you check this box, be sure to bring a copy of your POA to each IRS meeting or have your representative mail/fax the POA to the IRS office handling your tax matter.

If there are additional acts you want your representative to perform, check the box on line 5a and provide the details. Use line 5b to list any acts your representative may not undertake on your behalf. If you have a previous POA on file with the IRS and do not want that POA revoked, check the box on line 6 and attach a copy of the POA you want to remain in effect. Don’t forget to sign and date the form on line 7.

Part II – Declaration of Representative

Every representative listed in Part I, line 2, must read, sign, and date Part II. Additionally, each must list their licensing state or authority, as well as their bar/certification/license number. Make sure that the signatures are in the same order as listed in Part I. If it is not complete or done incorrectly, the IRS will return Form 2848.

Where to File Your Power of Attorney

If you did not check the box on line 4 (Part I), you can mail or fax your paper copy to the following:

| If You Live In… | Use This Mailing Address | Or Fax to… |

|---|---|---|

| Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, or West Virginia | Internal Revenue Service 5333 Getwell Road Stop 8423 Memphis, TN 38118 | 855-214-7519 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, or Wyoming | Internal Revenue Service 1973 Rulon White Blvd., MS 6737 Ogden, UT 84201 | 855-214-7522 |

| All APO and FPO addresses, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States | Internal Revenue Service International CAF Team 2970 Market Street MS: 4-H14.123. Philadelphia, PA 19104 | 855-772-3156 or 304-707-9785 (Outside the United States) |

You may also submit your IRS Form 2848 online at IRS.gov/Submit2848.

Need Help?

If you need assistance with a tax matter, Tax Defense Network offers free consultations. Just call 855-476-6920 to learn more or to get a quote.