Form 433-B, Collection Information Statement for Businesses

IRS Form 433-B is used to obtain financial information about a business to determine its ability to satisfy an outstanding IRS tax debt. This includes income and assets, as well as any business expenses and debts.

Who Should File Form 433-B?

If you operate an eligible business entity (see the list below) and are applying for an installment agreement (payment plan), you should complete IRS Form 433-B.

Eligible Business Entities

The following business entities may use Form 433-B.

- Partnerships

- Corporations

- Exempt Organizations

- S Corporations

- Limited Liability Companies (LLC) classified as corporations

- Other LLCs

If you are self-employed (sole proprietor), you should use Form 433-A. Do not use Form 433-B if you are submitting an Offer in Compromise. Instead, use Form 433-B (OIC).

How to Complete Form 433-B

IRS Form 433-B has a total of six pages and five sections that must be filled out completely before the IRS will determine whether your business payment plan is approved.

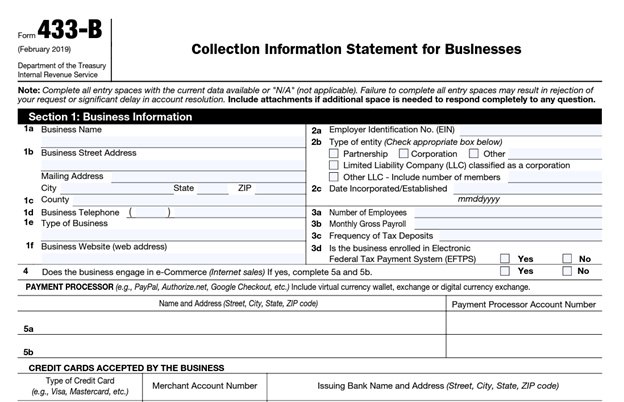

Section 1 – Business Information

In the first section, you need to provide your business name, address, and contact information. You will also need to indicate your business entity type, when your business started, and the number of employees. Additionally, the monthly gross payroll amount and the frequency of your tax deposits must be provided. If you sell online, provide details on all payment processors used (5a and 5b). Be sure to list any credit cards accepted by your business, as well.

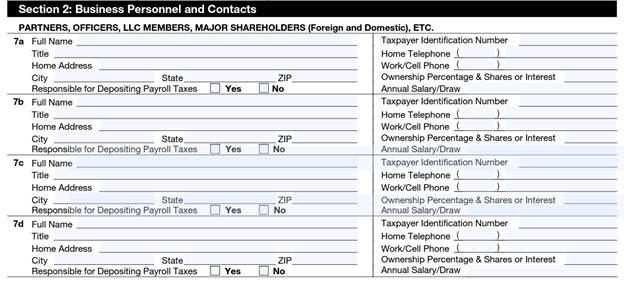

Section 2 – Business Personnel and Contacts

All partners, officers, LLC members, and major shareholders must be listed in this section. Include their full names, titles, and addresses. Be sure to indicate whether they are responsible for making payroll deposits, too.

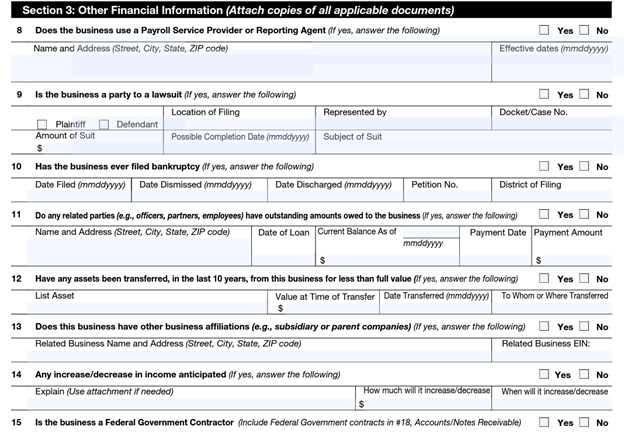

Section 3 – Other Financial Information

Section 3 includes questions about other financial aspects of your business, including pending lawsuits and bankruptcy filings. Be sure to complete all eight questions and attach any supporting documentation.

Section 4 – Business Assets and Liability Information (Foreign and Domestic)

This section is the most complex and spans several pages. Questions 16 and 17 deal with your company’s cash on hand and business bank accounts. Question 18 (a-f) requires you to list all accounts/notes receivable, including any government (local, state, or federal) contracts or grants. Next, you’ll need to provide information on your business investments (19a – 19c) and available credit (20a – 20c). Question 21 pertains to any real property you own, lease, or rent. You’ll also need to list any company vehicles leased or purchased (22a – 22e), as well as business equipment and intangible assets (23a – 23h). Finally, provide details on any business liabilities (debts), including notes and judgments not previously listed (24a – 24-c). Be sure to attach any relevant documentation.

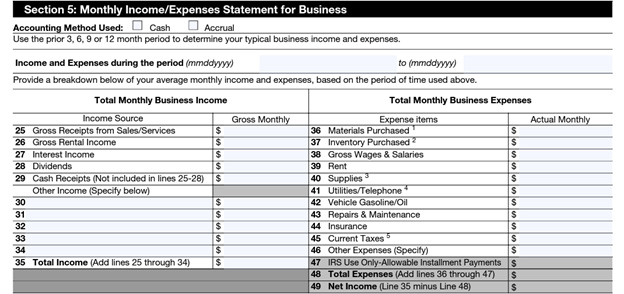

Section 5 – Monthly Income/Expenses Statement for Business

This final section includes information on your monthly business income and expenses. Be sure to indicate the type of accounting method you use (cash or accrual) and the dates for the period covered. List all income received during that period, including any rental income, dividends, and interest. You’ll also need to provide details on all expenses for that period. Be sure to sign (page 6) and date the form.

Need Help?

Since the information provided on Form 433-B must be detailed and accurate, we highly recommend working with a tax professional to ensure it is correctly filled out. If you need help completing IRS Form 433-B, please contact Tax Defense Network at 855-476-6920. You may also refer to IRS Publication 5059, How to Prepare a Collection Information Statement (Form 433-B), for additional tips on how to complete the form.