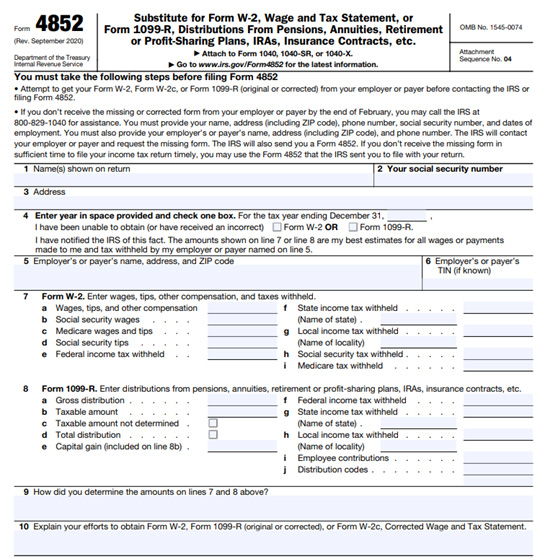

Form 4852, Substitute for Form W-2 or Form 1099-R

Form 4852 is used by taxpayers as a substitute for Form W-2, Wage and Tax Statement. It can also be used as a substitute for Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. when filing taxes.

Who Should Use Form 4852?

You can use Form 4852 if you are unable to obtain your original or corrected Form W-2, W-2G, or Form 1099-R before the tax filing deadline.

Before using IRS Form 4852, however, you should first attempt to get your missing form(s) from your employer or payer. If you still don’t have your form(s) by the end of February, you can reach out to the IRS for assistance by calling 800-829-1040. Be sure to have your employer’s name, address, and phone number on hand. The IRS will attempt to contact your employer/payer and request the missing form(s). If you don’t receive the form(s) in time to file, you should use Form 4852 to avoid potential late-filing penalties.

How to Complete IRS Form 4852

Form 4852 is a simple, one-page form with 10 lines to complete.

Line 1. Enter your name as it appears on your tax return.

Line 2. Provide your Social Security number (SSN).

Line 3. Enter your complete address, including street, city, state, and ZIP code.

Line 4. Enter the tax year this form will cover and check which form (W-2 or 1099-R) you have been unable to obtain.

Line 5. Write the name of the employer or payer who failed to send you the requested form(s). Be sure to include their full address and phone number, as well.

Line 6. Enter the taxpayer identification number (if known) for that employer/payer.

Line 7. Include your wages, tips, other compensation, and taxes withheld while working for the employer listed on line 5. If you are using Form 4852 as a substitute for Form 1099-R, skip this line and go to line 8.

Line 8. Enter distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, insurance contracts, etc. from the payer on line 5. You will also need to indicate the amount of local, state, and/or federal taxes withheld. Do not complete this line if you are using Form 4852 as a substitute W-2.

Line 9. Explain how you determined the amounts on either line 7 or line 8. This may include estimating your amounts, as well as using paystubs or distribution statements to calculate your totals.

Line 10. Detail all attempts you made to retrieve your missing or corrected Form W-2 or 1099-R.

Once complete, make a copy for your records and include Form 4852 with your tax return when filing.

Will I Have to File an Amended Tax Return?

If you receive your missing form(s) after you file Form 4852, be sure to compare both to ensure the information you provided is correct. If there are any discrepancies, you’ll need to amend your return by filing Form 1040-X.

Need Help?

If you need assistance retrieving your missing W-2 or 1099-R, always reach out to your employer, payer, or the IRS. For help completing IRS Form 4852, please contact Tax Defense Network at 855-476-6920 for a free consultation and quote.