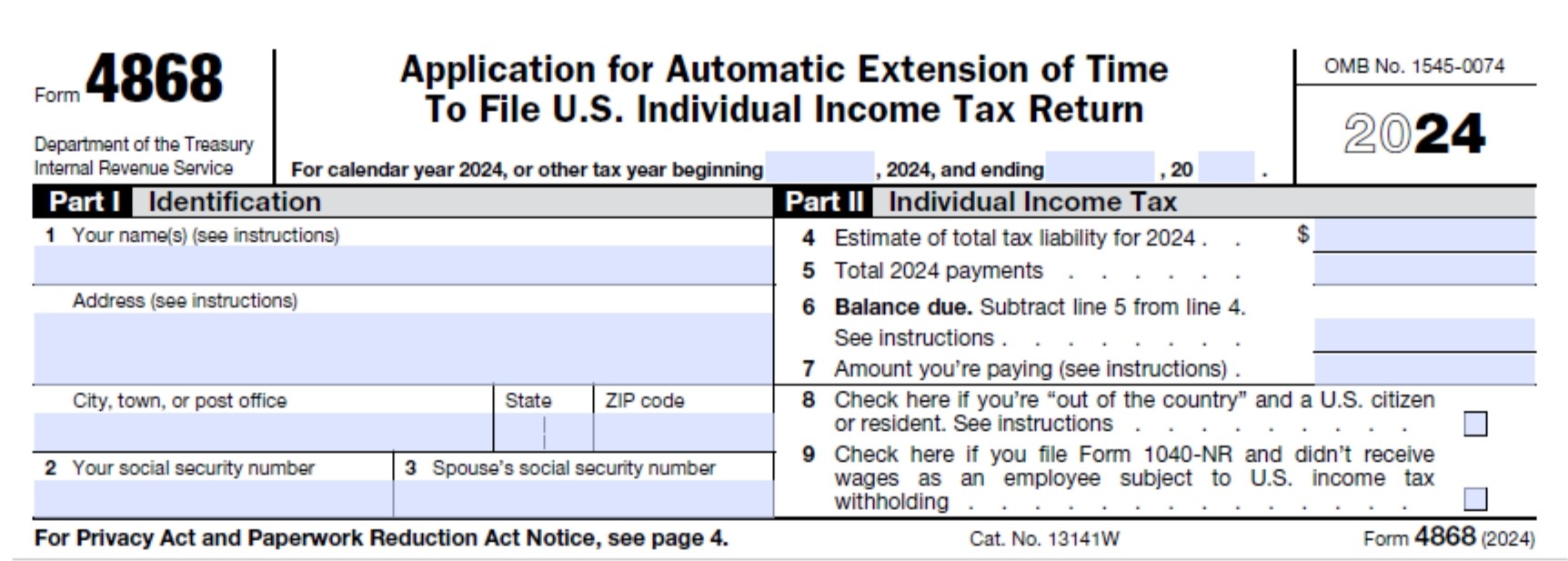

Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return

Use IRS Form 4868 to apply for a filing extension if you need additional time to complete your federal income tax return (1040, 1040-SR, 1040-NR, 1040-PR, or 1040-SS). Although this will extend your filing deadline by six months, it does not give you additional time to pay your taxes. Requests to extend your filing deadline must be submitted on or before the original filing deadline.

How to Complete Form 4868

There are three ways you can request a filing extension. One, you can pay all or part of your estimated taxes due using Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or a credit or debit card. Just be sure to indicate that the payment is for a filing extension. Two, file Form 4868 electronically using tax software or with the assistance of a tax professional. The third option is to file a paper Form 4868 using the instructions below.

Part I – Identification

Line 1. Enter your name and address. If you plan to file a joint return, enter both names (you and your spouse) in the order they will appear on your tax return. If your address is different from the one entered on your previous tax return,you shoulduse Form 8822, Change of Address, to notify the IRS of the change.

Line 2. Enter your Social Security number (SSN). If filing jointly, provide the SSN for the person who is listed first on your joint return.

Line 3. Enter the other spouse’s SSN here. Leave blank if you file alone.

Part II – Individual Income Tax

Line 4. Estimate your total tax liability for the tax year you are requesting the extension. This can be found on:

- Form 1040, 1040-SR, or 1040-NR, line 24;

- Form 1040-PR, line 6; or

- Form 1040-SS, line 6.

Enter “0” if you expect this to be zero. Be as accurate as possible. If the IRS determines that the estimate was unreasonable, the extension will be null and void.

Line 5. Enter the total tax payments you expect to report for the tax year. You can locate this information on:

- Form 1040, 1040-SR, or 1040-NR, line 33 (excluding Schedule 3, line 10);

- Form 1040-PR, line 12; or

- Form 1040-SS, line 12.

If you file using Form 1040-PR or 1040-SS, do not include any payment amount on line 5 that you plan to include with Form 4868.

Line 6. To determine your balance due, simply subtract line 5 from line 4. If line 5 is greater than line 4, enter zero on line 6.

Line 7. Enter the amount you are paying at this time. You aren’t required to make a payment to get the filing extension, but we strongly encourage you to pay as much as possible. If you don’t pay your taxes in full by the filing deadline, you may be charged a late payment penalty and interest will accrue on any outstanding balance.

Line 8. If you will be out of the U.S. on the regular filing due date, check this box.

Line 9. If you file Form 1040-NR and didn’t receive wages subject to U.S. income tax withholding, check this box.

Before submitting the form, review your information and complete the top section if the request is for a tax year other than the calendar year. You do not have to include a reason why you are requesting the extension. The IRS will only contact you if your request is denied.

Do not file Form 4868 if you want the IRS to figure your tax or you are under a court order to file by the regular deadline date.

Where to Send Form 4868

Where you mail Form 4868 will depend on whether or not you include a payment, as well as where you live.

| If you live in: | And you’re making a payment, send here: | And you’re NOT making a payment, send here: |

|---|---|---|

| Florida, Louisiana, Mississippi, Texas | Internal Revenue Service P.O. Box 1302 Charlotte, NC 28201-1302 | Internal Revenue Service Austin, TX 73301-0045 |

| Arizona, New Mexico | Internal Revenue Service P.O. Box 802503 Cincinnati, OH 45280-2503 | Internal Revenue Service Austin, TX 73301-0045 |

| Arkansas, Connecticut, Delaware, District of Columbia, Illinois, Indiana, Iowa, Kentucky, Maine, Maryland, Massachusetts, Minnesota, Missouri, New Hampshire, New Jersey, New York, Oklahoma, Rhode Island, Vermont, Virginia, West Virginia, Wisconsin | Internal Revenue Service P.O. Box 931300 Louisville, KY 40293-1300 | Internal Revenue Service Kansas City, MO 64999-0045 |

| Pennsylvania | Internal Revenue Service P.O. Box 802503 Cincinnati, OH 45280-2503 | Internal Revenue Service Kansas City, MO 64999-0045 |

| Alaska, California, Colorado, Hawaii, Idaho, Kansas, Michigan, Montana, Nebraska, Nevada, North Dakota, Ohio, Oregon, South Dakota, Utah, Washington, Wyoming | Internal Revenue Service P.O. Box 802503 Cincinnati, OH 45280-2503 | Internal Revenue Service Ogden, UT 84201-0045 |

| Alabama, Georgia, North Carolina, South Carolina, Tennessee | Internal Revenue Service P.O. Box 1302 Charlotte, NC 28201-1302 | Internal Revenue Service Kansas City, MO 64999-0045 |

| A foreign country, American Samoa, or Puerto Rico, or are excluding income under Internal Revenue Code section 933, or use an APO or FPO address, or file Form 2555 or 4563, or are a dual-status alien, or are a nonpermanent resident of Guam or the U.S. Virgin Islands | Internal Revenue Service P.O. Box 1302 Charlotte, NC 28201-1302 | Internal Revenue Service Austin, TX 73301-0215 |

| All foreign estate and trust Form 1040-NR filers | Internal Revenue Service P.O. Box 1302 Charlotte, NC 28201-1302 USA | Internal Revenue Service Kansas City, MO 64999-0045 USA |

| All other Form 1040-NR, 1040-PR, and 1040-SS filers | Internal Revenue Service P.O. Box 1302 Charlotte, NC 28201-1302 USA | Internal Revenue Service Austin, TX 73301-0045 USA |

If you’re including a check or money order with your form, make it payable to “United States Treasury” and include your SSN and phone number on it. Also, be sure to indicate that the payment is for Form 4868. Do not staple or attach your payment to the form.

Need Help?

If you need assistance in filing an extension or can’t pay your taxes on time, contact Tax Defense Network at [mainphonenumber} for a free consultation. We can help you file your tax returns and find an affordable solution for dealing with your tax debt.