Form 656-B, Offer in Compromise Instructions

IRS Form 656-B is used by taxpayers interested in settling their tax debt for less than they owe. This is known as an Offer in Compromise (OIC). Form 656-B is not a singular form but rather a booklet that not only explains how to apply for an OIC, but also contains all the necessary forms required to submit a settlement offer to the IRS.

Who Should Use Form 656-B?

If you are unable to pay your tax debt in full and are experiencing financial hardship, you may be a good candidate for an Offer in Compromise. Before using Form 656-B, make sure you:

- File all tax returns you are legally required to file.

- Have received a bill for at least one tax debt included in your offer.

- Make all required estimated tax payments for the current year.

If you are a business owner with employees, you must make all required federal tax deposits for the current quarter and the two preceding quarters before applying for an OIC. You can also determine your eligibility by using the IRS OIC Pre-Qualifier Tool.

How to Submit an Offer In Compromise (Form 656-B)

It’s important to note that there is a $205 application fee when submitting an Offer in Compromise. You must also include an initial payment with your form. Your offer will not be considered unless you submit Form 656, Offer in Compromise, as well as either Form 433-A (OIC), Collection Information Statement for Wage Earners and Self-Employed Individuals, or Form 433-B (OIC), Collection Information Statement for Businesses. You will also need to include any supporting documentation.

How to Complete Form 656, Offer in Compromise

There are nine (9) sections on IRS Form 656. If you are an individual or self-employed wage earner, you’ll need to complete section 1, as well as sections 3 through 9. Corporations, partnerships, LLCs, and LLPs should complete sections 2 through 9.

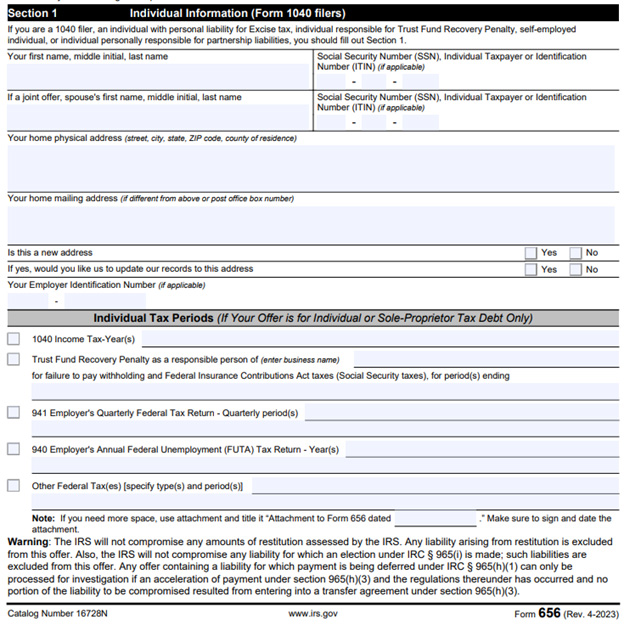

Section 1, Individual Information (Form 1040 filers)

In this section, you will include your name, address, and Social Security number (SSN). If you file jointly, you will need to include your spouse’s information, as well. Don’t forget to include your Employer Identification Number (EIN), if applicable.

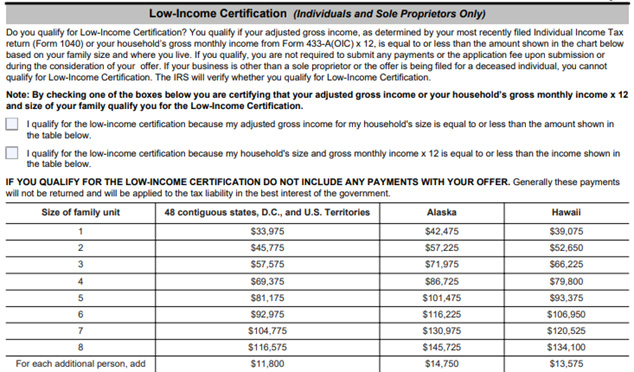

Next, you’ll need to select which tax periods you are including in your OIC (Individual Tax Periods). If you meet the low-income requirements and want to have the $205 application fee waived, be sure to fill out the Low-Income Certification area at the end of section 1. Skip section 2 and go to section 3 next.

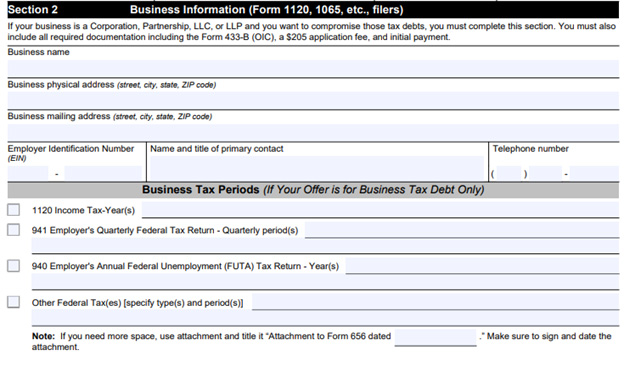

Section 2, Business Information (Form 1120, 1065, etc., filers)

As mentioned previously, this section is for corporations, partnerships, LLCs, and LLPs. If you are an individual taxpayer, do not complete this section. Businesses must include their company name, address, and EIN. The name, title, and telephone number of the company’s primary contact must also be included in this section.

Similar to section 1, businesses must also select the tax periods they are including in the OIC. There is not, however, an application fee waiver available to businesses.

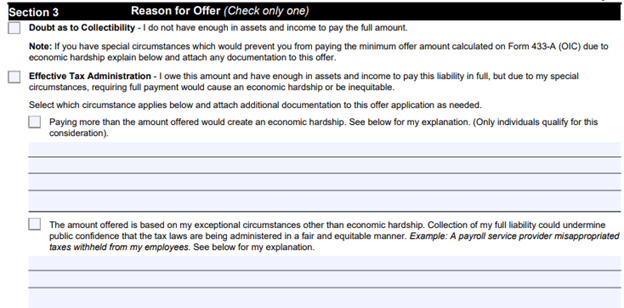

Section 3, Reason for Offer

All applicants must complete this section, as well as the remaining sections. Check one of the two options listed:

- Doubt as to Collectibility, or

- Effective Tax Administration

If choosing option 2, indicate which circumstance applies (economic hardship or exceptional circumstances) and provide a detailed explanation.

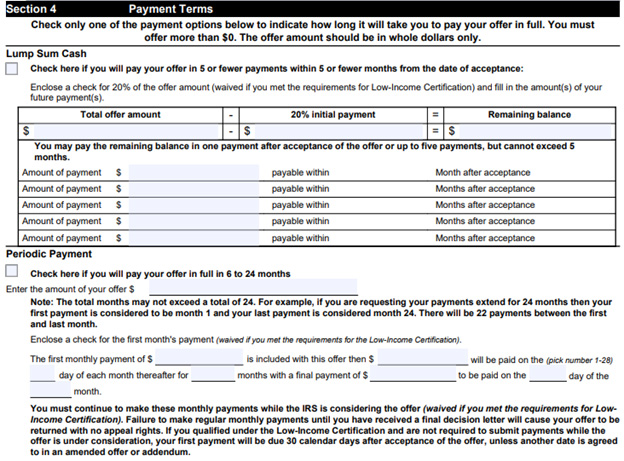

Section 4, Payment Terms

There are two payment options when requesting an Offer in Compromise:

- Lump Sum Cash – if you plan to pay your offer amount in five (5) payments or less, you’ll need to include 20% of the total offer amount when submitting your application.

- Periodic Payment – for offers that will be paid in 6 to 24 months, you need to enter the total amount of your offer. Next, divide the offer total by the number of months you’ll need to pay it off to determine your monthly payment amount. Then, submit the first month’s payment with your application.

If you select option 2, Periodic Payment, you’ll need to continue to make monthly payments while the IRS is reviewing your application and making its decision. If you miss a payment, the IRS will return your offer and you’ll lose your appeal rights. Those who qualified as low-income for the fee waiver are not required to submit a payment with their offer.

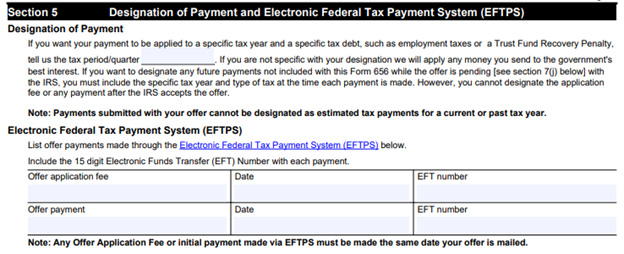

Section 5, Designation of Payment and Electronic Federal Tax Payment System (EFTPS)

In this section, you can designate which specific tax year and tax debt you want to apply your payment or allow the IRS to apply it to the government’s best interest. If you paid your application fee and/or made your initial payment through EFTPS, be sure to list the date and electronic funds transfer (EFT) number in the spaces provided. Please note that electronic payments must be made on the same date you mail your OIC application.

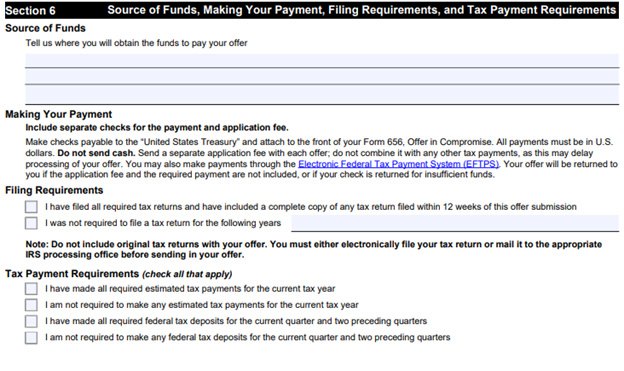

Section 6, Source of Funds, Making Your Payment, Filing Requirements, and Tax Payment Requirements

The IRS requires you to disclose where you will obtain the money necessary to pay your offer in section 6. This section also includes information on how to submit your payment and application fee. Additionally, you must check the appropriate boxes under the “Filing Requirements” and “Tax Payment Requirements” sub-sections.

Section 7, Offer Terms

Section 7 provides various disclosures concerning the terms and conditions of submitting an OIC request, including authorizing the IRS to contact relevant third parties. It also outlines your right to withdraw your offer or appeal the decision.

Section 8, Signatures

Once you have reviewed all terms and conditions in section 7, you will need to sign Form 656. If you file a joint return, be sure your spouse also reads and signs the form.

Section 9, Paid Preparer Use Only

If you paid someone to complete Form 656 for you, they must complete this section before you can submit your OIC application. If you are submitting the form on your own, skip this section.

Offer in Compromise (Form 656-B) Submission Checklist

Before you submit your Offer in Compromise, be sure you have the following items:

- Completed Form 433-A (OIC) or Form 433-B (OIC). Attach any necessary documentation. Do not send original copies!

- Completed Form 656.

- $205 Application fee (unless eligible for the low-income waiver) – check, money order, cashier’s check, or pay through the Electronic Federal Tax Payment System (EFTPS).

- Initial offer payment – this will either be 20% of your offer (lump sum cash) or your first payment (periodic payment).

Once you have everything ready, you’ll need to mail it to the address for your specific geographical region. You cannot submit Form 656-B online. The IRS will then review your offer and provide a decision within a few weeks.

Need Help?

The majority of OIC applications are rejected due to missing or incomplete information. Hiring a tax professional to help with the paperwork can not only make the process easier on you, but also ensure everything is correctly filed. To see if you’re an ideal candidate for an OIC and learn more about our tax relief services, call 855-476-6920 for a free consultation and quote.