Form 8379, Injured Spouse Allocation

Form 8379, Injured Spouse Allocation, is used when a tax refund is taken (offset) on a joint return due to the outstanding tax obligation of one of the spouses. By filing this form, the injured spouse may be able to retrieve their share of the joint refund.

Who Can Use Form 8379?

You may use IRS Form 8379 if you file a joint tax return and a portion (or all) of your expected refund was offset due to your spouse’s back taxes (state or federal), unemployment compensation debts, unpaid child support, or other federal non-tax debt. Do not use Form 8379 if you are seeking Innocent Spouse Relief. Instead, file IRS Form 8857.

How to Complete IRS Form 8379

Complete Form 8379 when you become aware that some or all of your tax refund was applied to your spouse’s debt obligation(s). The form must be filed within three (3) years of the due date of your original tax return or two (2) years from the date you paid the tax that was offset (whichever is later). You may file it with your joint tax return or file it later on its own. If filing separately, be sure to attach a copy of all W-2s and 1099s for both spouses. The form should be mailed to the same address where you file your income tax return.

Form 8379 is two pages with four (4) parts.

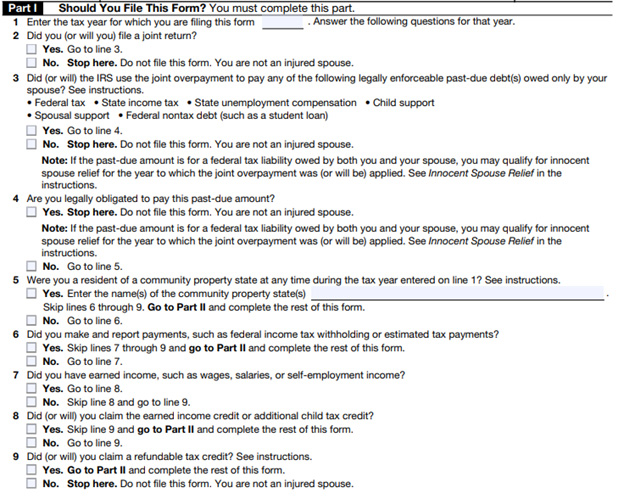

Part I – Should You File This Form?

In this section, enter the tax year for which you are requesting the injured spouse allocation (line 1). Next, answer “yes” or “no” for questions 2 through 9 and follow the instructions per your response. If you answer “no” on lines 2, 3, or 9, you are not an injured spouse and cannot use this form. The same is true if you answer “yes” on line 4.

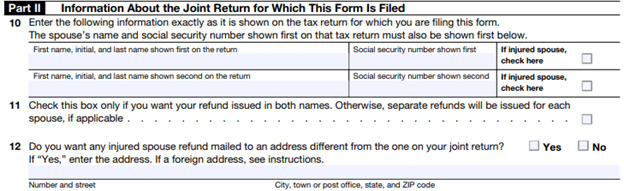

Part II – Information About The Joint Return for Which This Form is Filed

Enter your name and Social Security number (SSN), as well as your spouse’s, on line 10. Be sure it matches exactly to the information provided on your Form 1040. Check the box for whomever is claiming the injured spouse allocation. If you’d like your refund check issued jointly, check the box on line 11. If your address is different from the one on your tax return, check “yes” and enter the new information on line 12.

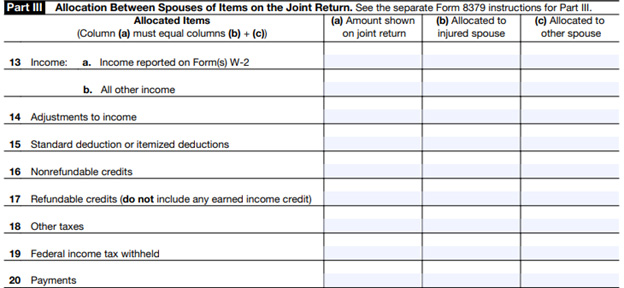

Part III – Allocation Between Spouses of Items on the Joint Return

To determine the amount of tax owed, you must allocate your wages, expenses, and credits separately in this section (lines 13 through 20). Items that do not specifically belong to you or your spouse should be equally divided.

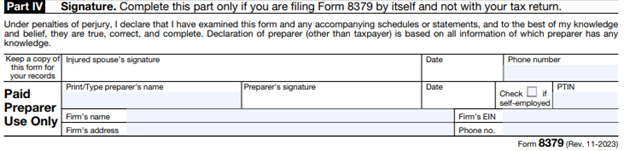

Part IV – Signature

Do not complete this section if you are filing IRS Form 8379 with your tax return. Only the injured spouse must sign (if filing the form on its own). Be sure to include your phone number and the date the form was completed. If you use a paid preparer, their information must also be included on the form.

If you live in a community state (AZ, CA, ID, LA, NV, NM, TX, WA, or WI) special rules will apply to the calculation of your injured spouse refund. The IRS will use your state’s rules to determine what amount, if any, is due.

Generally, it takes about 14 weeks to process Form 8379 when filed with your tax return. If you submit it on its own after filing your taxes, the processing time is reduced to approximately 8 weeks.

Need Help?

If you need assistance completing IRS Form 8379, please contact Tax Defense Network at 855-476-6920. We offer affordable tax preparation, as well as other tax services.