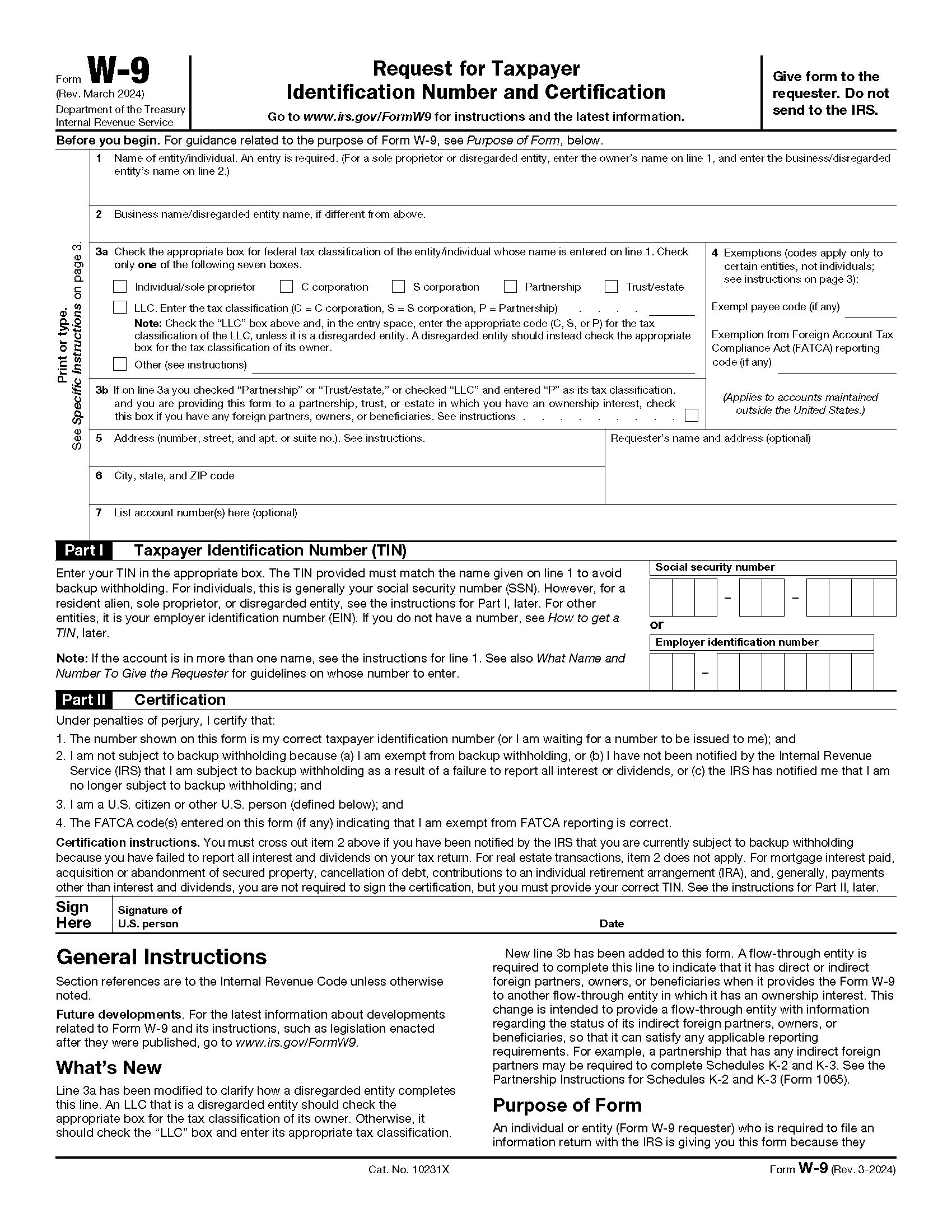

Form W-9, Request For Taxpayer Identification Number and Certification

IRS Form W-9 is a tax document that individuals and businesses use to send taxpayer identification numbers (TIN) to other individuals, organizations, and financial institutions. For individuals, your Social Security number (SSN) should be included on the form. Businesses will use their Employer Identification Number (EIN). Form W-9 is not shared with the IRS.

Who Should Complete Form W-9?

There are several instances where you may be asked to complete Form W-9. Below are just a few of the most common scenarios.

- You are self-employed and sign on to do a project for another business where you expect to earn more than $600 during the tax year. The company’s accounting department will require you to complete a W-9 so they can report your earnings to the IRS and send you Form 1099-MISC or 1099-NEC.

- You’ve won a contest with a cash prize in excess of $600. The contest sponsor will likely need a W-9 so they can report your winnings to the IRS on a Form 1099-MISC.

- A financial institution may request a Form W-9 if you have investments or loans with them. This includes, but is not limited to, savings accounts, mortgages, and retirement accounts. Any interest income, distributions, or proceeds from real estate transactions will be reported to the IRS through various 1099 forms.

- Private scholarship providers will often request a W-9 if your award is over $600. This aids them in completing the 1099-MISC that must be sent to you and the IRS.

Form W-9 contains sensitive information that can put you at risk for identity theft. Be sure you trust the person asking for it and that they keep the form in a safe place. Never complete a W-9 over the phone. Whenever possible, use a secure delivery method, such as an encrypted email attachment, to send your form. If you feel uncomfortable completing the form, reach out to a tax professional for guidance.

How to Complete Form W-9

Line 1, Name

The name that you use on your income tax return should be entered here. Do not leave it blank! If you are a sole proprietor, partnership, LLC, or corporation (C or S), you’ll need to complete line 2, as well.

Line 2, Business Name

Enter your business, trade, or DBA (doing business as) name on this line. If it is the same as line 1, leave this line blank.

Line 3, Federal Tax Classification

Check the appropriate box for the tax classification of the person listed on line 1. Check only one box.

| IF the person/entity on line 1 is a(n)… | THEN check this box… |

|---|---|

| Corporation | Corporation |

| Individual/sole proprietor or single-member LLC |

| Limited liability company and enter the appropriate tax classification. (P= Partnership; C= C corporation; or S= S corporation) |

| Partnership | Partnership |

| Trust/estate | Trust/estate |

Line 4, Exemptions

If you are exempt from backup withholding and/or Foreign Account Tax Compliance Act (FATCA) reporting, enter any codes that may apply to you.

Line 5 & 6, Address

Enter your address on lines 5 and 6. This is where the person requesting the W-9 will send your information returns. If this differs from an address already on file, be sure to write “NEW” at the top of the form.

Line 7, Account Number(s)

Line 7 is optional. Complete this if you need to give the requestor your bank or brokerage account information.

Part I, Tax Identification Number (TIN)

Individuals should enter their SSN. Sole proprietors may enter either their SSN or Employer Identification Number (EIN). Single-member LLCs that are disregarded as an entity separate from their owners should enter the owner’s SSN or EIN. If the LLC is classified as a corporation or partnership, enter the entity’s EIN.

If you are a resident alien and don’t have an SSN, enter your IRS Individual Taxpayer Identification Number (ITIN) in the Social Security box. Anyone who does not have a TIN should apply for one and write “Applied For” in the TIN space.

Part II, Certification

To verify the information provided is correct, sign and date the form. If the IRS has notified you that you are subject to backup withholding, you must cross out item 2 in Part II.

You are not required to sign the form if it’s being used for mortgage interest paid, acquisition or abandonment of secured property, cancellation of debt, contributions to an individual retirement arrangement (IRA), and generally, payments other than interest and dividends. You must, however, still provide the correct TIN.

Need Help?

If you need assistance completing Form W-9, visit the IRS website. For help with other tax matters, contact Tax Defense Network at 855-476-6920. We offer affordable tax preparation and tax relief services.