Schedule 8812, Credits for Qualifying Children and Other Dependents

IRS Schedule 8812 is used to figure the Child Tax Credit (CTC), Credit for Other Dependents (ODC), and the Additional Child Tax Credit (ACTC) for qualifying taxpayers who use Form 1040, 1040-SR, or 1040-NR.

How to Complete Schedule 8812

Taxpayers must have a Social Security number (SSN) or Individual Taxpayer Identification Number (ITIN) issued on or before the due date of their return (including extensions) to use Schedule 8812. If either you and/or your spouse (if filing jointly) do not have one, you cannot claim the CTC, ODC, or ACTC.

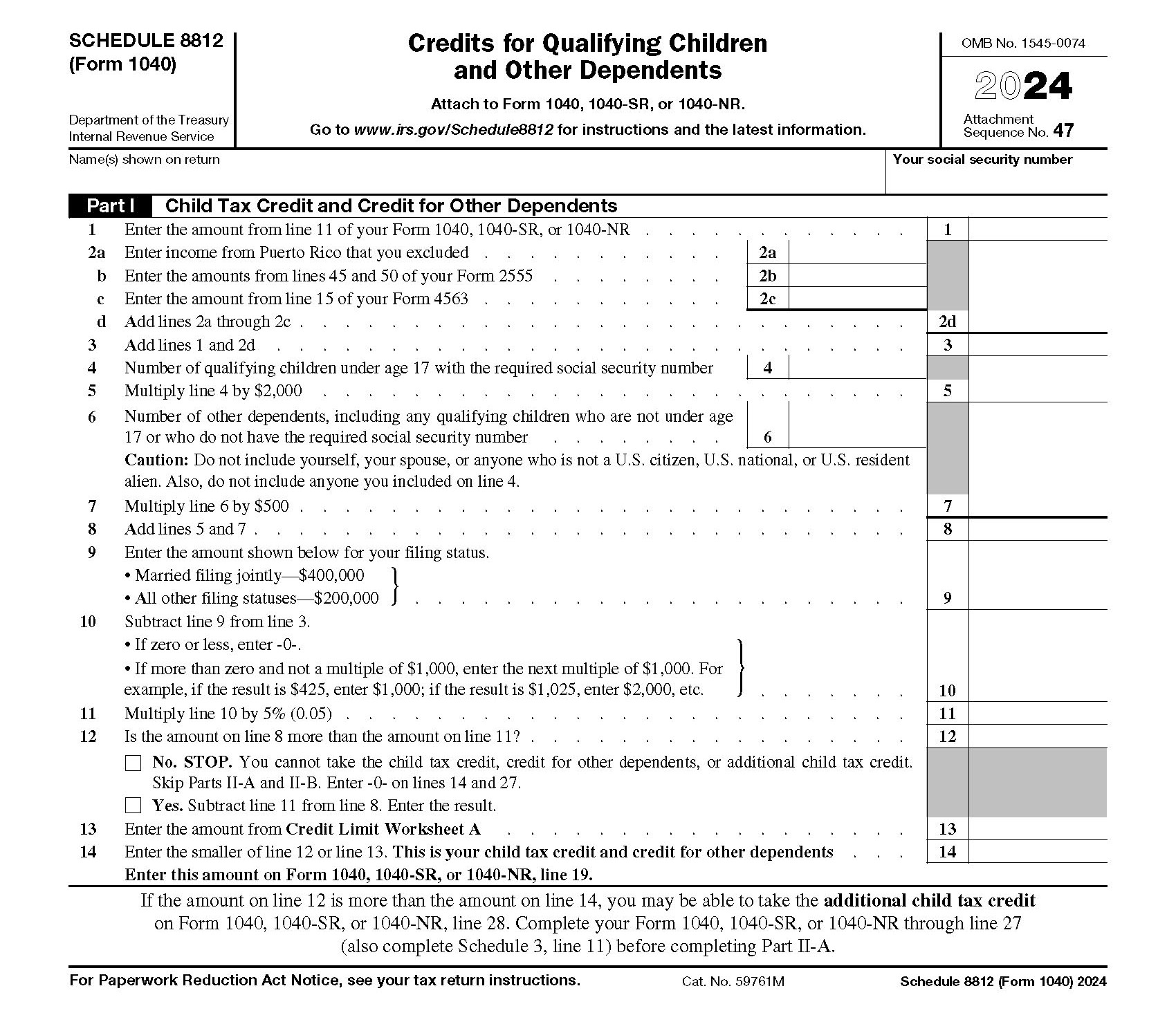

Part 1 – Child Tax Credit and Credit for Other Dependents

Before starting Schedule 8812, be sure to complete lines 1 through 15 on your Form 1040. If applicable, you may also need to complete Form 2555, Foreign Earned Income, and/or Form 4563, Exclusion of Income for Bona Fide Residents of American Samoa. Enter the appropriate income information from these forms in the boxes for questions 1 and 2, then add the amounts from 1 and 2d together on line 3.

Lines 4 Through 8

Next, you’ll need to include how many qualifying children (16 or younger) you have on line 4. Multiply that number by $2,000 and add the total on line 5. Any dependents without an SSN or over the age of 16 should be counted on line 6. Multiply that number by $500 and write it on line 7. Then, add lines 5 and 7 together, putting the result on line 8.

Lines 9 through 12

Follow the math guidelines for lines 9 through 11. If the amount on line 8 is larger than line 11, you cannot take the Child Tax Credit, Credit for Other Dependents, or the Additional Child Tax Credit. If line 8 is smaller, subtract it from line 11 and add the result on line 12.

Lines 13 & 14

To determine the amount for line 13, you’ll need to complete the Credit Limit Worksheet A found in the Schedule 8812 instructions booklet (page 4). On line 14, enter the smaller of lines 12 or 13. This is your Child Tax Credit and Credit for Other Dependents. You’ll also enter this amount on line 19 of your Form 1040, 1040-SR, or 1040-NR. If line 12 is larger than line 14, you may be eligible to claim the Additional Child Tax Credit.

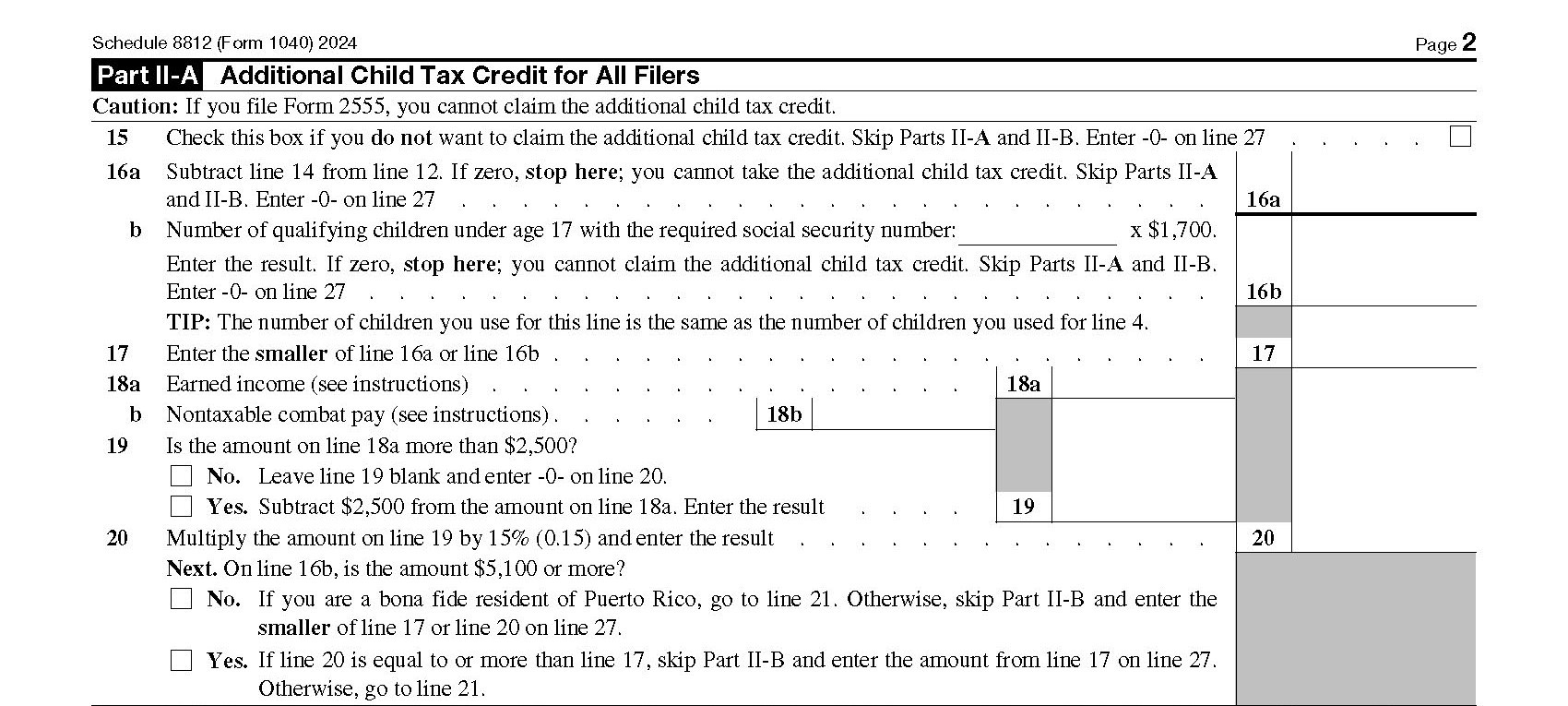

Part 2A – Additional Child Tax Credit for All Filers

You must complete Form 1040 through line 27 and Schedule 3, line 11 before working on this section of Schedule 8812. If you file Form 2555, you cannot claim this tax credit.

On line 15, check the box if you don’t want to claim the Additional Child Tax Credit. If so, skip questions 16 through 26 and enter “0” on line 27.

If you wish to claim the credit, subtract line 14 from line 12 in Part 1, and enter the amount on line 16a. If it is zero, skip all remaining lines and enter “0” on line 27. For all other amounts, enter the number of qualifying children you have under the age of 17 (this should be the same as line 4 in Part 1) and multiply by $1,500. Put the total on line 16b. Again, if the result is zero, you can’t take the credit and must skip to line 27.

If the result is larger than zero, enter the smaller of line 16a or 16b on line 17. Next, refer to the Schedule 8812 instructions to determine your earned income amount and non-taxable combat pay. Then, follow the instructions for questions 19 and 20.

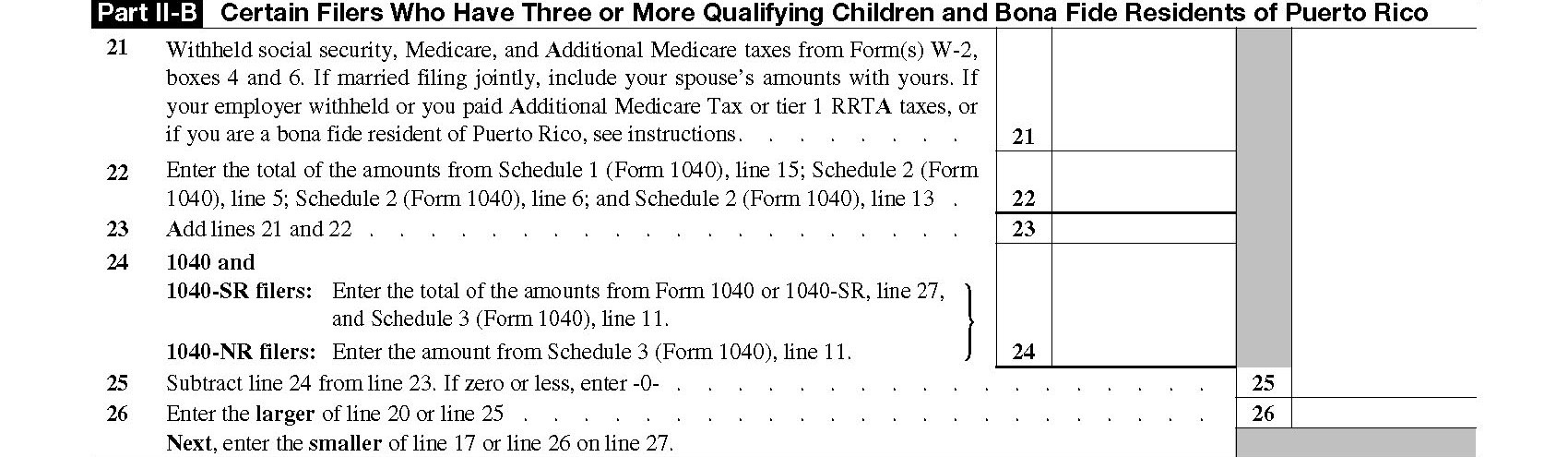

Part 2B – Certain Filers Who Have Three or More Qualifying Children and Bona Fide Residents of Puerto Rico

Most taxpayers won’t be required to complete this section. For those who do, however, follow the instructions for questions 21 through 26. Be sure to have Schedules 1, 2, and 3 (Form 1040) handy as you will need information from these forms to complete Part 2B.

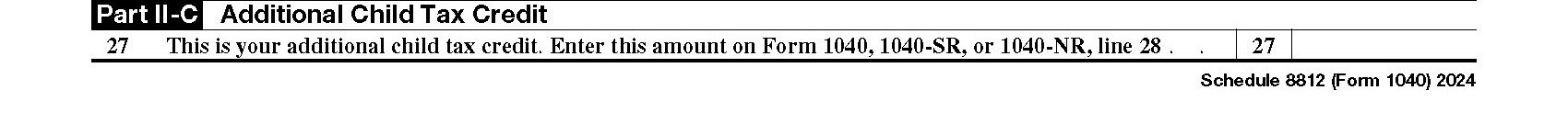

Part 2C – Additional Child Tax Credit

If eligible, the total for the Additional Child Tax Credit will be located on line 27. This number should be entered on line 28 of your Form 1040, 1040-SR, or 1040-NR.

Need Help?

If you need assistance completing your tax forms, including Schedule 8812, please contact Tax Defense Network at 855-476-6920. We offer affordable tax services, such as tax preparation, tax audit representation, and so much more!