Schedule A (Form 1040), Itemized Deductions

Use Schedule A (Form 1040) to figure your itemized deductions when filing your federal income tax return. You should itemize if the total of all your allowable itemized deductions is greater than your standard deduction.

Who Should Use Schedule A?

Determining whether you should use Schedule A (Form 1040) or take the standard deduction is a matter of math. Generally, if you own your own home or paid a lot in medical expenses (more than 7.5% of your adjusted gross income) during the tax year, you should consider itemizing your deductions. That’s because you can claim deductions for your mortgage interest and property taxes, as well as most unreimbursed medical and dental expenses. You can also deduct contributions to IRS-recognized charities, as well as state and local taxes. If you have a large gambling loss (equal to or less than your winnings), you should also consider using Schedule A.

How to Complete Schedule A (Form 1040)

Schedule A (Form 1040) is one page and consists of seven (7) sections. At the top of the form, include your name and Social Security number (SSN) as it appears on your tax return.

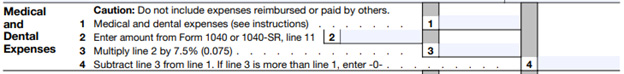

- Medical and Dental Expenses. Do not include any expenses reimbursed by your employer, insurance, or paid by others. Include the total of all allowable expenses on line 1. Enter your adjusted gross income (AGI) on line 2 (found on Form 1040, line 11). Next, multiply your AGI by 7.5% and enter the amount on line 3. Subtract the amount on line 3 from line 1 and enter it on line 4. If line 3 is larger than line 1, enter “0” on line 4.

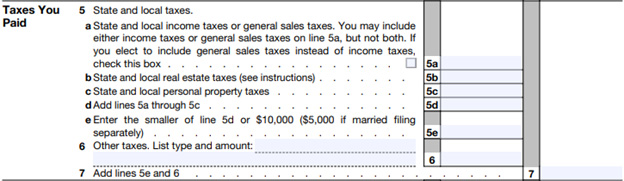

- Taxes You Paid. On lines 5a through 5c, enter the state and local taxes you paid during the tax year. Put the total on line 5d. Enter your tax total or $10,000, whichever is smaller, on line 5e. On line 6, include any income taxes you paid to a foreign country and generation skipping tax (GST) imposed on certain distributions. On line 7, put the total of lines 5e and 6.

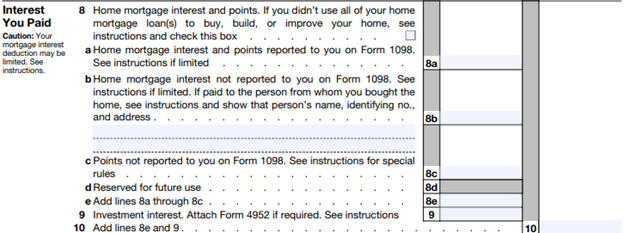

- Interest You Paid. On lines 8a through 8c, include eligible mortgage interest and points you paid for the tax year. Add the totals together and put the amount on line 8e. If you have investment interest, include it on line 9 and complete Form 4952 (if applicable). Add lines 8e and 9 together. Put the total on line 10.

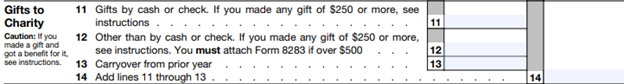

- Gifts to Charity. Enter the total value of gifts you made by cash or check on line 11. If your deduction is limited, refer to IRS Publication 526 to determine the amount you can deduct. For donated items, such as clothing and furniture, deduct the fair market value (FMV) of these items on line 12. If the item is valued at $500 or more, you’ll need to complete and attach IRS Form 8283. For gifts valued at $250 or more, you must also attach a statement from the charitable organization receiving the donation. If your total deduction is over $5,000, you may also need appraisals. On line 13, include any charitable deductions that you were unable to claim in a previous tax year. Add lines 11 through 13 together and put the total on line 14.

- Casualty and Theft Losses. You will need to complete and attach IRS Form 4684 to figure the amount of your loss. Enter the amount from line 18 (Form 4684) on line 15 of Schedule A.

- Other Itemized Deductions. If you have any of the other itemized deductions listed in the Schedule A instructions, list them on line 16.

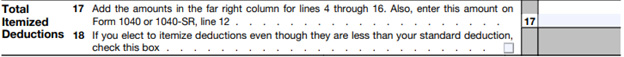

- Total Itemized Deductions. On line17, only add the totals from the far-right column on Schedule A (lines 4 through 16). You will also enter this amount on line 12 of your Form 1040. Check the box on line 18 if you decide to itemize even though the amount is less than your standard deduction.

Need Help?

If you need help completing your Schedule A (Form 1040) or other tax forms, please contact Tax Defense Network at 855-476-6920 for a free consultation. We offer a variety of affordable tax services, including tax prep and audit assistance.